Energy Transition #9: Carbon Credits Market

Takeaways from PRAKRITI 2025 - India's first-ever international conference on carbon markets, ,

This is the 9th post in the Energy Transition Series: Megatrend of the Decade. The previous posts are collated here:

India's first-ever international conference on carbon markets, PRAKRITI 2025, was held on February 24-25 in New Delhi. Organized by the Bureau of Energy Efficiency under the aegis of the Ministry of Power and MoEFCC.

It served as a platform for discussions and ideas to enable India to launch a robust, efficient, and effective carbon market by mid-2026.

Why is it important to develop Carbon Markets?

Carbon markets turn climate action into an economic opportunity, making emissions reduction a win-win for businesses. It also nudges to invest more in monitoring the carbon intensity of industries.

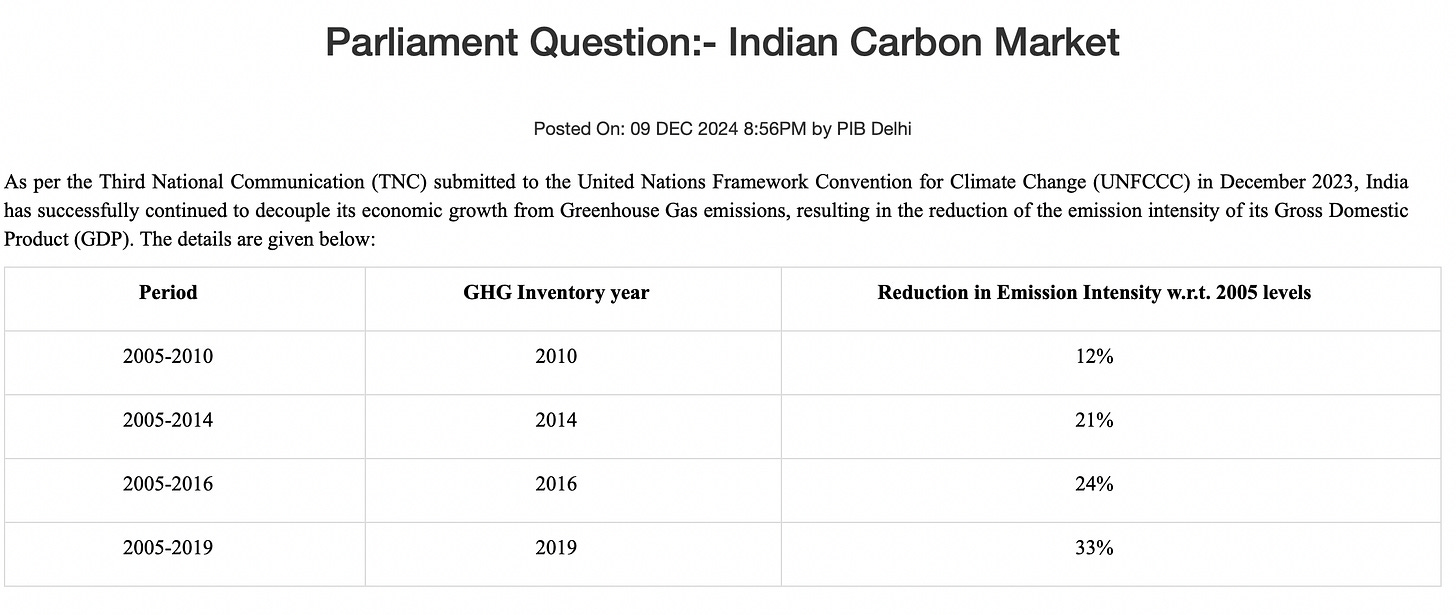

Secondly, India ratified the Paris Agreement on Climate Change in 2016, committing to limit the global average temperature rise to below 2°C by the end of the century. The first pledge was to reduce the greenhouse gas (GHG) emission intensity of its economy by 33-35% by 2030 from 2005 levels.

