Energy Transition #7: Balancing Electricity Supply and Demand

With increasing variability...Energy Storage to the rescue!!

Electrification aka demand for electricity increasing 🚀

More Renewables aka variability in electricity generation increasing 🚀

What do these two trends lead to?

As we move towards a more renewable-rich electricity mix - we need to ensure that the challenges coming from the variability are addressed. In the current systems, the Plant Load Factor (PLF) of thermal power plants/other conventional sources can be tinkered to cater for daily and seasonal variability

but

In the case of renewables, there are a lot of factors affecting the power generation. Plus, these factors are not in our control.

And the incremental cost of energy from renewables is minuscule. Why not store it? You got that right. In this post, we will be talking about Energy Storage i.e. BESS, Pump Hydro, Hydrogen, etc.

Make sure to come back here and check previous posts in this series:

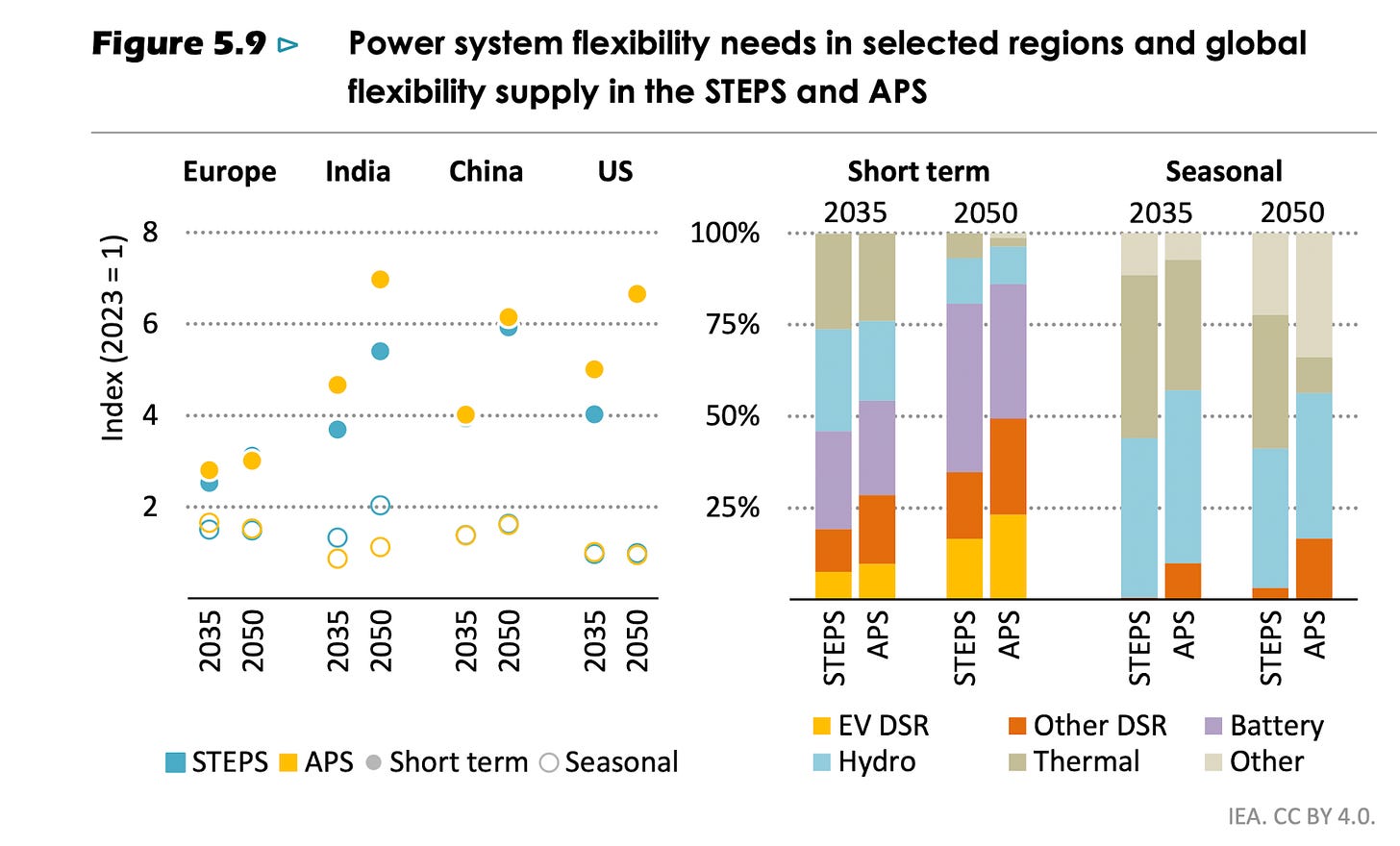

Efficiency and Flexibility are key to having manageable Electrification and Clean Energy Transition. Efficiency measures reduce the power demand while flexibility aims to (1) have flexibility at the supply level and (2) make the demand flexible whereby a portion of demand can be moved to periods with higher supply (eg moving EV charging to daytime where Solar Generation is at peak)Let’s look at power flexibility needs

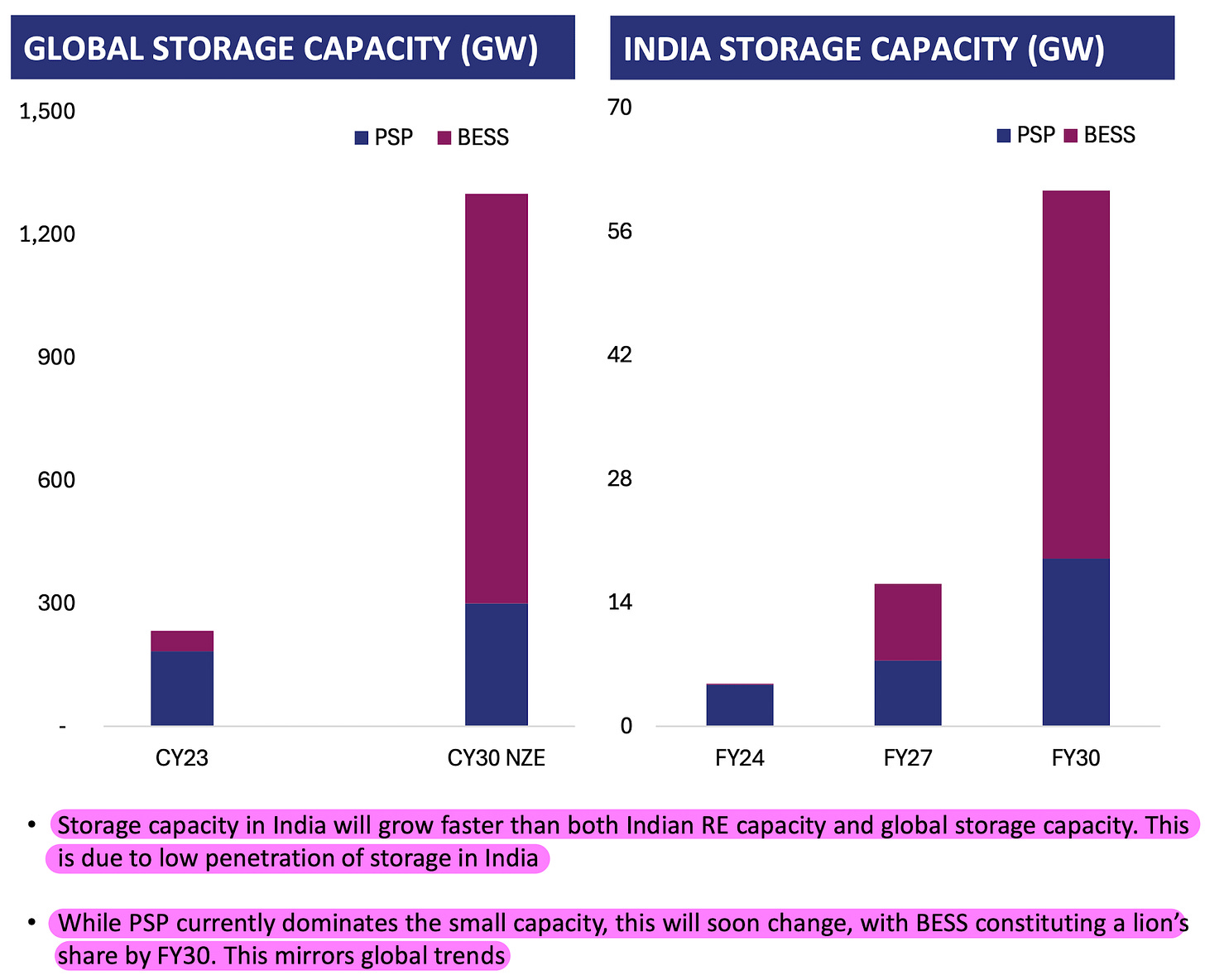

The variability is going to increase considerably with the renewables. The situation is even more dire in the case of India:

In India, seasonal flexibility needs will increase 30% faster than average electricity demand growth during the same period, where electricity demand almost doubles.

