Learning New Things #3: What is Ergodicity?

Applying Ergodicity in Investing!! A model for risk

Dear fellow Learner,

Prominent thinkers like Charlie Munger believed in having a "latticework of models" for understanding and retaining knowledge.

So what is a Mental Model? Think of mental models as different lenses through which you can view situations, which helps you make smarter decisions. Whether you're dealing with personal choices, work challenges, or even trying to grasp global issues - these lenses/frameworks equip you and help make everything a bit clearer and less chaotic.

Now, let's add another powerful tool to this toolkit—first principles thinking i.e. breaking down complex problems into their most basic elements and then building up from there - like peeling an onion, layer by layer, to understand the core components before reconstructing your understanding.

So the idea is to understand different mental models through first principles thinking to have a solid foundation for the tookit required in this 21st Century.Today, let’s discuss the concept of Ergodicity:

ERGODICITY

Before I define it, let me give you a hypothetical investment bet:

What is Ergodicity?

Ergodicity refers to the relationship between the average outcome of a system over time (lifetime outcome) and the average outcome of a population performing the same activity once (population outcome).

If lifetime outcome = population outcome then the system is Ergodic, otherwise not.

Understanding ergodicity leads to decisions that minimize regret but maximize long-term potential. It is the study of how short-term consequences affect the long-term.

Back to the bet

So you have studied probability and calculated easily that the Expected Value is 20 Lakh (2 Cr X 10% + 0 X 90%). So this is a great bet with 1:2 Risk : Reward.

So should you take this bet?

Although the bet has a good expected value and positive risk reward ratio - 90% of the time you lose i.e. going to zero. We are heading to the risk of ruin

So here the Lifetime outcome is a positive return. Like a VC model making lots of bets which have low probability but very high payoffs.

The one-time outcome is mostly ruin. If you can do this only once, you are highly likely to lose. For example, as a startup, you are more likely to fail than to succeed. The base rates are pitted against you.

The key is repeatability. Are you able to bet again & again and be in the game?

Focus on being in the game.😵💫Confused?

Investing is probabilistic. It is prone to varied probabilistic outcomes. If you trade the same setup, it will still not give you a 100% win rate or the same risk/reward outcomes.

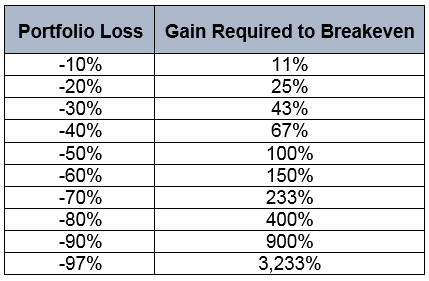

It behaves in a non-ergodic way e.g. when you invest, the path (whether you gain or lose money along the way) matters a lot. Looking at the average return doesn’t always tell you the whole story. Losing money early on can greatly impact your overall wealth, as you need disproportionate returns to break even.

What can we learn from this Mental Model?

(1) Survive: First protect the downside

“It is not the best ones who succeed. It is the best ones of those who survive.”

Survival matters more than performance in determining long-term success. To be the greatest at anything, you must survive the trials, tribulations, injuries, mistakes, drawdowns, etc. that knock others out of the “race” before it starts.

Performance matters most for success in a single race.

Survival matters most for long-term success over many races.

For example, a single injury can end a runner’s chance of racing again. Avoiding serious injury is key to long-term racing success.

“In any endeavor in which success depends on you accumulating some kind of resource (money, skill, connections, trust, etc.), do not maximize growth regardless of survival. Instead, maximize growth that conserves survival.

The chance of irreversible consequences must be considered in any repeatable activity. Ex: bankruptcy, injury, depression, burnout, break-ups, trust, etc.

(2) Position yourself for long term

Over a prolonged period, survival is more important than performance.

“A finite game is played for the purpose of winning, an infinite game for the purpose of continuing the play.”