In August 2022, the target was further revised by the government to 45% reduction in GHG emission intensity by 2030 from 2005 levels. The target looks aggressive, but India has already achieved the first target of 33% and, hence a level up

Between 2005 and 2020, India’s emission intensity of Gross Domestic Product (GDP) reduced by 36% as against the NDC target of 45% to be achieved by 2030. (Link)

With carbon markets, the companies will have an incentive to work more towards decarbonization. Especially the carbon-intensive ones.What is Carbon Credit Trading Scheme (CCTS)

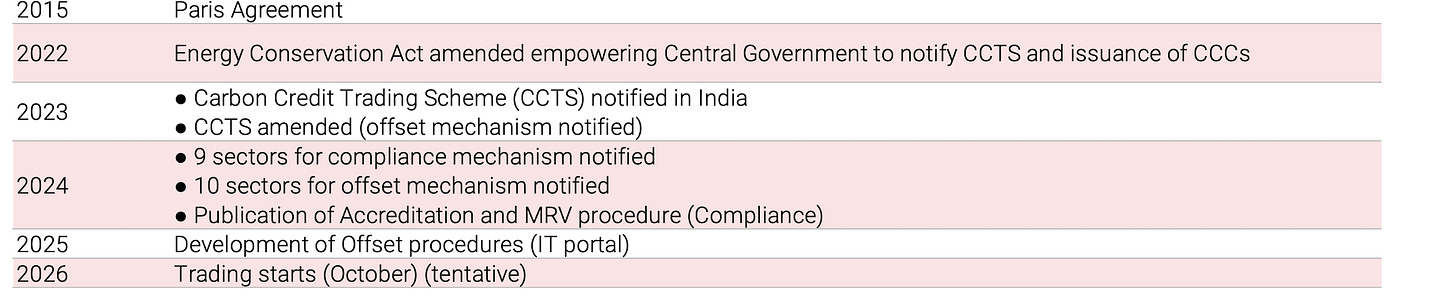

Carbon Credit Trading Scheme (CCTS) is a framework that allows entities to trade carbon credit certificates (CCCs) to reduce greenhouse gas (GHG) emissions in India. The scheme was notified in June 2023. It was amended in December 2023 (to bring in non-obligated entities).