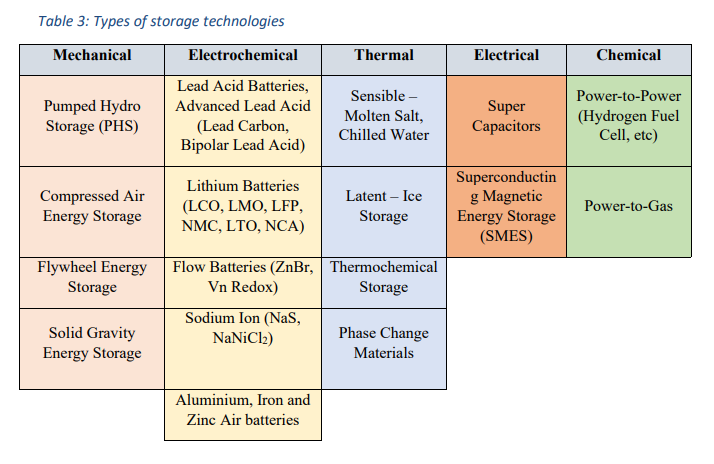

Let’s look at storage options to bolster flexibility at the Supply Level

There are multiple storage options but we will talk about Hydrogen, BESS and Pump Storage Hydro as these look like the best options

(1) Hydrogen

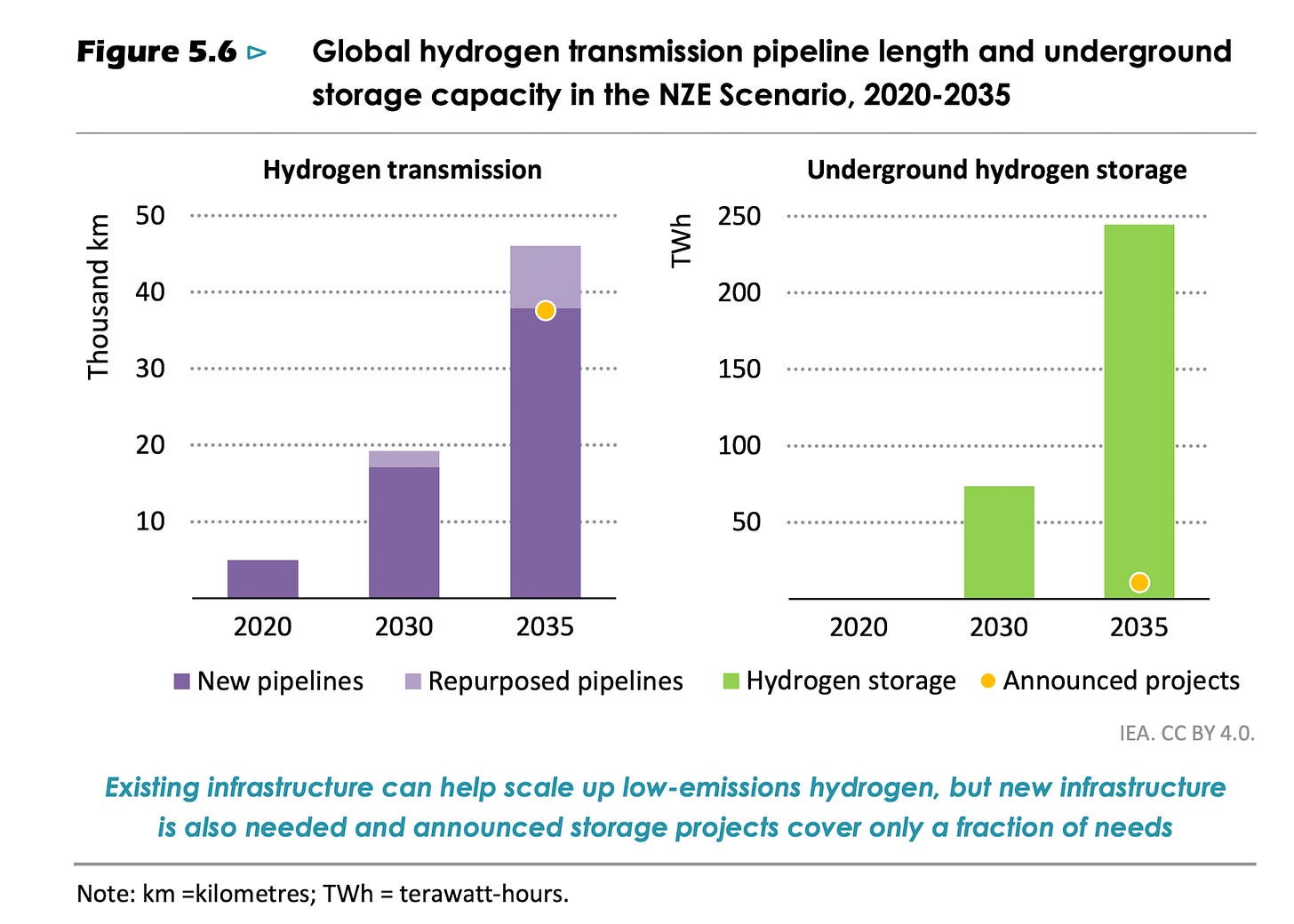

Electrolysers can contribute to seasonal flexibility by using excess renewables generation to produce hydrogen that can be stored in long-duration storage facilities. However, currently, the investment in hydrogen storage is miniscule.

(2) Pumped Storage Hydropower (PSH)

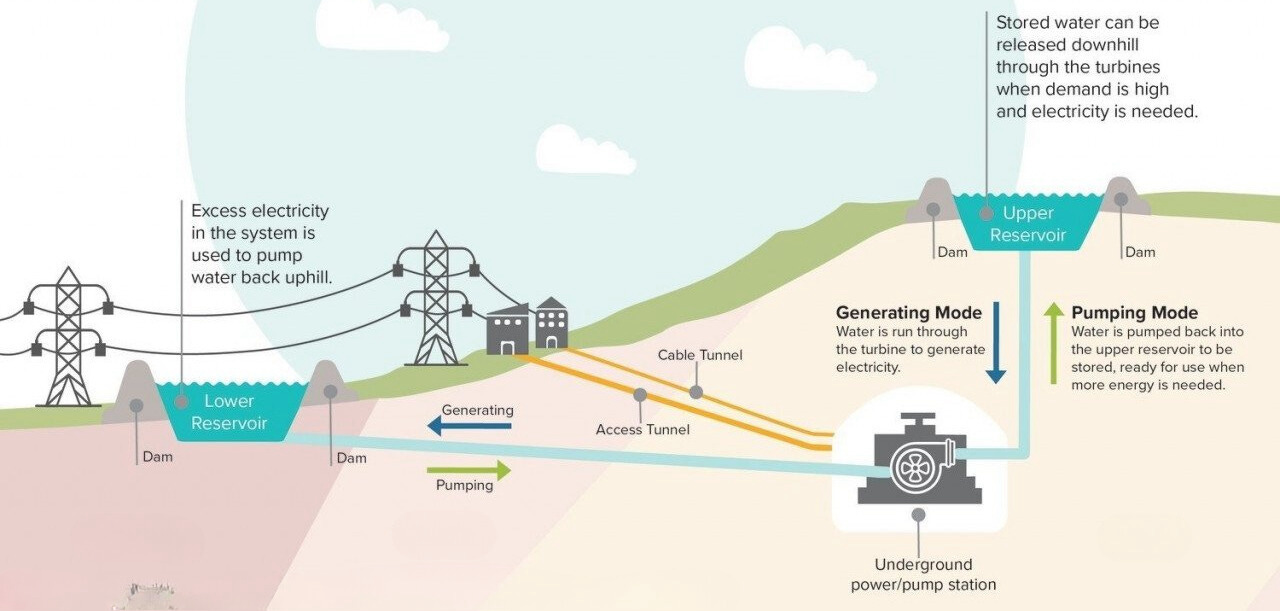

PSH is like a giant battery, utilizing two water reservoirs at different elevations to store and generate energy.

