Learning from Superinvestors #1 - Ramesh Damani Ji

Notes, reflections, and learnings from the book Masterclass with Super-investors by Vishal Mittal and Saurabh Basrar

⚠️ ATTENTION

I am not SEBI Registered. Whatever follows is not a recommendation or advice. Please consult your financial advisor.

Any stock mentioned is not a recommendation.(1) We should be forward-looking

A basic mistake that most investors make - when they are driving, they look at the rearview mirror rather than the windshield to map the road ahead.

The stock market is about looking ahead and not looking behind

Investing in markets is about looking ahead. Focus on where the puck is moving. The following passage from Prof Bakshi’s blog caught my attention which resonates with Ramesh Damani Ji’s advice about looking ahead.A lot of attention is paid to this market cap/GDP ratio and what it means for the relative cheapness or expensiveness of a market. However, not enough attention is paid to the size of the opportunity in India, how it has grown over time, and how that opportunity will become exponentially larger if the prediction about India’s future economic growth, made by Mr. Sanyal and many other commentators, turns out to be roughly right. Just think about this for a moment: If India’s GDP reaches the $29-33 trillion range by 2047, India’s market cap will also increase from the current $5 trillion to $30 trillion, or thereabouts.

Source: Prof. Sanjay Bakshi

This reinforces the view that though we may be overvalued in the present...there is a long runway for India.Part of stock market investing is that you think beyond.

At a price, everything is captured. Basically as a fundamental investor, one should look at where downside risk is limited i.e. the price already captures all the negatives. (2) Atoot Vishwash (Unshakeable Faith) in India Story

Countries never go bankrupt - they can raise taxes, appropriate wealth, do anything they want, and also force hard changes

The opportunity of the last 30 years will be dwarfed by the opportunity of next 30 years

(3) Focus on Position-sizing

When you have a great idea, you need to back up the truck and buy

Further, when stock goes up, a smart investor will keep adding at various points, while an average investor might not.

Damani Ji writes about backing up the truck aka position sizing multiple times in his interview in the book.

IMO, be it trading or investing, position sizing is significant. The position sizing question has to be dealt with at many layers:

(1) As part of your total wealth/net worth what is the allocation to equities?

(2) As a percentage of the equity portfolio, how much weight does an investment carry or the group of investments carry (basket approach)?This is how position sizing takes you to a completely different trajectory:

In 2000, when the tech bull market ended, about 95% of my portfolio was in technology stocks

You only need 1-2 big winners; if you size them you will see the magic….

I would say I was riding the trend - I was bullish on Technology, I happened to be in technology and the bull market was in TMT. Infosys and CMC had gone up 100x each and the rest of the portfolio was dwarfed.

Full disclosure....it is easier said than done. Imagine the kind of volatility a concentrated portfolio has. This requires full conviction and stomach to hold for bigger gains.

The approach I follow is borrowed from the trading world, the R-multiple approach. Define the total risk in the portfolio in terms of %. eg max 4% risk on initial capital, One can have 8 positions of .5% risk each. This .5% risk for the single position then guides the position size based on % SL.

(I will try to cover this approach in future) Journey to 100x

“The next Xerox is Xerox”.

It meant that Xerox was one of the glamour stocks in the 1960s and it doubled multiple times. You don’t sell it just because it doubled or tripled. You just keep it - “Next Xerox is again Xerox”. I remembered that. I had realized the size of the opportunity. I understood that the Indian Industry was a billion dollars in size, while it is a trillion-dollar Industry in a Global Context.

Conviction comes from understanding what you are investing in. This is a continuous process. Well, I can't develop conviction based on one conference call or Annual Report...it takes continuous tracking of the company/sector.

He is not a price-oriented investor. IMO, part of the reason is (1) The amount of investment he makes will create price action on its own (2) he has innate conviction about his ideas that is not affected by how others view them and is reflected on charts. Q: Some of the stocks become very expensive at particular periods of time. Don’t you think about selling them and buying at a cheaper price?

RD: It’s a mugs game - you think you will buy it cheaper, and the market pushes the price more. I have rarely seen it done successfully. Once in a while you will get it, but generally it does not happen. So that doesn’t tempt me.

In markets especially during bull markets, the most important thing is position. One needs to understand the exponential math...eg if you have already made a 50% gain you don't need another 50% to double, you only need 33%. If you are a smart stock picker, you will have some leadership stocks. You will typically have one or two among the top 50 stocks that are moving. The trick in position sizing, is to let those stocks run because in a bull market, they can go a long way.