Components of CCTS Mechanism

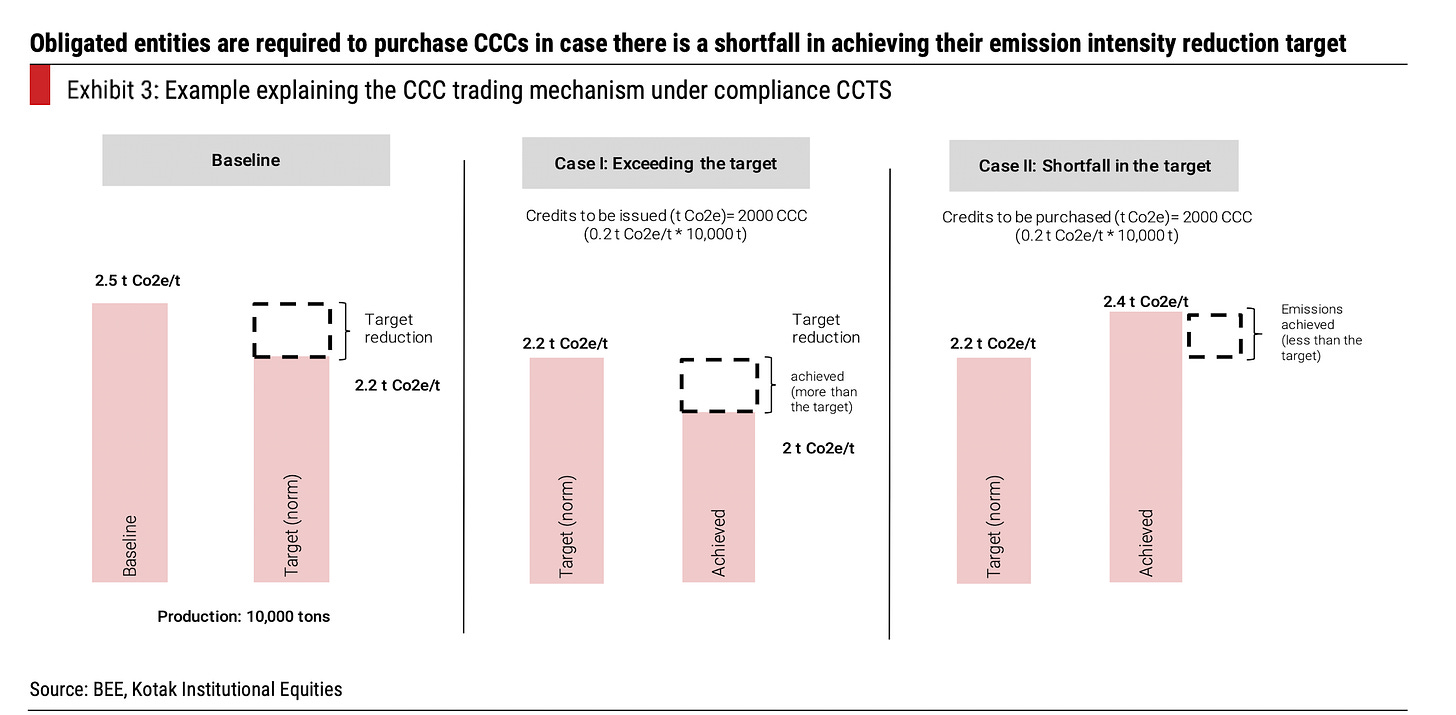

Compliance: Obligated entities must meet GHG emission targets within a three-year compliance cycle

Carbon credit issuance: Entities that meet or exceed their targets receive CCCs

Carbon credit purchase: Entities that don't meet their targets must purchase CCCs

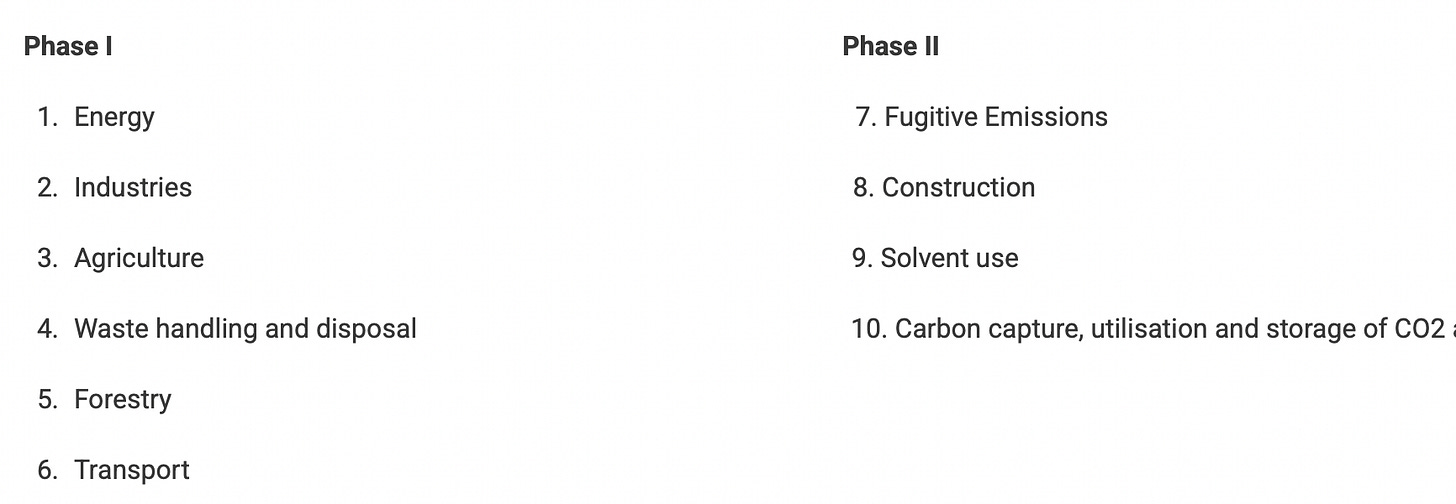

Offset mechanism: Non-obligated entities can register projects to reduce GHG emissions and receive CCCs. BEE shall identify the sectoral scope and methodologies to be used under offset mechanism with the support of respective technical committees