Power is produced when water moves from the higher to the lower reservoir, passing through a turbine (discharge). The system uses electricity to recharge and pump water back up to the upper reservoir. This cyclical process allows PSH to store and release energy when needed, effectively functioning as a massive energy storage system.

However, this mode of storage has its limitations owning to High Initial Costs, Geographical Limitations, Environmental Impact, Regulatory Hurdles, Energy Losses, etc.

Further, this form of storage is facing Competition from Other Technologies like advanced batteries, which are becoming more cost-effective and may offer more flexibility in certain applications.

(3) Batteries

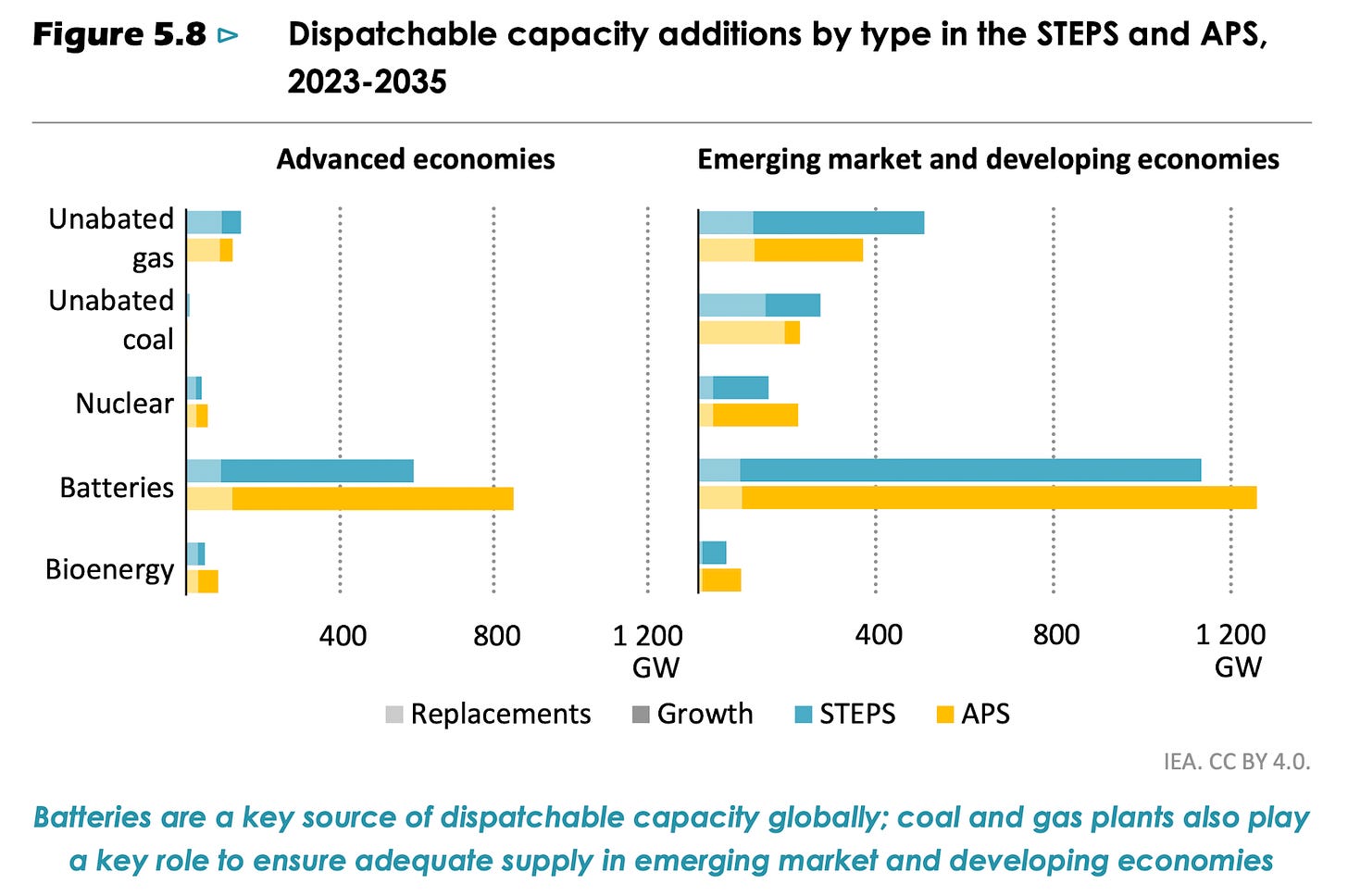

The most viable solution looks like scaling up of Batteries i.e. BESS

“Batteries are rapidly scaling up to provide short-term flexibility; demand response can provide short-term and some seasonal flexibility while also helping to keep costs down; thermal power and hydropower are the main sources of seasonal flexibility today and are set to remain so through to 2050.”

“Batteries” is a key piece in the “Energy Transition” jigsaw puzzle. Not only for storage, they are required for EVs as well and hence this technology is very crucial for Clean Energy Transition

“Batteries provide short-term flexibility for periods of one to eight hours, helping to improve grid stability and enabling the rapid growth of solar PV by allowing electricity generated during the day to meet demand at other times.”

Demand Response Measures

Demand response has a major role to play in power system flexibility. What is Demand Response?

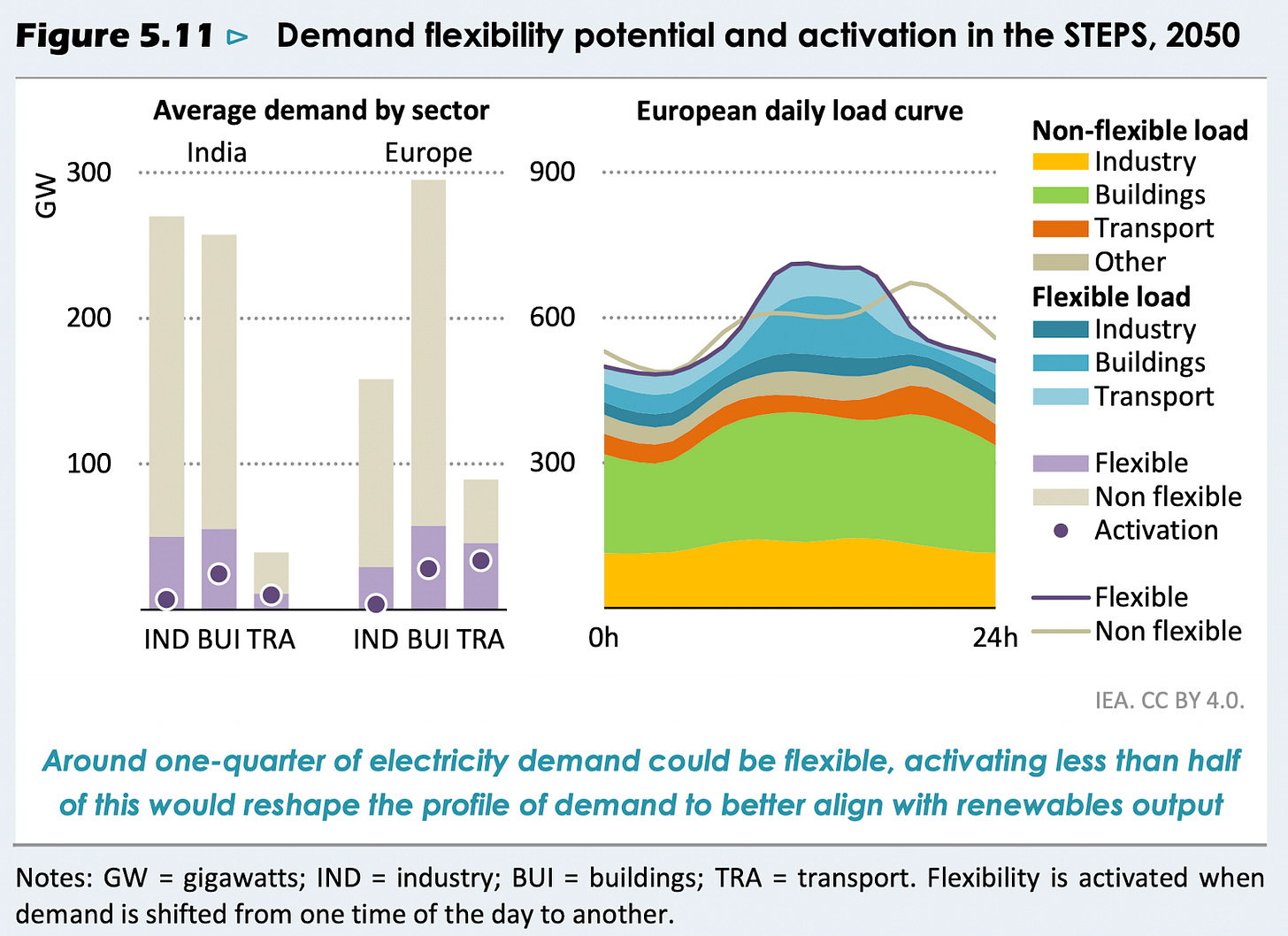

Demand response is shifting the timing of electricity consumption from one part of the day to another without changing the level of service to consumers

