A cardinal rule while dealing in securities especially from the fundamental analysis point of view has been the concept of intrinsic value (popularized by the book The Intelligent Investor by Benjamin Graham). If you buy a stock below its intrinsic value you have a margin of safety. The lower we buy from the intrinsic value higher the margin of safety. (See: Margin of Safety by Seth Klarman)

But how do we get to the intrinsic value…here we are guided by frameworks

"When accessing all information is common, paying attention to important information is rare." - James Clear

The idea of having different frameworks is to pay attention to what is important and the ability to get better outcomes by (1) Looking from different vantage points (2) attempting to stack the probabilities for increasing upside and reducing downside.

This was infact one of the key learning from Raamdeo Agrawal Ji - to evaluate ideas through the lens of different frameworks.

The objective of this post is to understand the framework “Terms of Trade” (11th MOSL Wealth Creation Study 2001-2006)

What are Terms of Trade

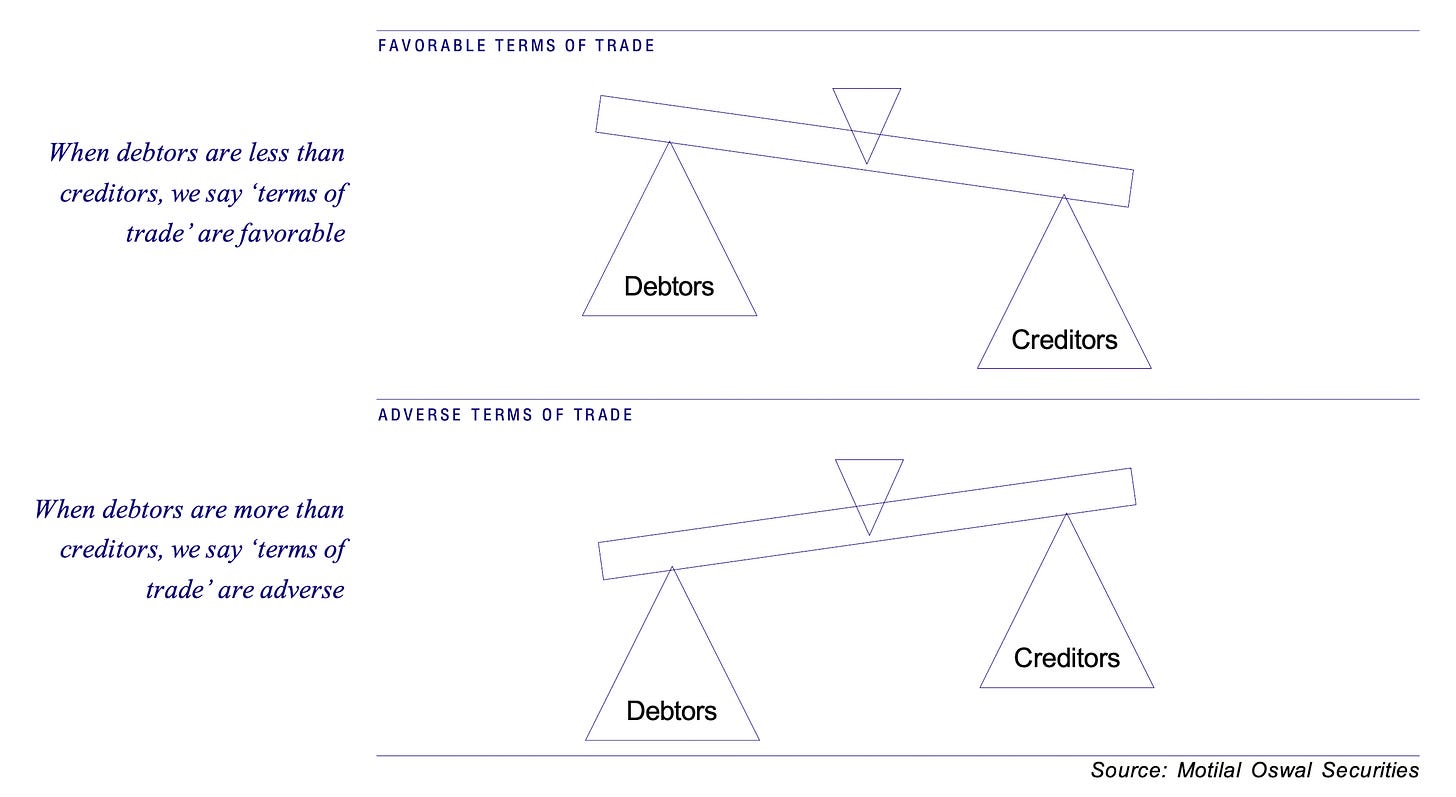

Terms of Trade here means the relationship between a company’s creditors and debtors. It is, essentially, the balance between what a business owes and what it is owed.