Illustration for Obligated entities

CCTS is aimed to reduce GHG emissions along with providing opportunities for decarbonization as well as creating a transparent and credible compliance mechanism.Initially it would cover carbon dioxide (CO2) and perfluorocarbons (PFCs), with provisions to expand to other greenhouse gases in the future.

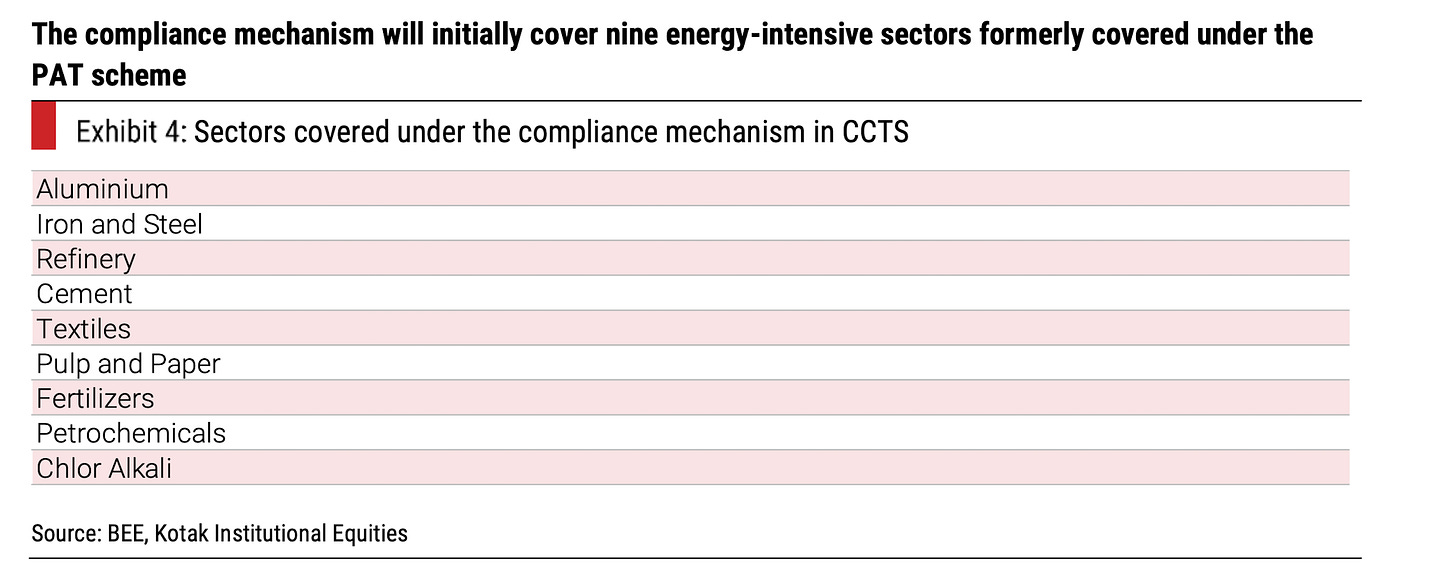

(PAT: Perform, Achieve and Trade (PAT) is an existing regulatory instrument to reduce Specific Energy Consumption in energy intensive industries, with an associated market based mechanism to enhance the cost effectiveness through certification of excess energy saving which can be traded.)

Following sectors are proposed to be included in the offset mechanism in a phased manner:

How will it impact Energy Transition

The major theme in Energy Transition is (1) Electrify and (2) Decarbonize

This framework has both stick and carrot. Stick in the form of compliance for companies in obligatory sectors and carrot i.e. voluntary participation by non-obligatory entities. Plus any surplus in reducing emissions is an economic gain.