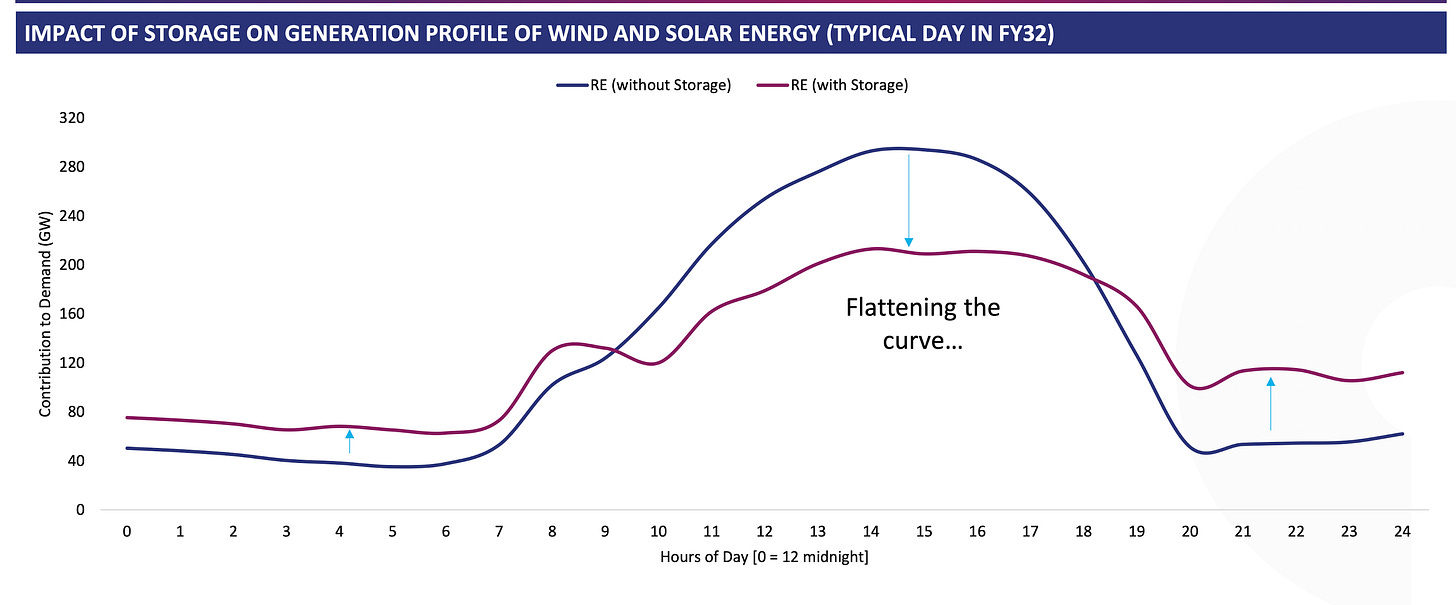

Activating demand response i.e. moving the flexible demand to times when there is oversupply can help shape the demand curve. To undergo such, hour-to-hour balancing in demand and supply needs widespread installation and use of smart meters, smart thermostats (especially in heating/cooling equipment), and digitalized grids. Then only we can get this flexibility.

This measure is not only positive for the sake of the electricity system but also to reduce the cost of electricity to the consumers with the added benefit of reduced emissions. As the share of solar PV rises, it creates a regular and predictable pattern of abundance during the day. Economics 101, these periods should have low wholesale electricity prices incentivising a shift in consumption from periods when electricity prices are high to when they are lower.

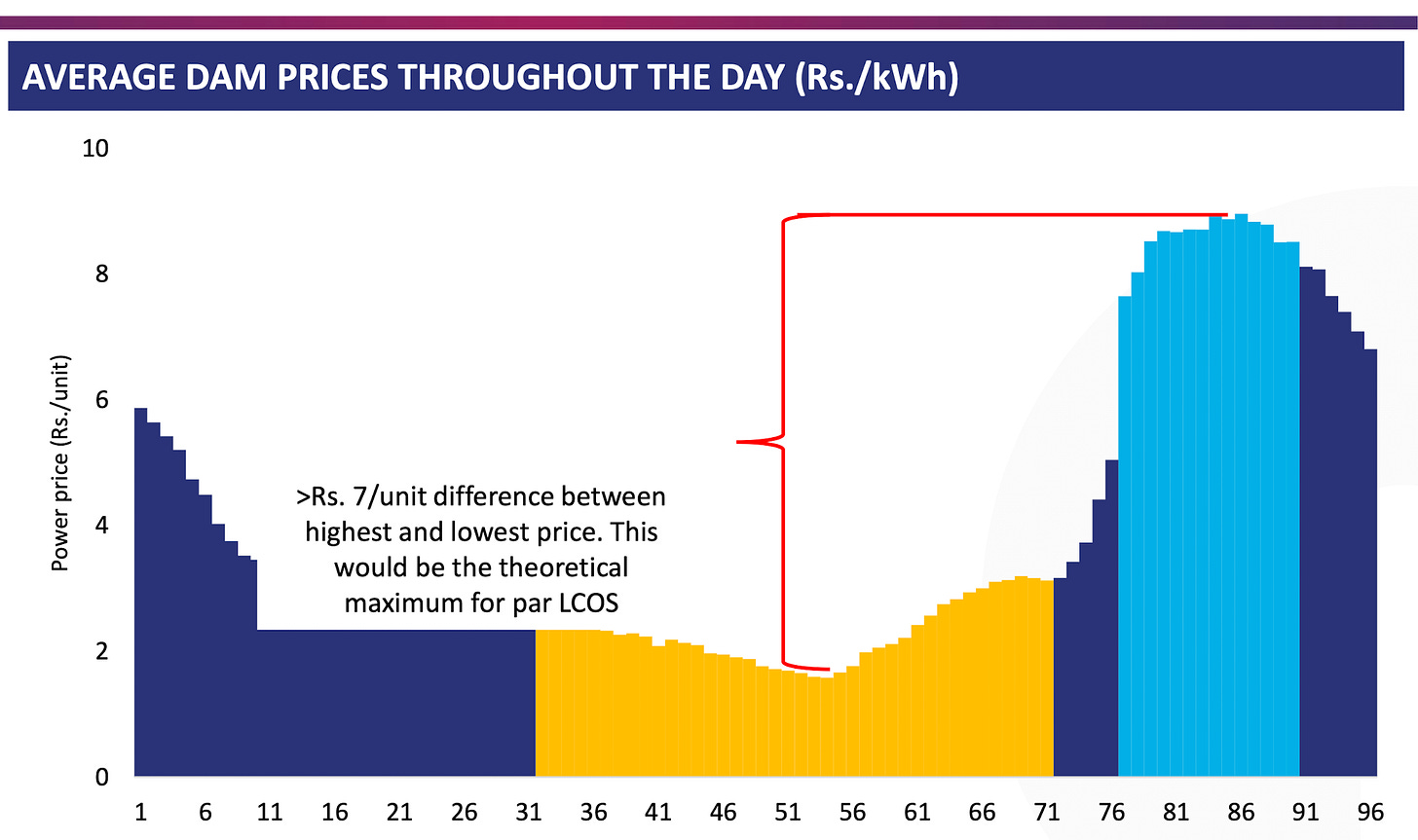

In India, we don’t have hour-by-hour pricing or dynamic pricing of electricity. The distribution of prices throughout the day is as follows (based on IEX prices):

