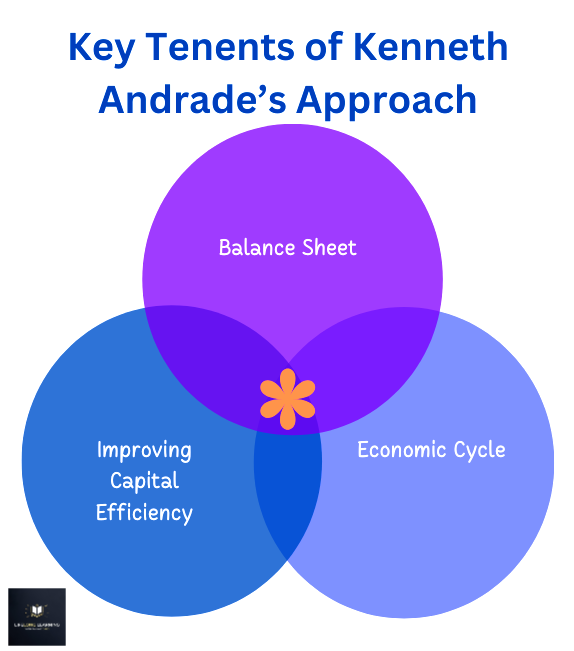

A Balance Sheet focused investor; he likes to buy dominant companies in sectors with improving capital efficiency and wait for the economic cycle to deliver the returns.

All the Previous posts on Masterclass with Super-Investors :

⚠️ ATTENTION

I am not SEBI Registered. This is not a recommendation or advice. Please consult your financial advisor.

Any stock mentioned is not a recommendation.A brief explanation of the business cycle

1)When external factors are favorable—e.g., increasing GDP or value migration into a sector— sales grow, and typically accompanied with increase in margins and hence increasing return on capital

2) Capitalism 101: When return on capital > cost of capital; more capital is deployed in that activity / sector.

i.e. existing players add capacity and new players enter.

(A contemporary example is Quick Commerce - now that the business model seems feasible more players are foraying into this space)

(Or look at the number of players entering Solar EPC or Module Manufacturing)

3) This capacity in the industry leads to a point where there is no more room for capacity addition. The capacity addition at this stage starts reducing the return ratios. At this point i.e., this peak of the expansion phase - you have peak profits and peak margins.

Capital infusion after this point leads to decreasing return on capital.

(But the companies keep on adding capacities — there are multiple factors. For example, the capex was started way back in anticipation of continued demand, and psychological factors like the sunk cost fallacy come into play. Very importantly, we can look through the lens of game theory—since the return on capital is more than the cost of capital, management sometimes prioritizes market share at the cost of profits.)

4) As more capacity comes on board, market forces decrease the return ratios. There comes a point where incremental returns are less than cost of capital. This period is the key differentiator between good and bad companies. As the cycle reverses, and market forces cause the weaker players (inefficient players) to get acquired or bankrupt.

5) This process of constructive destruction, effectively cleans up of excess capital in the Industry. An equilibrium establishes over time between supply and demand. Eventually as demand grows a supply demand gap is created once again starting a new capital cycle.

So what Kenneth Ji teaches us (my inference) is that we should evaluate investment opportunity from the lens of first principles. This capital cycle is fundamental.

The question here is how is your company navigating this business cycle? Kenneth Andrade's framework is to look at the 3 things predominantly - (1) Balance Sheet (2) Capital Efficiency (3) Economic Cycle 1) Focusing on Balance Sheet

In my first 10 years, there was no investment style or philosophy. I was basically looking at the breadth of the stock markets. I was looking at micro sectors and I picked up a great deal of knowledge. It was just collation of data. If someone woke me up in the middle of the night in 1996-97, I could have told him the average cost per spindle of any random textile company, or the capital cost of any steel plant that was coming up. So that was the distillation of information that I developed. I just worked on the balance sheet metrics, a philosophy that I still carry now.

The balance sheet should not come under stress at any point of time - that is sacrosanct.