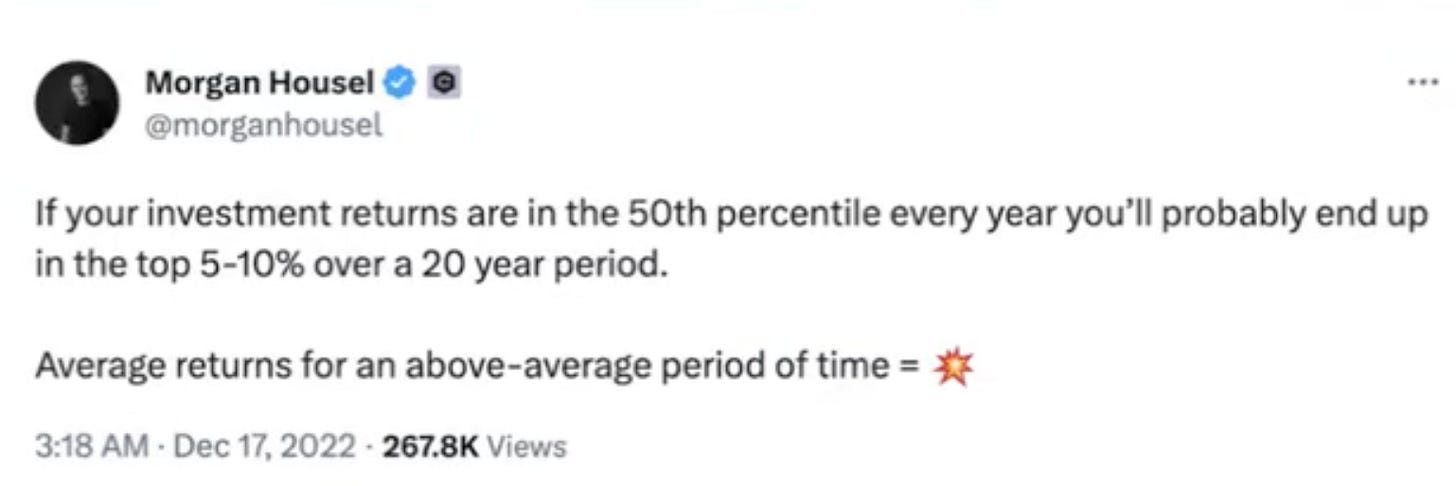

Focus on staying in the game. Even if you make average returns but are persistent enough to play the game long enough - you will come out victorious.(3) Focus on sustained performance

The success of Diljeet Dosanjh’s Concerts took internet by the storm. But many don’t realize the years of hard work required to reach such a stage.

Music / Film Industry is also non-ergodic. There is no sure-shot formula for success.

Too often, we observe a snapshot of someone’s life and believe that we witnessed a piece of short-term performance. But if practice is required to get to a place where one can attempt that, then what we are really observing is long-term performance.

I believe that all the good things in life benefit from compounding. You have to be persistent in your efforts!! The aim is to sort risks into two types: serious risks that can cause major harm and manageable risks that you can recover from. The key is to completely avoid serious risks or minimize them enough so they become manageable.

There are different strategies for dealing with risk

Barbell Strategy (Taleb’s Incerto Series):

Expose the majority of your time, money, and work to safe activities with only a small amount of time, money, and work to risky activities. The risky activities create an opportunity for a high payoff but the lower exposure limits the downside.

The reduced chance of permanent loss allows for a small exposure to more aggressive activities. So long as the small exposure of time, money, etc. is something you can afford to lose.

The tradeoff is that by limiting risk you limit upside.

Kelly Criterion (Fortune’s Formula)

A betting strategy that finds the optimal betting size based on the odds and bankroll in an attempt to maximize wealth over time.

Risk exposure depends on the odds/payoffs of a bet.

Pre-Mortems and Post-Mortems

Pre-Mortems: Study is done before the project starts assuming it failed, to figure out how it failed and how to avoid it.

Post-Mortems: Study after a project ends to find out what, if anything, went wrong and how to improve on it next time.

Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani (TechnoFunda Investing)

Book/reading recommendations

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.