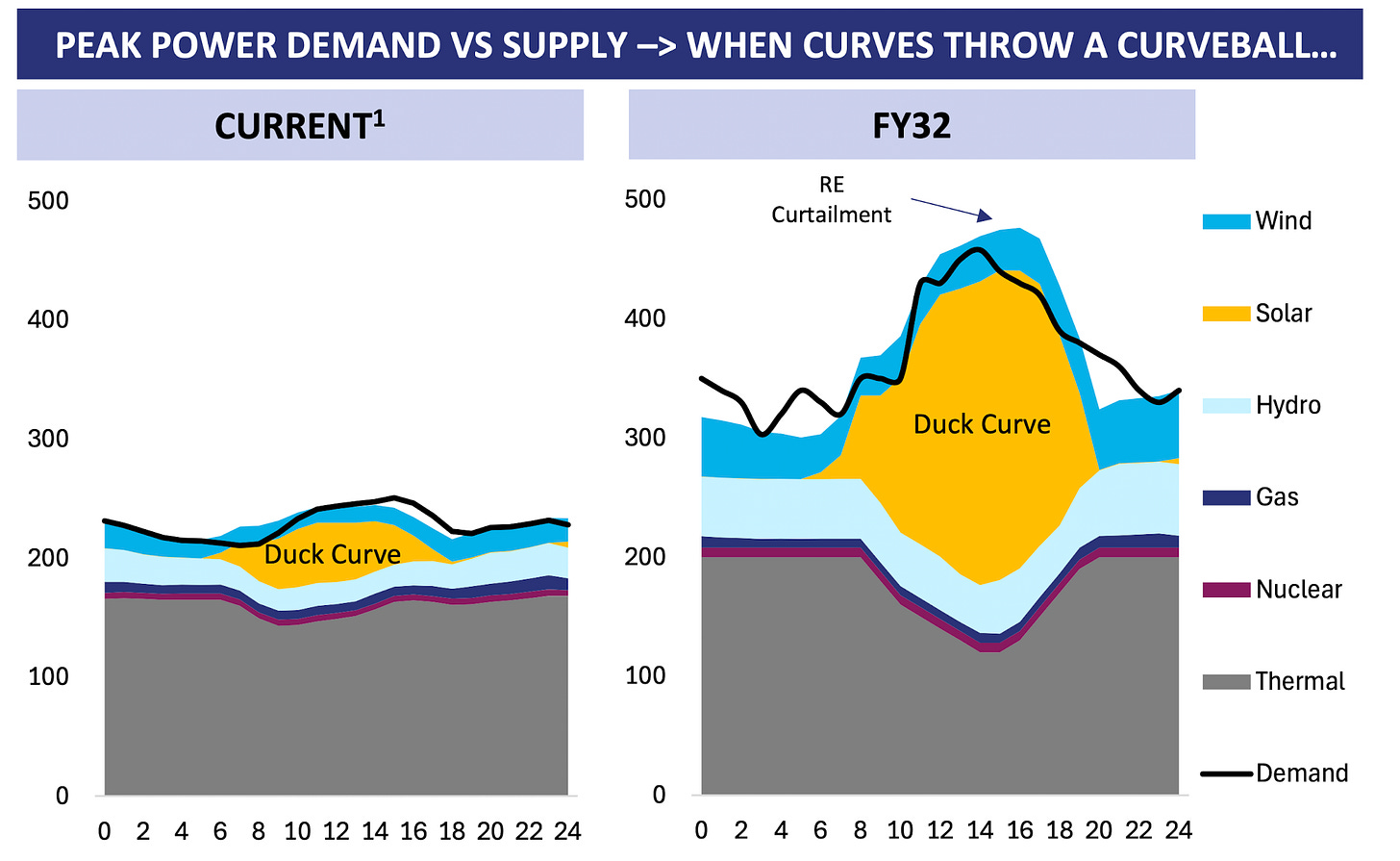

Clearly, there is a demand spike in the evening, which is the period when SOLAR is not producing. This demand-supply problem over the day is an inherent problem that has to be solved by moving flexible power requirements to day time and complementing renewable generation with Storage. The variability in generation can be seen from the projected peak power demand-supply in FY32 when Solar will be a sizeable chunk of power generation.

Electricity Storage in India

A higher % of Renewable Mix in power generation causes problems like a mismatch of supply-demand curves, Grid instability & frequency loss, and Uneven loading of T&D infrastructure among other problems. At 20% penetration, grid stability issues become more frequent. At 30% penetration, the grid becomes unstable, affecting other generators as well.

The solution to all these problems is to have Energy Storage in the Power Transmission and Distribution Infra.

WHAT will energy storage infra lead to: Flattening of the Curve and Grid Stability:

