Dear Learners,

The idea of this substack is to learn one new thing every week - whether it is about a Company, an Industry, Mental-Model, Productivity, Technology, etc...

In today's post, let's look at Kavach as a technology and the opportunities to invest in this space!!

Let's dive in!!Why is Kavach important for Railways?

One of the important problems to solve in our Country’s Railway Infrastructure is Safety. In 2024 alone, we have seen several railway accidents involving derailments, collisions, level-crossing mishaps, etc., which lead to substantial social and economic costs.

Enter Homegrown Solution: Kavach

What is kavach?

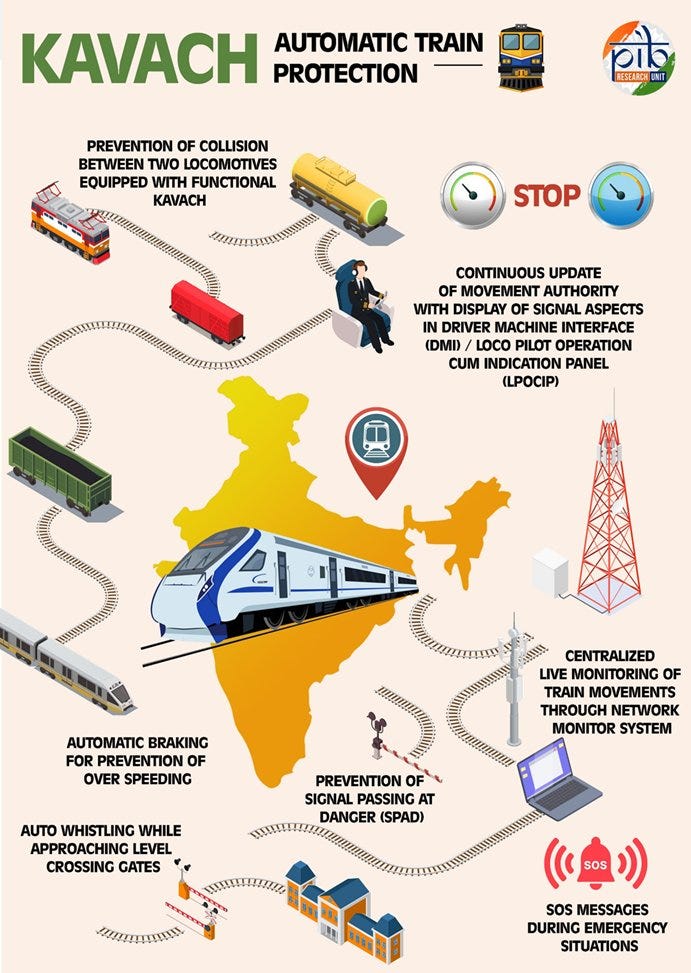

Kavach is an indigenously developed Automatic Train Protection (ATP) system, i.e., a safety mechanism designed to ensure the safe operation of trains by automatically controlling train speeds and movements.

Basically automatic brakes - which are very sophisticated and reliable!!Developed by the Research Designs & Standards Organisation (RDSO) in collaboration with Indian industry partners.