2) Capital Efficiency

This is the “Bulb on 💡” moment so read this section carefully…

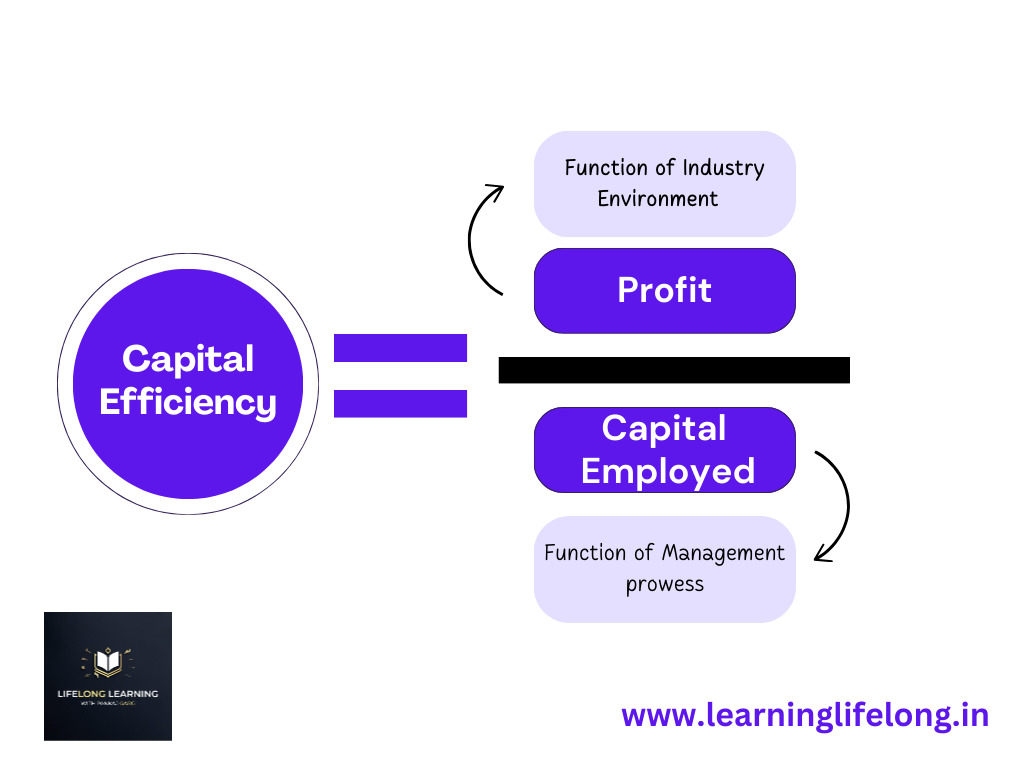

Capital efficiency has two parameters. Profit is the numerator which depends on the industry environment and Capital Employed is the denominator which is largely the management’s job to allocate capital.

How often have you seen that when an industry is doing well, most of the companies from that sector do well? This is reflected in the technical analysis as well with the companies in one Industry moving step-in-step with one another.

The premise here is that a lot of outcome is driven by external factors and when the tide turns, there is not much that can be done.Capital Efficiency is the metric that separates the wheat from the Chaff - since the external factors are not in control look for the capital employed:

The lesser the capital employed over multiple cycles, the better it is for the long-term investor. Normally, at the top of the cycle, all good managements end up without debt.

So the strategy is to buy leaders in an industry after looking at where you are in the cycle especially from the sales part (numerator) after first having filtered the company through the capital allocation lens.

One way he suggested is to look at EV/sales or Mcap/sales if the valuation is favorable you can go ahead even if PE is high - which signifies that this is not profitable part of the cycle but you go ahead if you know what would make the industry come back.

In a nutshell, invest in market leader with low debt in an industry under distress. However, one needs to be very conservative on the financial leverage side.Our job is to buy capital efficiency. Suppose you give me a technology company and a commodity company. If I think that I can make commodity business a more capital efficient investment at a price, I would rather allocate capital there. I can have high allocation to commodity stocks in my portfolio. Our job as capital allocators is to buy the most capital efficient business.

Let's take two businesses. The first one earns 9% RoE, is debt free, trades at 10 P/E or at book value, when the rest of the industry is losing money. The second one does 30% RoCE but trades at 40 P/E - which one would I prefer? You are paying three or four times the valuation for the higher RoE.

So if I buy at a price under book value, the valuation is compensating me for the RoE. This is more of an absolute approach to investing than a relative approach.