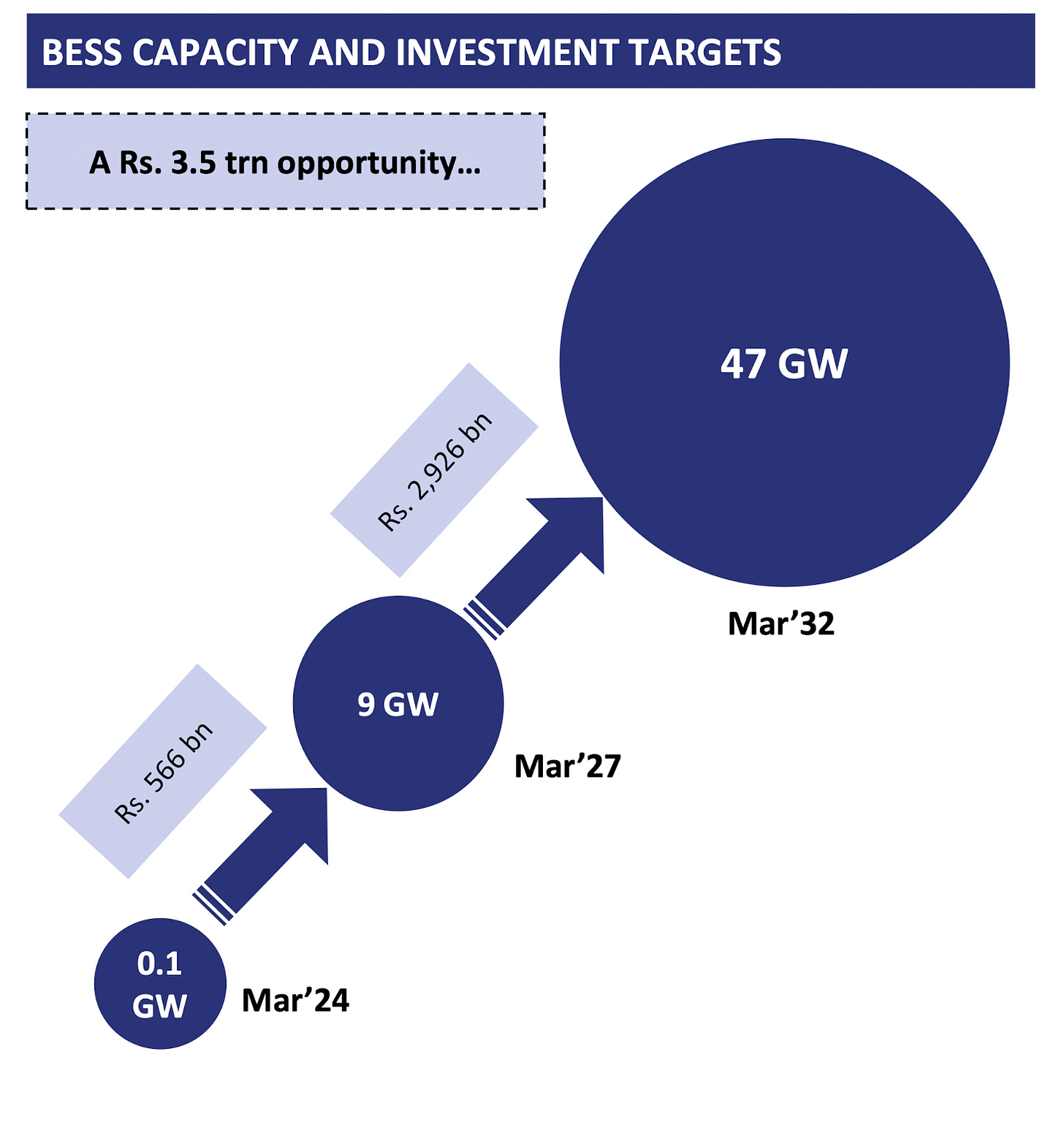

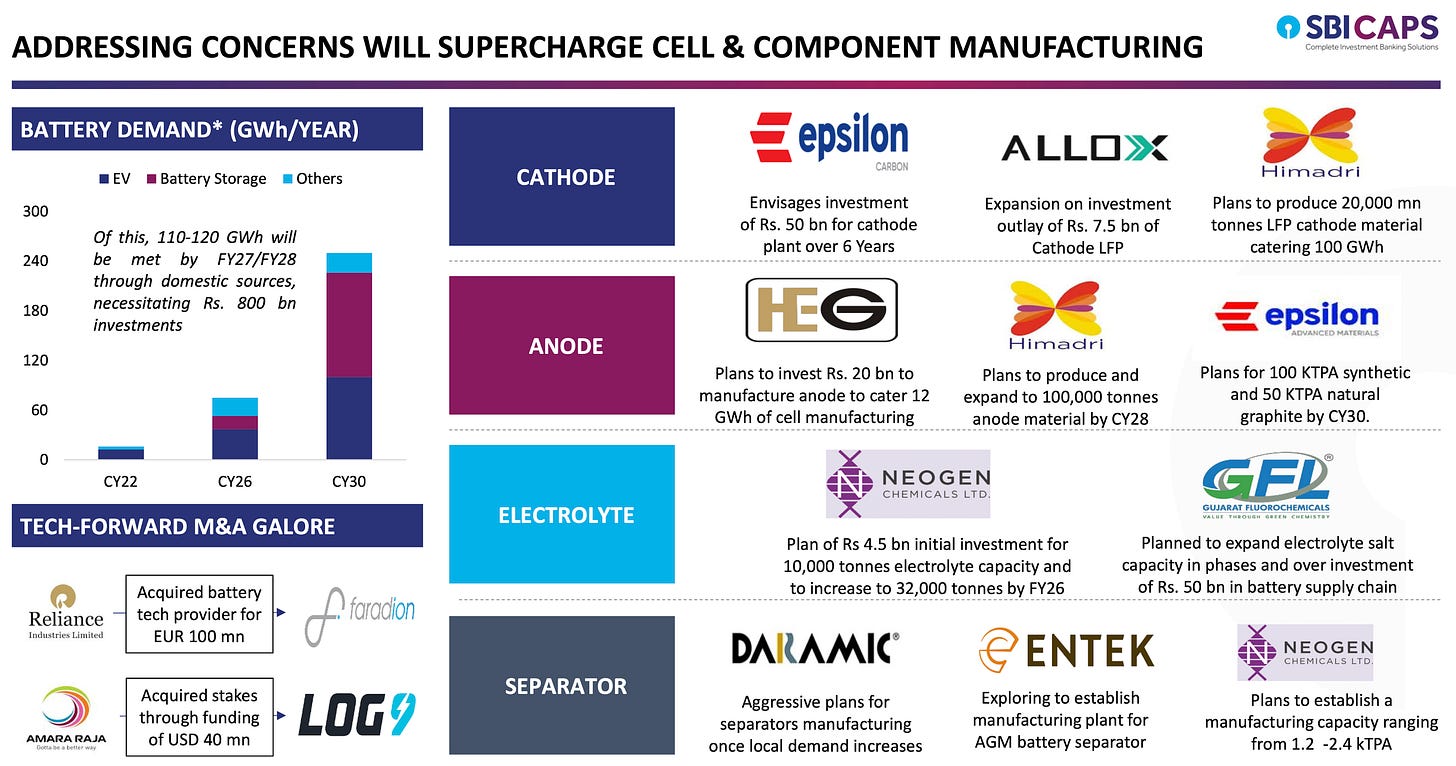

But HOW to achieve this, huge investments are required which may lead to investment opportunities for investors. As per SBI Cap, BESS alone is a 3.5 Trillion USD opportunity till FY32.

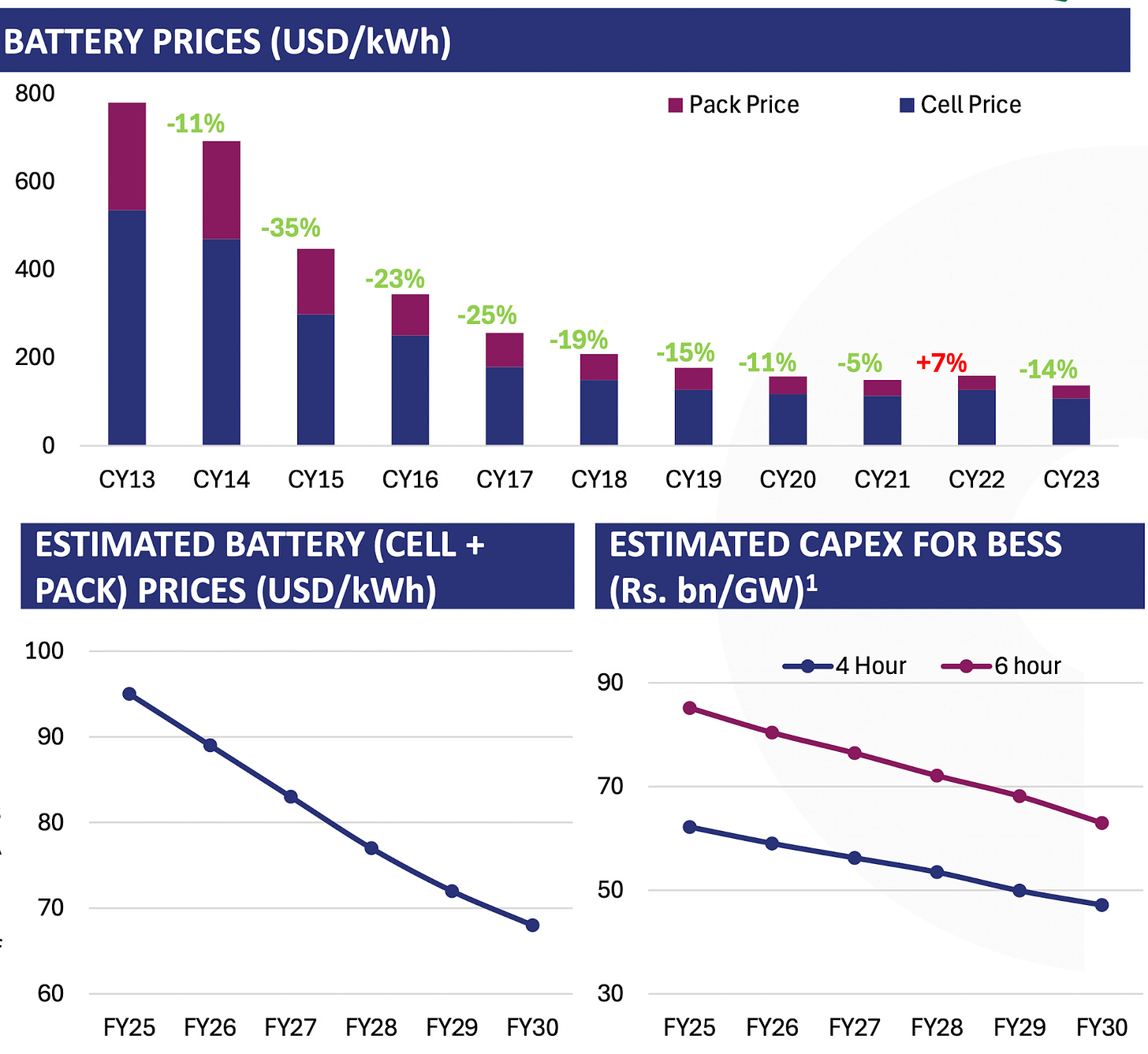

An important tailwind is the declining costs of BESS. Battery and related components make 80% of the cost. This is where lot of R&D is going on making it cheaper every year.