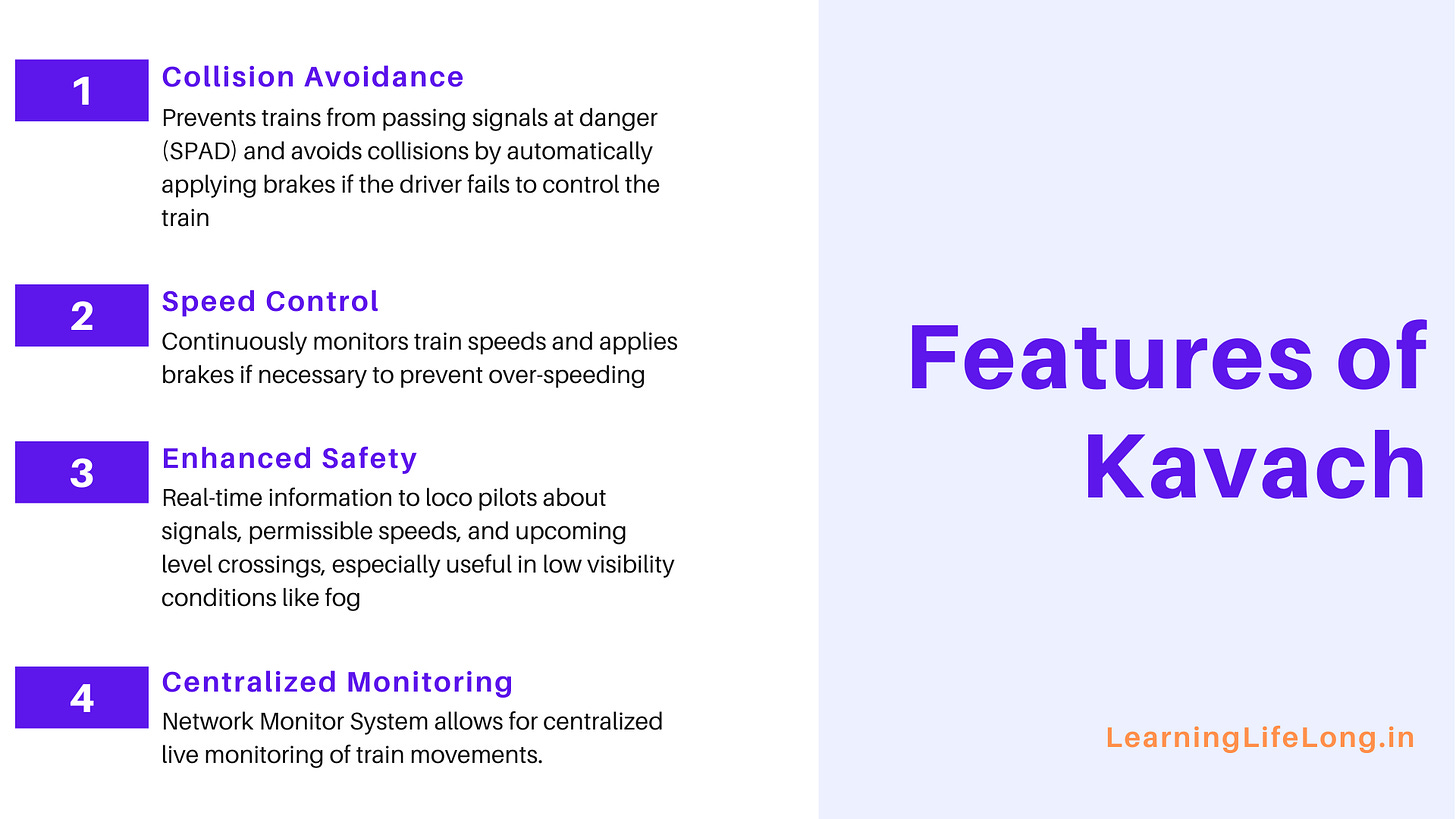

Key Features of Kavach:

So, How is this system implemented?

Well Implementation of Kavach include:

Installation of Kavach equipment at Stations

RFID Tag Installation - throughout the entire track length

Telecom Towers - to facilitate continuous and reliable communication between the train and the control centers.

Optical Fibre Cable (OFC) - along the tracks for fast and efficient data transmission.

Loco Kavach Installation - Every locomotive operating on Indian Railways is being equipped with Kavach technology.