In simple terms, ‘Terms of Trade’ refers to the ratio of debtors to creditors. If a company has more creditors than debtors, it enjoys a natural source of working capital, reducing the need for external financing. Conversely, if debtors exceed creditors, the business must deploy additional capital to sustain its operations, potentially impacting profitability.

Favorable Terms of Trade can signal competitive advantage.

A business with favorable ‘Terms of Trade’ often requires little working capital and enjoys strong free cash flows. Companies that can negotiate better terms with their suppliers (longer credit cycles) while maintaining short debtor cycles tend to have a significant competitive advantage.

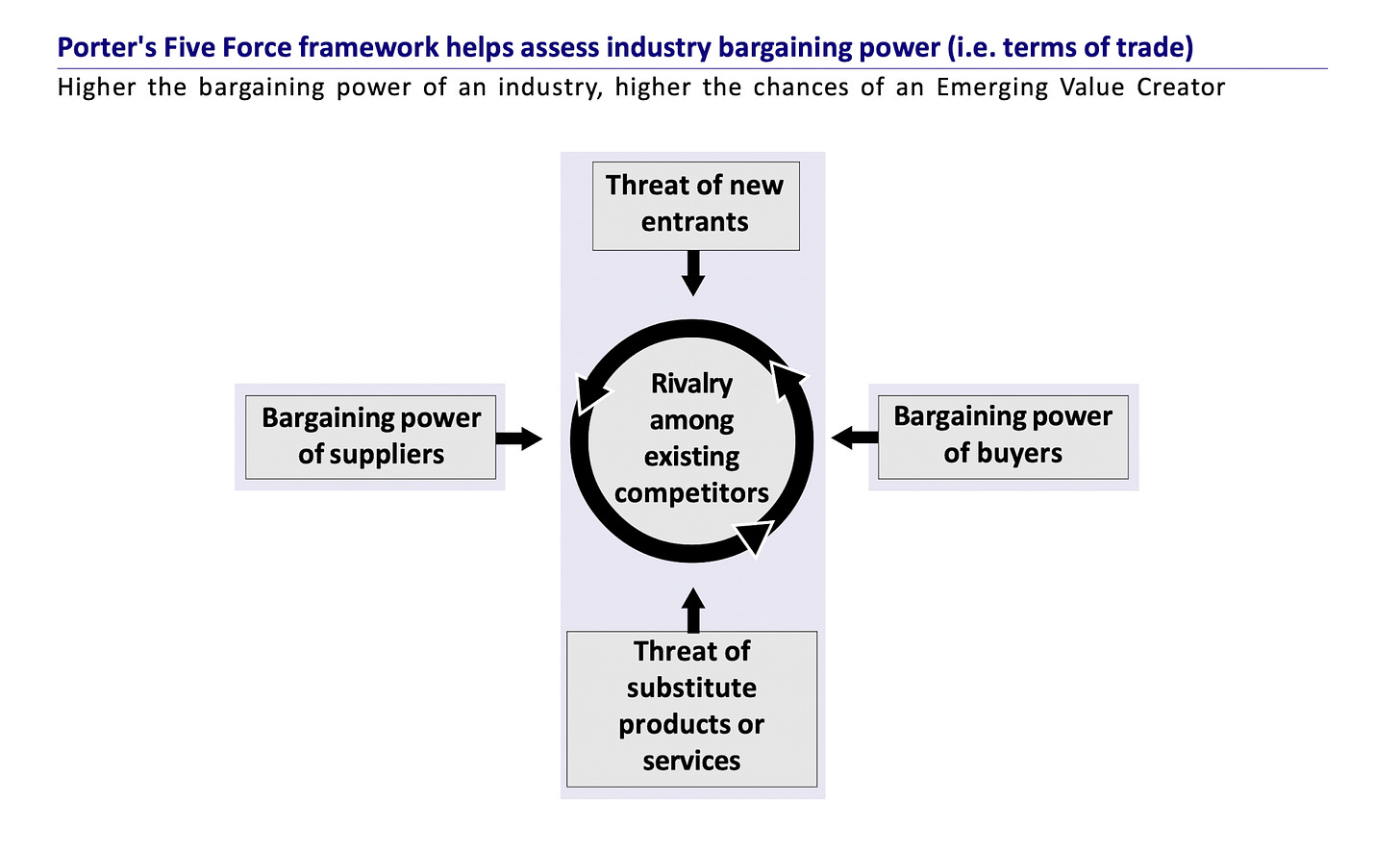

From the Porter 5 Forces framework - it may mean lower bargaining power of - buyers and suppliers.