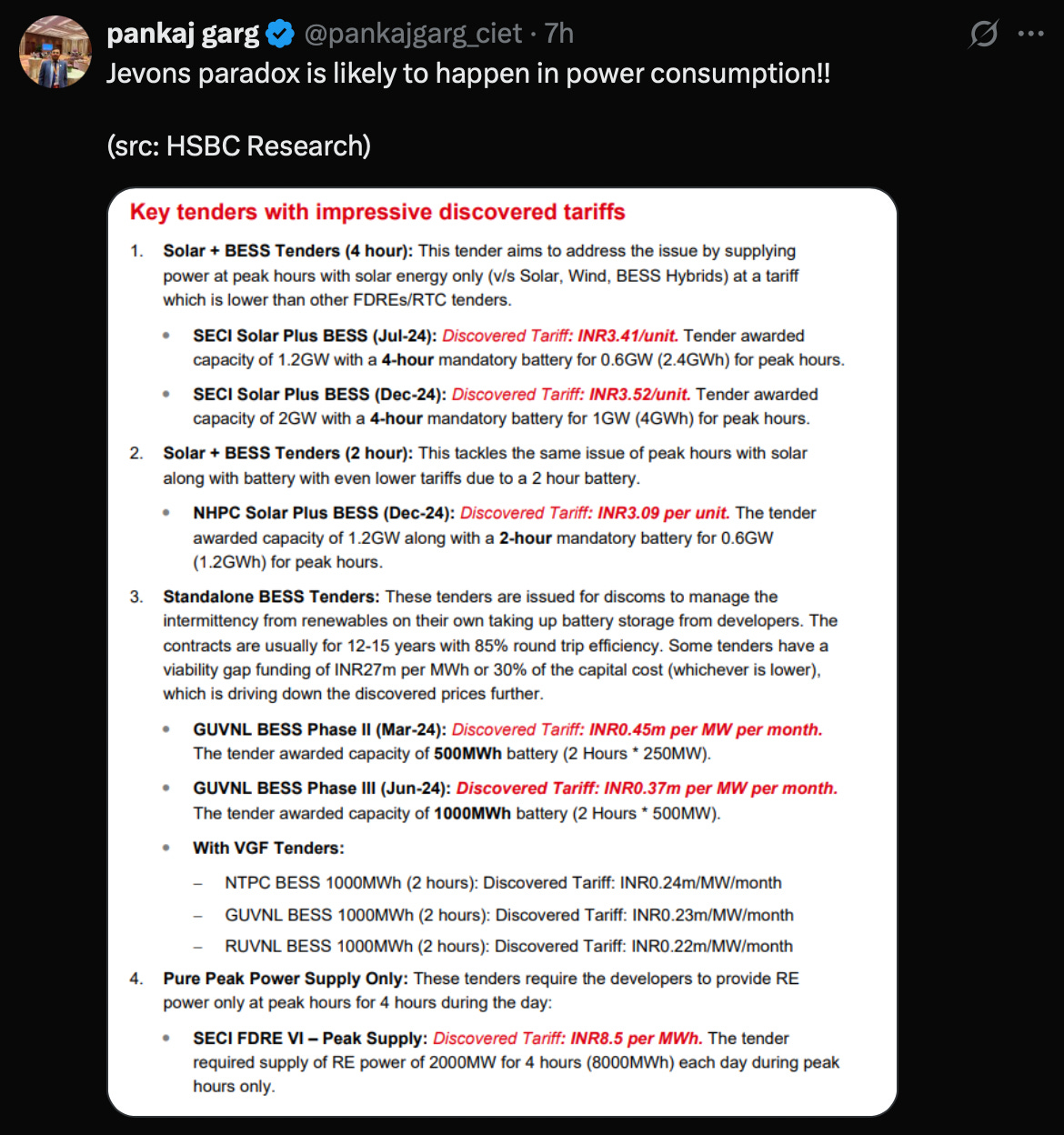

This may lead to accelerated adoption of clean technologies and as a matter of fact renewables are becoming cost effective as well.