The Kavach Opportunity:

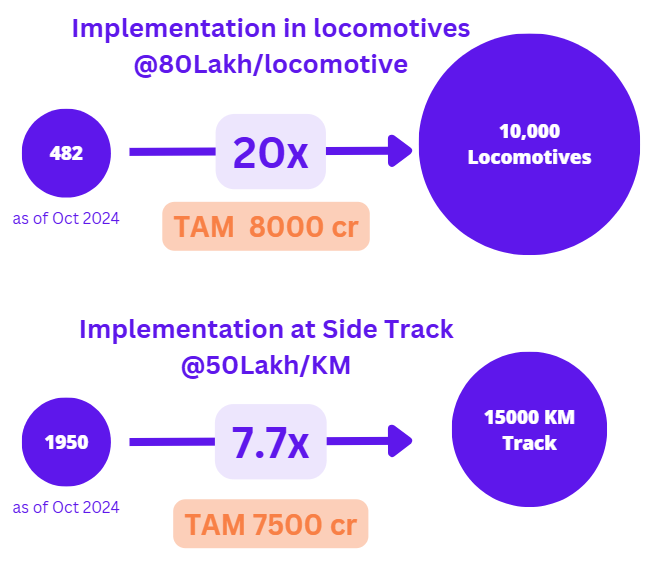

The cost for the provision of Track-Side, including Station equipment of Kavach, is approximately Rs. 50 Lakhs/Km and the cost for the provision of Kavach equipment on locomotives is approximately Rs. 80 Lakh/Loco.

Next phase of the Kavach installation comprises (a) equipping 10,000 Locomotives and (b) 15000 Route KM.

Hence the projected TAM is 15, 500 Crore (15,000X0.50 + 10000X0.80)

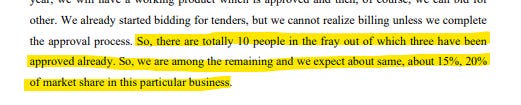

Originally, as alluded to earlier, three companies helped in the development of Kavach. However, other players are also entering - 10 players in the fray.

Companies in the Kavach ecosystem

As discussed earlier, starting with 3… there are now over ten companies in the ecosystem. Three companies are approved, and the rest look forward to getting approved by RDSO or are in the Kavach value chain.

CG Power/G.G. Tronics India Private Limited

Although they have won order, the kavach opportunity is small relative to the size of CG Power.GG Tronic/ CG power: 500-600 cr order received (i.e., a 4% share as yet)

Kaynes

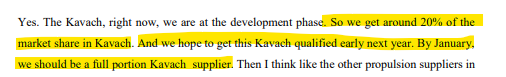

They are targeting 15-20% of the market. In the near term, this translates to a 3000 cr opportunity. (Current order book is 5400 cr, so a big chunk if they execute)Chart is also strong (I am not saying that it is because of Kavach, but it is definitely an optionality)

At All-time-High

Kernex

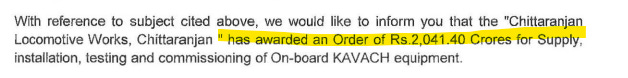

Kernex order win 2000 cr (13 % share of TAM) or 25% of the loco kavach

It is one of the strongest charts, and I must admit, even after knowing the story, I could not pull the trigger as I was fixated on the balance sheet. My logic for not executing was that they didn't have the balance sheet to execute.

Let's see 🤞At All-time High

HBL Engineering (name recently changed from HBL Power)

One of the three authorized OEMs for producing critical components of Kavach.

(Actually needs a detailed separate post - invested in this one)

I'm just waiting for orders here. The chart is very positive.

Edit/Update: 14th Dec Won ~1500 cr order for installation in locomotives

Near All-Time High

Final Thoughts

Efforts to enhance rail safety, such as improved infrastructure and automated systems, are critical to addressing the persistent gaps in safety.

As we evolve to make a world-class infrastructure, operating at higher speeds through Vande Bharat and eventually through establishing a high-speed rail network, aka bullet train network, on the lines of the Japanese Shinkansen Model, we first have to demonstrate that the system is safe and reliable.

There is a huge upside to the players operating in the segment as the Government puts in capex for Kavach...but at the same time, the competition has increased manifold!

Also, the actual implementation and funds allocation in the past have fallen short of projection. Actual implementation is paramount.

*****Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani (TechnoFunda Investing)

TradingView Affiliate Link

Resources

What I am Reading this Month:

Supporting my work

If you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Thanks for reading Learning Lifelong! Subscribe for free to receive new posts and support my work.