Don’t cut your winners just because they have increased more than a certain percentage of your portfolio. Infosys was 90% of my portfolio once - you want to keep riding the winners.

Riding the winners is the philosophy we follow in our community as well. How to make sure that you are allocating more to the winners - by averaging up known in trading parlance as pyramiding.

These are the principles I had the privilege to learn from my mentor Vivek Mashrani. You can enroll in the community here:Just because a stock is overvalued is no reason to get out. Some of the sharpest gains come in the last phase of the bull market.

(4) Independent Thinking

Do your homework and have the integrity of independent thought

Borrowed conviction will not help.No one rings a bell when a great investment idea comes. In fact if everyone disparages it, probably you are on to a good investment idea!. If everyone applauds you for your pick - it’s probably not a great idea. There has to be spectism in what you are buying. Finding picks is a lonely job - that integrity of independent thought you need is very lonely.

To be great in the stock market - you need to find your own path

(5) Follow the leaders

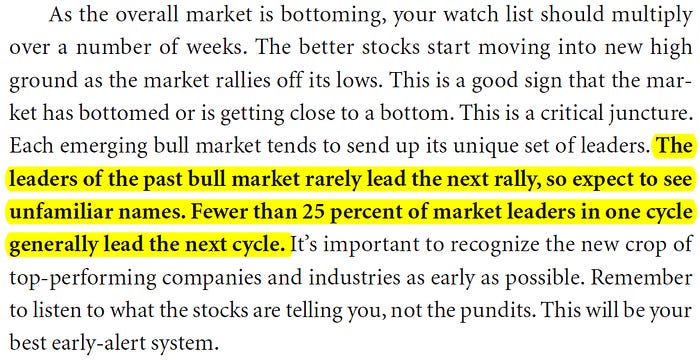

I had learnt that when a bull market gets over, the leaders are squashed completely

This advice is more apt at the start and end of a bull market. Similar thoughts are echoed by Mark Minervini in his book "Trade Like a Stock Market Wizard" where he takes one level further where he advised to look at leaders and not the indices. Stocks can top out well before the bull market ends.

(6) Process

There is no point in regretting - there are many stocks that I have missed. How can you be so stupid, I ask myself! Despite that, it doesn’t matter if you can double money every three years - it’s pretty cool.

This is easier said than done. 25% CAGR on the whole portfolio is not luck...its hard work, process, and consistency.

Against equities average return of 15% it is 10% Alpha. My criterion is an enormous value on the market cap of the company - I see how the market is valuing that company and if I am happily willing to buy this whole company at that price. So I wear businessman’s hat. I might be willing to overlook and tolerate some issues in the hope that they will change.

The first filter is the market cap - how cheap the company is relative to the size of the opportunity or where it could be after 10 years.

