⚠️ Before going into the stock Disclaimer that...

I am not SEBI Registered. This post is not a recommendation or investment advice. Please consult your financial advisor.

⚠️ I am biased. I am invested and may change my mind anytime, as this is an IPO stock, and the investment is a positional trading position.A Primer on Pre-Engineered Building (PEB) Sector

The sector has been covered in the previous post. Please go through the previous post to understand the industry landscape.

Briefly, there is a shift towards pre-engineered buildings from conventional buildings - part of the time required to deploy pre-engineered buildings is less than that of conventional buildings. It is a cost-effective solution as well.

So, a value migration story and beneficiary of private capex.Interarch Building Products

Interarch is pure play Pre-Engineered Building Player (PEB)

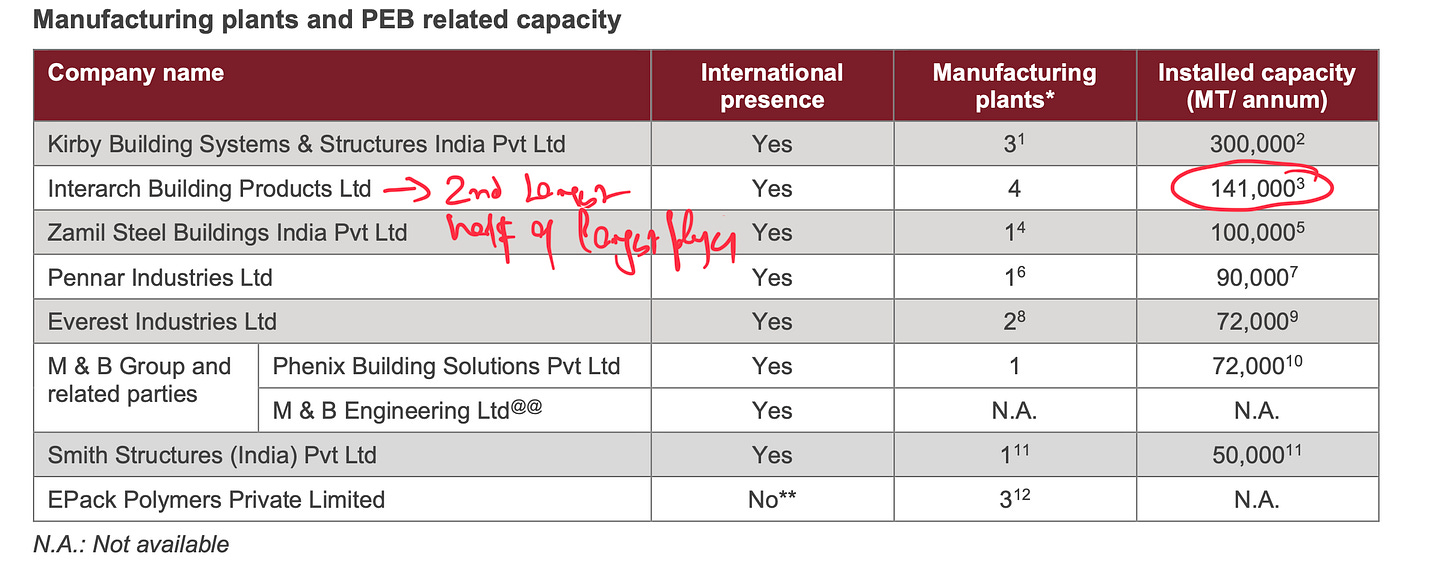

2nd Largest in terms of installed Capacity