Importance of “Terms of Trade”

High-growth companies create the bulk of the wealth. The faster the growth, the faster the expected wealth creation. However, growth requires cash to fund their growth - this is where the terms of trade we look at the sources of operating cash flow.

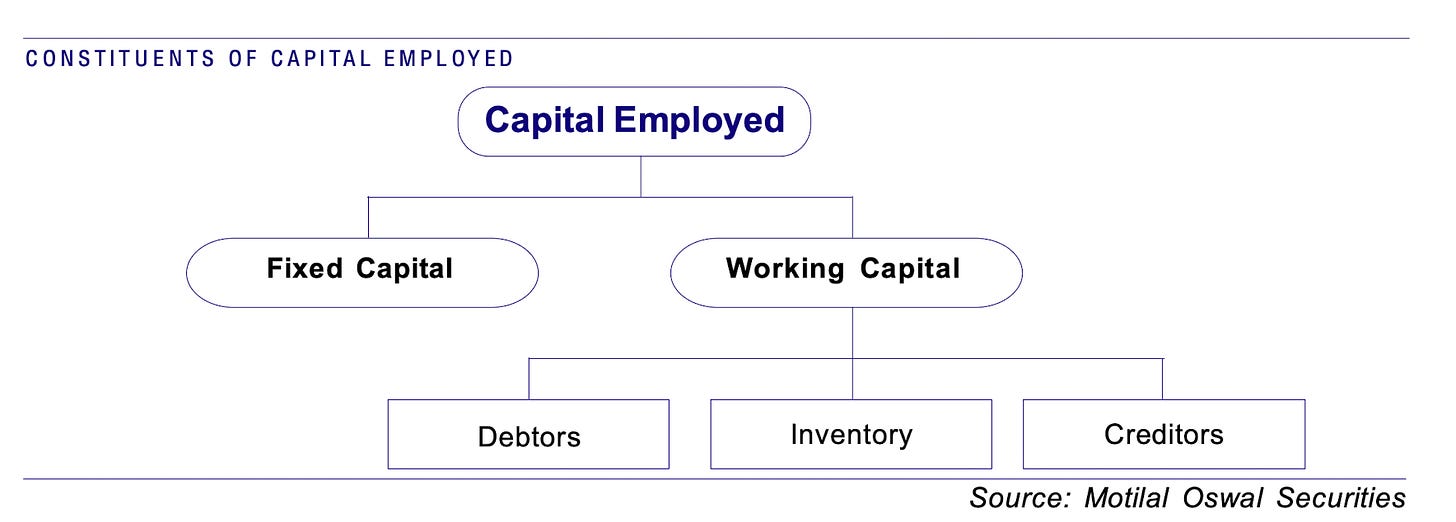

To operate a business, typically two types of capital is required i.e. Fixed Capital (Plant and Machinery etc.) and Working Capital (Inventory, creditors and debtors).

Growth typically demands investments in both fixed and working capital requirements. But as investors we are focused on return and one measure of profitability is the Return on Capital Employed (ROCE).

How can a company increase ROCE:

Increase profit without increasing capital employed

Maintain profit with a decrease in capital employed

It is generally difficult to change the fixed capital requirements, however, as the industry structure changes or the company’s positioning changes the working capital requirements can decrease.

Framework in Action: Some case studies from the past

DMart:

DMart, one of India’s most successful retail chains, maintains extremely favorable ‘Terms of Trade’ by negotiating long credit cycles with suppliers which has helped it to scale profitably.

Customers, however, pay upfront at the stores, ensuring strong cash flows and reducing working capital requirements.

Zomato (or shall I call Eternal):

Collects payments upfront while payments to the suppliers etc. has to be made later.

Maruti Suzuki:

The company maintains strong ‘Terms of Trade’ by securing supplier agreements that extend credit cycles while ensuring upfront payments from dealerships.

Titan (Luxury Retail):

Titan’s favorable ‘Terms of Trade’ stem from a combination of brand strength and effective inventory management. Customers often pre-order high-end watches and jewelry, improving cash flow management.

Asian Paints (Manufacturing):

The company’s unique dealer distribution system ensures payments are received quickly, while supplier agreements allow longer payment cycles.

This results in negative working capital, a hallmark of strong ‘Terms of Trade.’

Nestlé India (Consumer Goods):

The company benefits from fast inventory turnover and a strong supplier network that allows it to extend credit while receiving upfront payments from distributors.