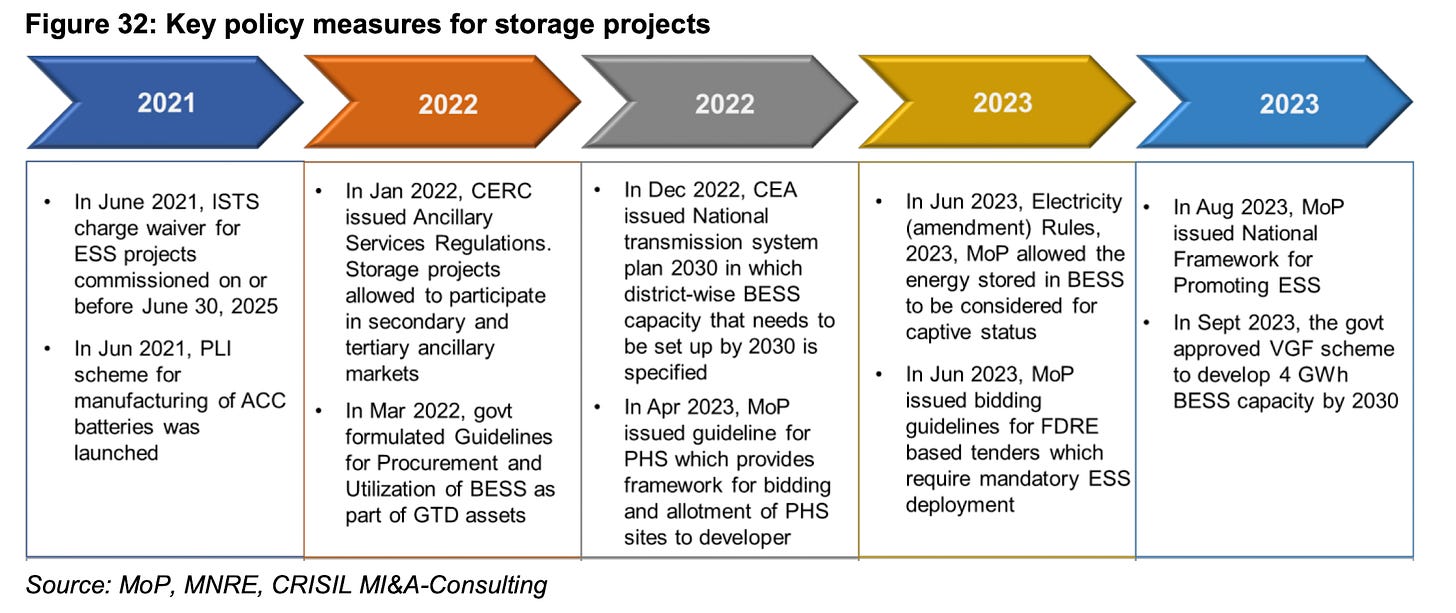

Plus the Policy Push is there:

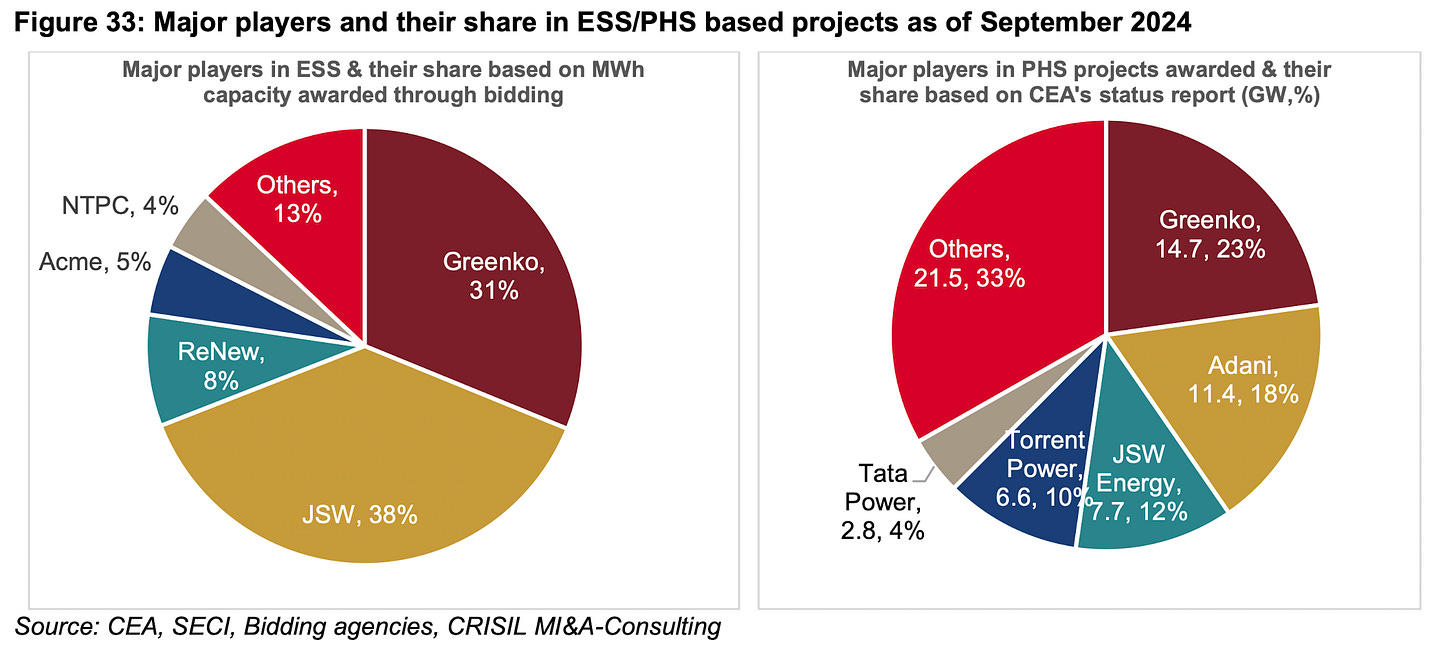

Some of the key players in the ecosystem are:

Challenges:

(1) The costs although declining are still high. There is unavailability of long discharge cells

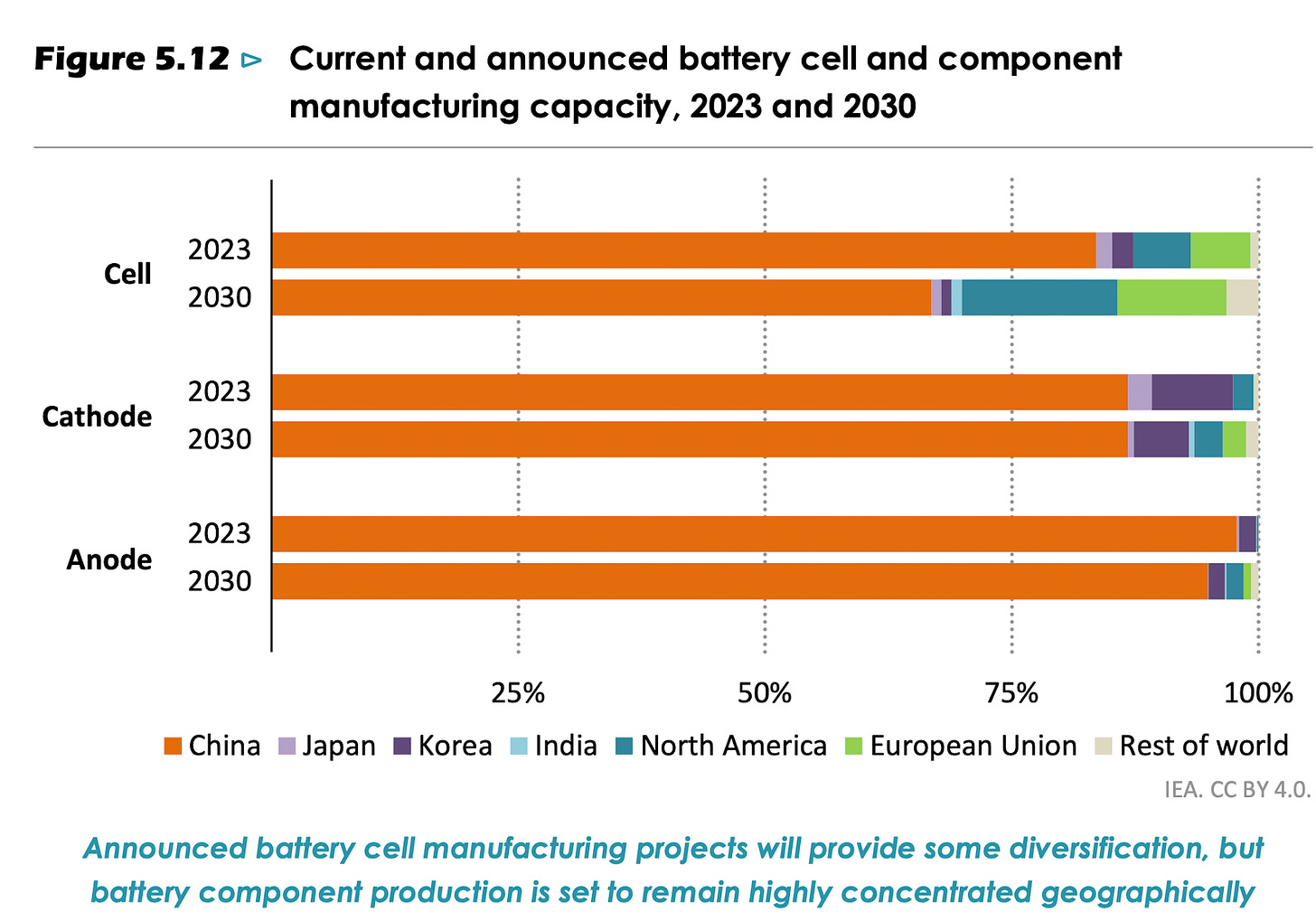

(2) Acute dependence on imports for batteries and raw materials

(3) E-waste disposal: The waste is toxic how to dispose? Opportunities for circular economy?