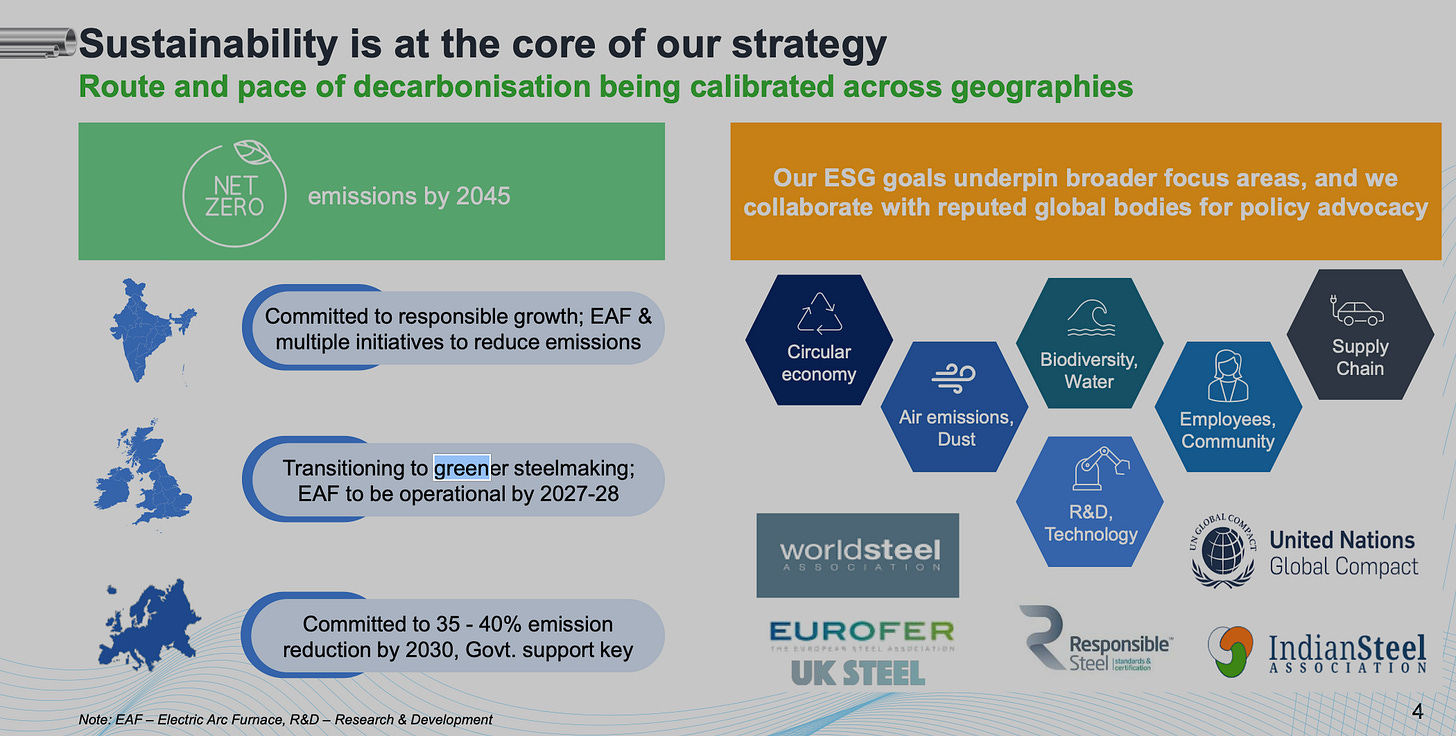

This will also have a spillover effect to decarbonize industries like steel which is likely to focus more on Green Hydrogen or EAF. Companies are already investing towards this effort - part of the reason being uncertainity of evolving regulations in export markets especially in the developed world.