3) Economic Cycle

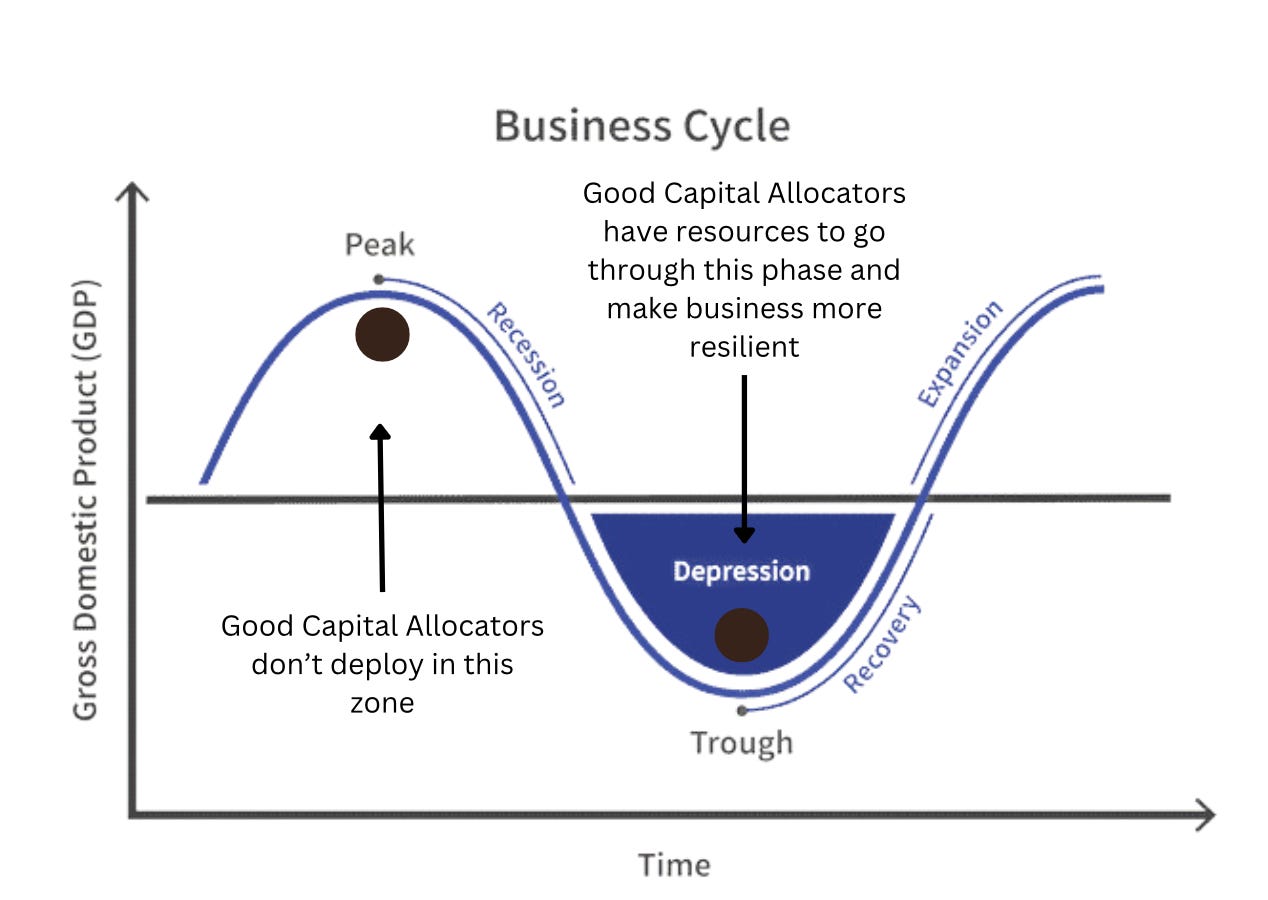

A lot of big mistakes happen when you get the call on the economic cycle wrong. The company is not at fault, but the management is not able to beat the economic cycle. When all the companies leverage at the top of the cycle, they bring in so much additional capacity that they disrupt the most efficient players. Even in the infrastructure boom of 2003-08, all the players were able to raise so much capital that it disturbed the pricing attitude for the players.