(4) Dependence on other countries for technology?

SUMMARY

The aim of this post was to educate "why energy storage is important?". There is no denying that the share of renewables in power generation is increasing and that brings on its own set of problems.

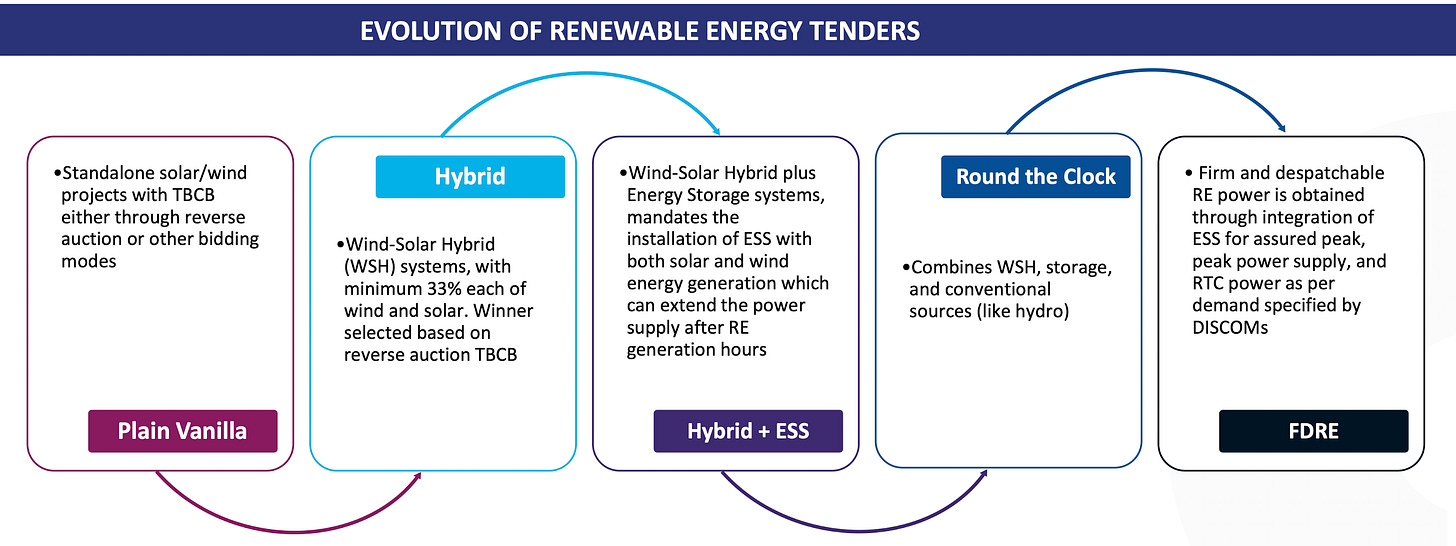

At the policy level (in India) we see the evolution of renewable projects with Storage Component

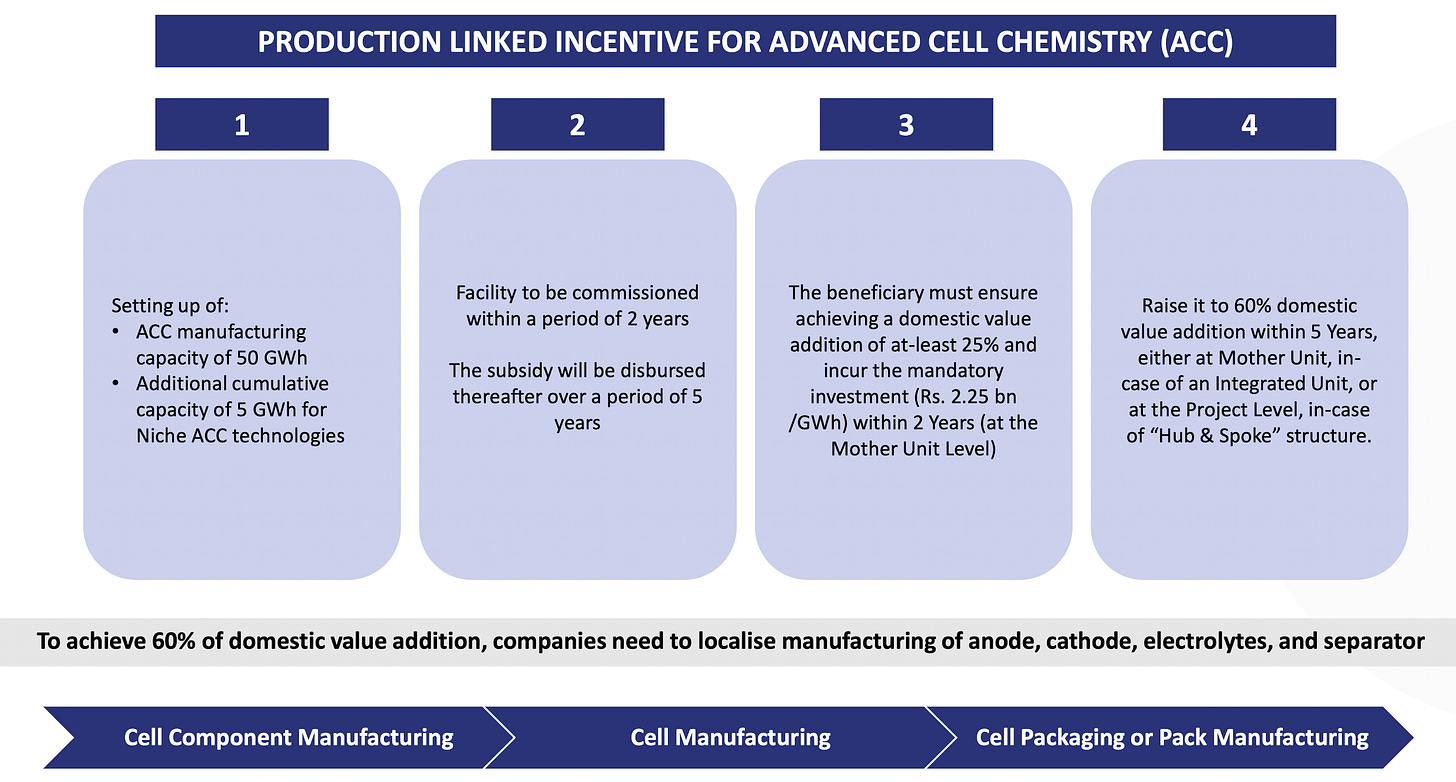

Further for capacity building PLI for advanced cell have been announced.

It is paramount to develop the Energy Storage Infrastructure. Only then we will be able to meet the challenge and opportunity that ELECTRIFICATION presents.

Until Next Time. CHAO 😃

Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani (TechnoFunda Investing)

Book/reading recommendations

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

You can help me fund my research costs by subscribing to MarketSmith India for your research via my referral link:

https://marketsmithindia.com/mstool/sharereferral.jsp#/

Use code MSIC2C55295-5

Get an extra 60 days when you subscribe to an Annual Plan. 🎉

Connect on X @pankajgarg_ciet

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Thanks for reading Learning Lifelong! Subscribe for free to receive new posts and support my work.

Good