Snippets of continued efforts towards decarbonizing

SAIL

Tata Steel

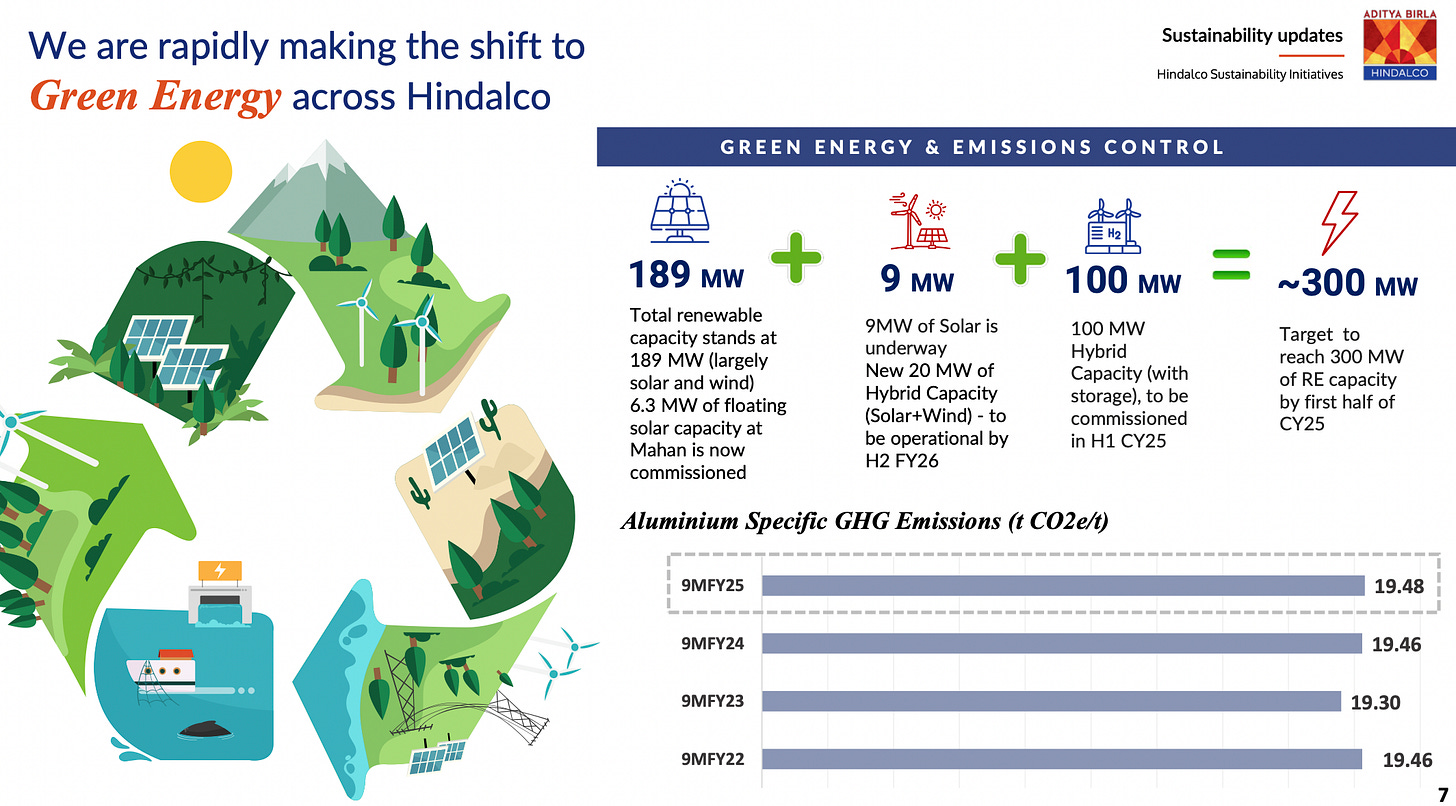

Hindalco

Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani (TechnoFunda Investing)

What I am Reading this Month:

Best Loser Wins: Why Normal Thinking Never Wins the Trading Game

Stan Weinstein's Secrets For Profiting in Bull and Bear Markets

The Almanack Of Naval Ravikant: A Guide to Wealth and Happiness

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Thanks for reading Learning Lifelong! Subscribe for free to receive new posts and support my work.

What happen if a country withdraw from Paris Aggreement?