Note: These are case studies - not an investment adviceLet’s take the concept of Terms of Trade even further to the concept of float. There are businesses that due to the nature of Industry or competitive positioning enjoys negative working capital which can help fund the fixed capital expenditure.

Float refers to funds that a company holds temporarily but does not own. However, can be leveraged to their advantage.

The most typical example of this concept is Berkshire Hathaway Insurance Operations. Insurance as a business model requires premiums to be prepaid, while claims are settled over time. This delay allows Berkshire Hathaway to use these funds for investments, essentially borrowing money at no cost. Plus: No Fixed Repayment Schedule, No Interest Obligations and No Collateral Requirements.

The ability to generate substantial float often stems from market power, enabling companies to negotiate favorable terms with suppliers and customers. Understanding and leveraging float can significantly enhance a company's financial performance, providing a competitive edge in the marketplace.The questions that I find worth asking are

Is the Industry itself enjoys favorable terms of trade?

Eg, customer facing business like Telecom, Oil Distribution, CGDs where the company is paid upfront but enjoys credit from suppliers.Is the company you are evaluating enjoys relatively better terms of trade than the peers?

Does the company have float and is utilizing the float effectively?

Does Adverse Terms of Trade Work?

There are exceptions. Not every company will have favorable terms of trade but still can create huge wealth…why? because they value add and have high margins.

Eg IT services companies have long receivable cycles which get compensated through high profitability. Combine with good growth rates it becomes a recipe for wealth creation.

To sum up

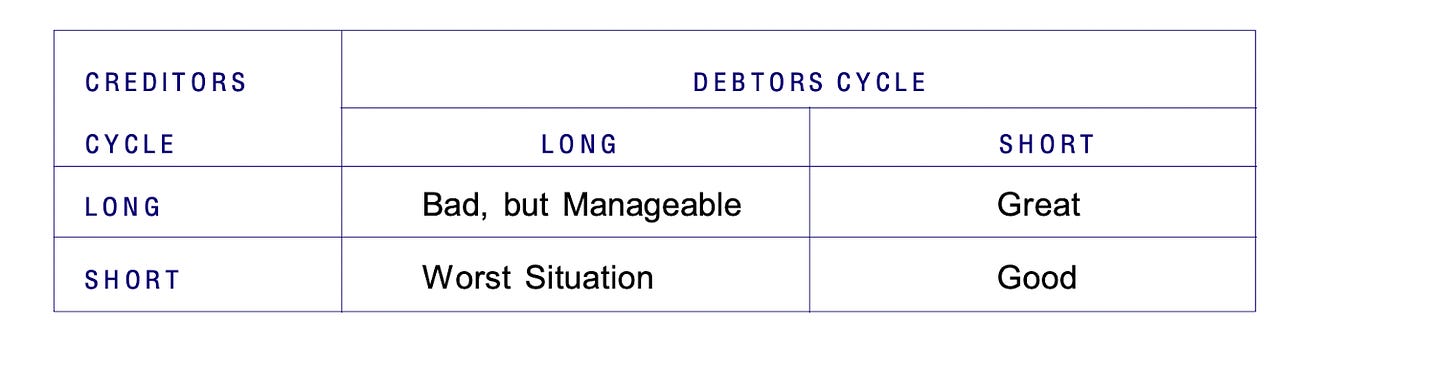

When terms of trade change from adverse to favorable, the impact on the speed of wealth creation can be significant.

Having favorable terms of trade does not mean that nothing can go wrong in the industry. Some industries by structure have favorable terms of trade but can still be loss making or giving returns below the cost of capital.

Nevertheless, Terms of Trade can be a valuable tool in evaluating financial health and long-term sustainability.

Short debtor cycles and long creditor cycles: This ensures a company doesn’t lock up too much capital in receivables.

Consistently positive cash flows: Businesses that convert their profits into cash efficiently tend to create more shareholder value.

Industry trends: Certain industries inherently have better ‘Terms of Trade’ (e.g., FMCG) compared to others (e.g., capital-intensive manufacturing).

While strong earnings growth and high RoCE are essential, managing working capital efficiently through favorable ‘Terms of Trade’ can be the differentiating factor between a good company and a great one.*****

Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani (TechnoFunda Investing)

TradingView Affiliate Link

Resources:

Motilal Oswal 11th Wealth Creation Study

Flirting with Floats by Prof Sanjay Bakshi Sir

What I am Reading this Month:

The Almanack Of Naval Ravikant: A Guide to Wealth and Happiness

Never Enough: From Barista to Billionaire

Finished reading

Felt like an honest glimpse into the life of a billionaire. Makes you question the purpose of money in our life.Supporting my work

If you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: I am not SEBI registered. The information provided here is for informational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.