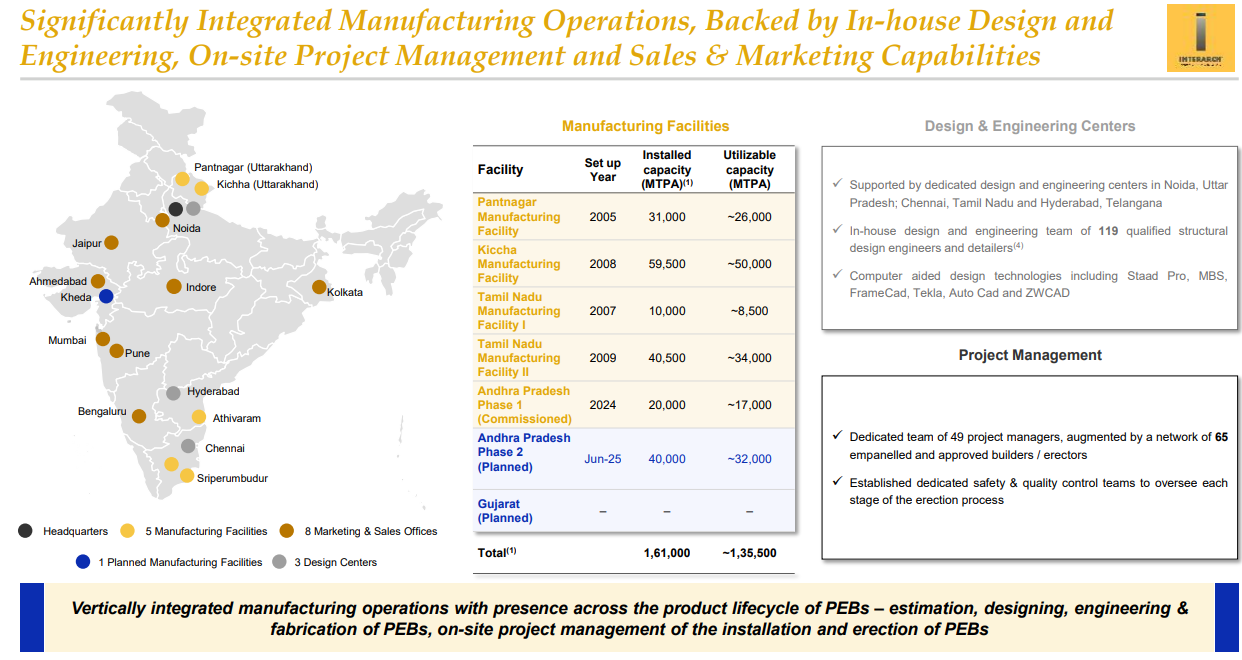

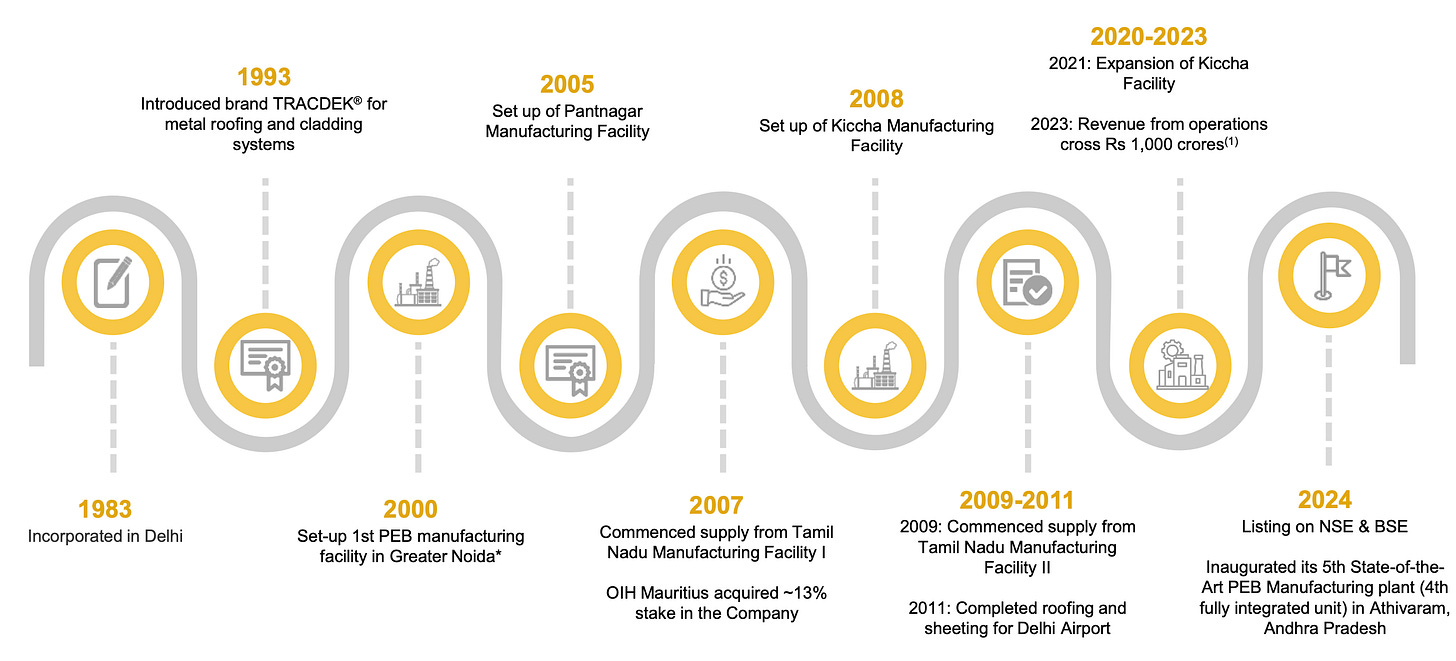

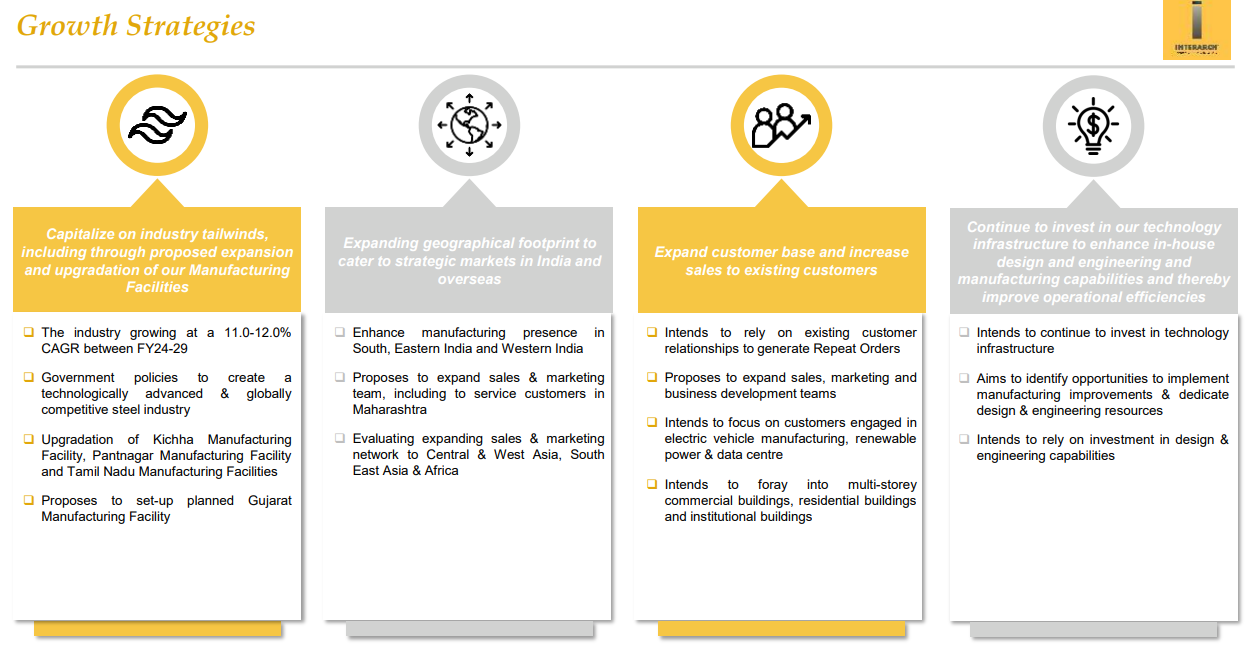

5 Manufacturing Facilities - the fifth facility has commenced phase 1 while phase 2 is in Capex mode, and 6th facility is also planned.

Have a 6.5% market share among integrated PEB players in India.

First Generation Enterprise: Founded the company in 1983, so 40+ years of experience

Let’s delve deeper into what the Company does….