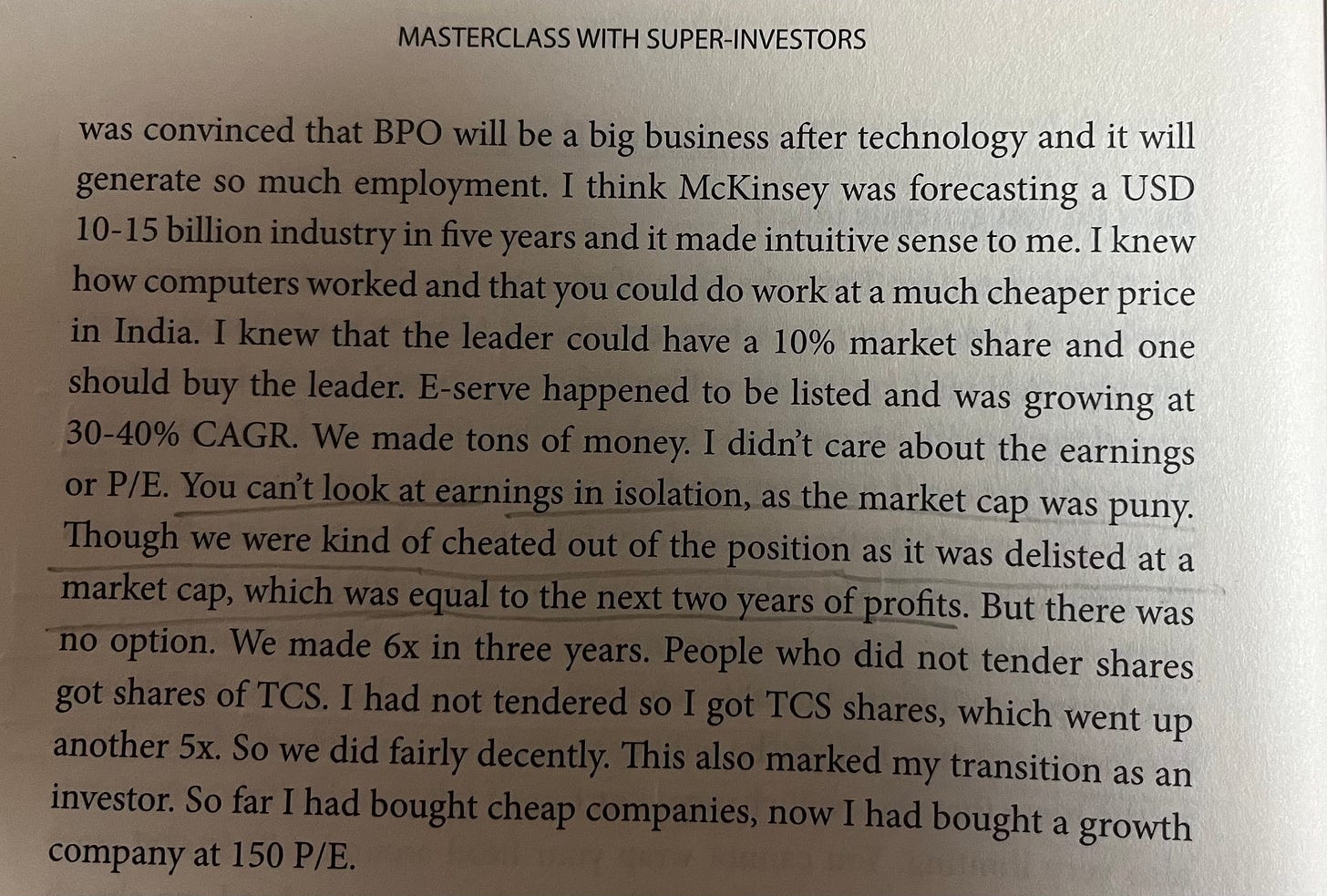

Looking at PE only is futile.

eg E-Serve International. Mcap 150 cr, Profit 1 cr i.e. PE 150x

I often find that I am more bullish on the company than the management are! I understand the long-term potential of the business a little better, as they are running the company on a day-to-day basis, bogged down by the short-term, and unable to think of a 3-5-year horizon. Typically when that happens, it is a great bargain - you are getting something really cheap - managements themselves are shaken about the prospects of the business.

Management

Our job is to judge the management. They can tell us anything they want. If they say that there will be a 40% growth, you don’t have to come and buy the stock.

You have to judge the management - you try and understand, look at the body language and see if their talk is credible. You should look at the past track record and see where they have delivered.

Generally, the people who talk in big round numbers are what we tend to avoid. We realize that the business is full of uncertainty and we are looking for someone who tempers that uncertainty.

Portfolio Construction

Don’t care about portfolio construction vs. the benchmarks. I don’t care about sectors - I want to find stocks that are cheap.

“If I can find really cheap stocks, I can put 80% of my money into technology. I don’t balance my portfolio using some mechanical formula”

Signals from the market

At the extremes, a market gives you the invitation that it’s ending or starting and good investors pay a lot of attention to that. Most of the time, timing is a futile exercise, but at extremes, it can be a very profitable exercise.

How the market reacts to news is a very important factor that I use. At the top of the bull market, news headlines will be very positive but the market goes down. It reacts negatively despite good news coming out. It indicates that there is selling going on out there - the smart money is anticipating bad times.

At the bottom of the bear market, the headlines will be very negative - the individual stocks however instead of going down, go up.

“So the principle is that when the public gets smart, the smart get out”

Resource: Masterclass with Super-Investors

Invest in yourself…. be a learning machine

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free course by Vivek Mashrani

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Thanks for reading Pankaj’s Substack! Subscribe for free to receive new posts and support my work.

pure funda of a great investing guru, thanks

👍👍👍