All mistakes happen at “peak of the cycle”, because the “peak of the cycle” is characterized by higher capital deployment due to the extrapolation of profitability of the last two to three years.

So if I have to look at one parameter, it will be the extent of addition to the gross block at the peak of the cycle.

Market shares don't come from capacity addition, but comes from customers moving to the stronger players. So the industry consolidates over a period of time.

You normally don't have one company doing well and other companies in the same space not doing well. I think that's what I have learned and tried to put together with portfolios as I have transitioned over the years.

eg. in 1990s all three 2-wheeler companies did well. During the tech boom, all tech companies did well, then consumer, power, real estate...time and again cycles have taught that stock moves in groups.This is the reason William O Neil created ratings for Industry - How to Make Money in Stocks

To make money - Don’t lose money

At the peak of the cycle, the capital deployed is always the highest. So that was the learning experience - that over a period of time, when you don't lose money, that is when you make money.

The cycle also gives a hint as to when to exit i.e. when top players start leveraging

You look for cyclical peaks. When the top two or three players start leveraging and creating new capacity, you will get price disruption in the industry. Then all the factors will start playing out, if there is enormous amount of profits at the top of the cycle. The other case is that you need to look out for any breakdown in the balance sheet.

Investment Process - putting it all together

We basically buy a good company, which is the market leader, at a good price and sit on it. I don't like to lose money. If the risk free return is x, then I try to work for a number double of that.

There is no 'one size fits all' approach. I tend to look for businesses that are not doing well - which have started losing money or are not making enough money. It's all about the assimilation of data, putting it together in a portfolio, and implementing it. But the data has to transition to the P/L account - first to the topline and then to the bottom line. You should know when to be top-line focused and when to be bottom-line focused.

Balance Sheet

From my perspective, I am a balance sheet focused investor. You throw earnings growth at me and I don't know the future. I understand cash flows and what impact they have on the balance sheet. That precedes the earnings growth. It's more predictable because what you see is what you get. Earnings growth is what you believe is what you get.

Capital Efficiency and Enter at the bottom of the cycle

We aim to buy the dominant and most capital efficient business at the bottom of the cycle. I wouldn't know, at the company level in the portfolio, which will perform the best, but the framework will remain the same. If all the components of the framework has the same characteristic, some part of the portfolio will break out. The discipline would be to not over allocate in favourite ideas, where we believe we have information edge or have some biases. At the end of the day, the returns will be generated by the industry getting back into growth.

So the philosophy is right entry price (Margin of safety), and letting the market cycle and the business cycle play out over time without trying to time it precisely.

Other insights

1) Know Thyself - Circle of Competence - Depth

Limit yourself to what you understand and then optimise it. The more you shrink your universe, the less you go outside it. Today, when I shrink my universe and say financials are something that I don't understand because of valuations, it doesn't mean that if financials do well, I am not supposed to do well. There are always parts of the market doing better than the market.

2) Continuous Learning

You have to constantly keep looking for things that are going wrong. When you are going right, you have to constantly question whether it's the market that is going right or you are going right. 90% of the times, it is the market going right. So in my first role in professional capacity, it initially seemed that I was always on the right side of the market. But actually it was the market that was going right and I was just participating in it.

This is typical nature of probabalistic arena where the lines between luck and skill are blurred.

Keep asking the question is the result because of your research or approach or the overall market is such.

Key is to develop processes - so at end of the day we can ask whether the process was followed or not? Keep doing this and we will start understanding and will get an edge. 3) Momentum vs valuation

This question is very apt in the context of current market conditions:

Kenneth’s approach is to look for pockets of opportunities i.e. Valuation driven rather than being momentum driven. Protect the downside more than to catch the upside.

His valuation-driven investing approach focused on identifying capital-efficient companies with strong balance sheets and dominant industry positions. Amateurs look at PnL. He looks through the lens of the Balance Sheet, as it is through the balance sheet that we can gauge the future earning capacity of the company and get a big chunk of return by playing the economic cycle.Resource: Masterclass with Super Investors by Vishal Mittal and Saurabh Basrar.

Book/reading recommendations

Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

It was good to read article. Try to exemplify some idea although with disclaimer. Such as cement sector is going through consolidation of capex with few groups.