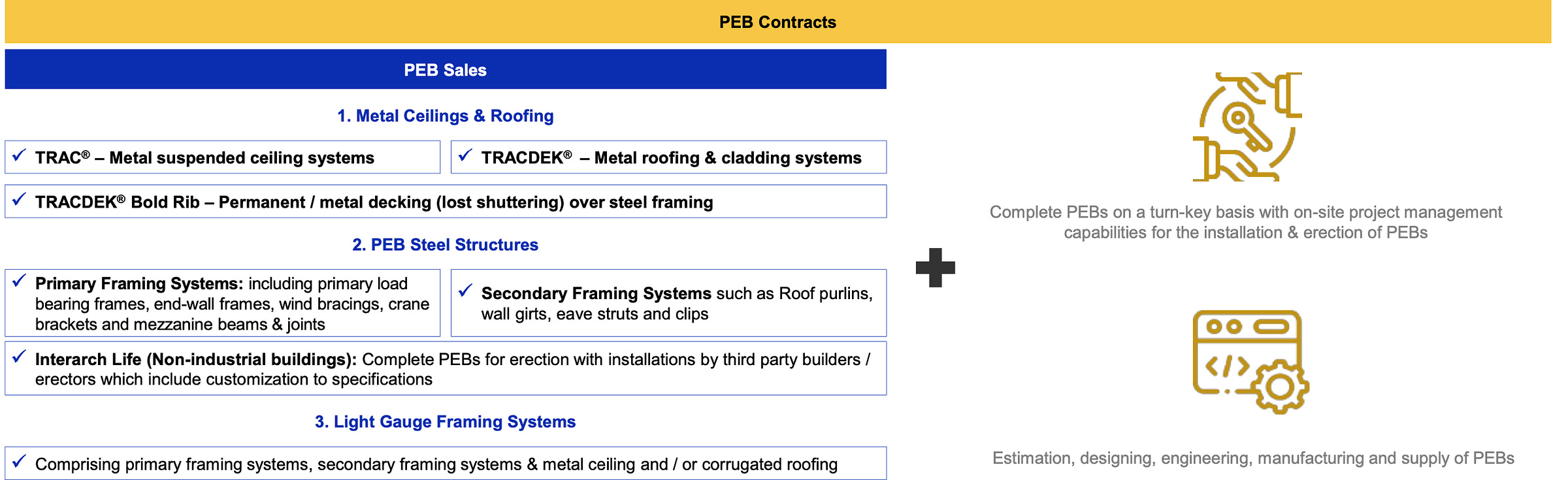

As a PEB player, they sell steel products - ceilings & roofing, steel for structural and framing systems, i.e., take raw steel from the likes of Tata Steel and convert it into parts of the engineered steel structure.

+

The structures are not only manufactured but also designed in-house.

+

The project management is also handled by Interach.In a nutshell - for the customer, this is a hassle-free transaction as the responsibility of the project is on one party.Hence, orders are not decided on L1 rather than on relationships, etc. - This is evident from repeat orders.

FY 23 and FY 24 witnessed over 80% repeat orders

Business Economics

- Avg order size of 12 cr. The range of order size can vary from 1.5 cr to 180 cr taking between 4-12 months to execute them.

- A fully operational plant of 50,000-60,000 MTPA capacity has a revenue potential of 550 cr (at current steel prices).

For the Gujarat Facility, they have mentioned the capex, including the land of 100 cr, so in that case, the payback period will be 2-2.5 years Industry Agnostic

This is a benefit as new Industries come in or different Industries grow - this is evident from having done a Data Center project + now doing projects for Renewables, Battery Plants, etc. The Semiconductor Sector may also provide an opportunity.Expect to grow at 1.5x to 2x the industry growth as apart shift to organized players happens.

Looking to double revenue in 3-4 years along with stable margins

Looking into B2G business, especially Railways

Currently operating in light steel building segment and planning to foray into heavy steel building

Q1/Q2<Q3<Q4

Currently (after Q1 results) order pipeline of 4000 cr, past hit rate of 20-27%.

Risks

Commodity Risk - Sudden increase in steel prices.

This is partially mitigated with 50% of the contracts with steel price variability and carrying inventory for short-term projects

Execution Risk

Mental Model - “The strength of the chain is the strength of its weakest link.” A building is made of many parts. To take an analogy from furniture like IKEA - one missing or sub-optimal part can lead to a delay

Also execution risk on account of lack of Human Resources - designers/workers.

Demand Risk

The demand is very much private capex-driven. So, any unforeseen macro risk can have dire consequences.

Transportation of parts: Logistics may pose a big challenge given the size of parts and quantum of parts.

Technical Analysis

Closing Thoughts

1) This is a recent IPO, and hence, all said and done till this point is marketing. The growth pre-IPO is commendable however, in the very first concall, the growth rate projected and what was presented before IPO are in contrast. So, the actual execution matters.

2) It is important to have a categorization of the business model in mind - there are businesses with more or less secular demand (shallow cyclicality) on the other hand this seems like a highly cyclical business. There are businesses where incremental investment requirements are less i.e. huge operating leverage - in this case, I don't think that they will have huge operating leverage (the design part has operating leverage...but how much is design % of the whole project?). The intensity of capex is however relatively less as the payback period is less than 3 years.

For the time being, this stock is a positional play till it is discovered at large (the new sector) available at decent valuations (P/E 29x), and the private sector capex plays out.

Disc: I have a trading position. Looking forward to understanding more about the sector and the company in particular***

Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Thanks for reading Pankaj’s Substack! Subscribe for free to receive new posts and support my work.