Decisions are made in real-time. I am trying to understand my trades better, dissecting the why behind the actions, and looking for inherent weaknesses in my trading.

I am not a teacher but a fellow learner...idea is to document and reflect...let me know if my rationale aligns with yours! In trading, it is important to align with your psychology. Otherwise, it will be difficult to follow the process over a long period or to trade peacefully. So, one of the core principles for me is to never compromise peace of mind.

Trading and investing are endeavors where there is no single correct answer. There are different paths to nirvana but the correct path for an individual is - what can be followed consistently, over time building and improving edge leading to long-term profitability.

You don't have to follow the correct path, you have to follow the path correct for you

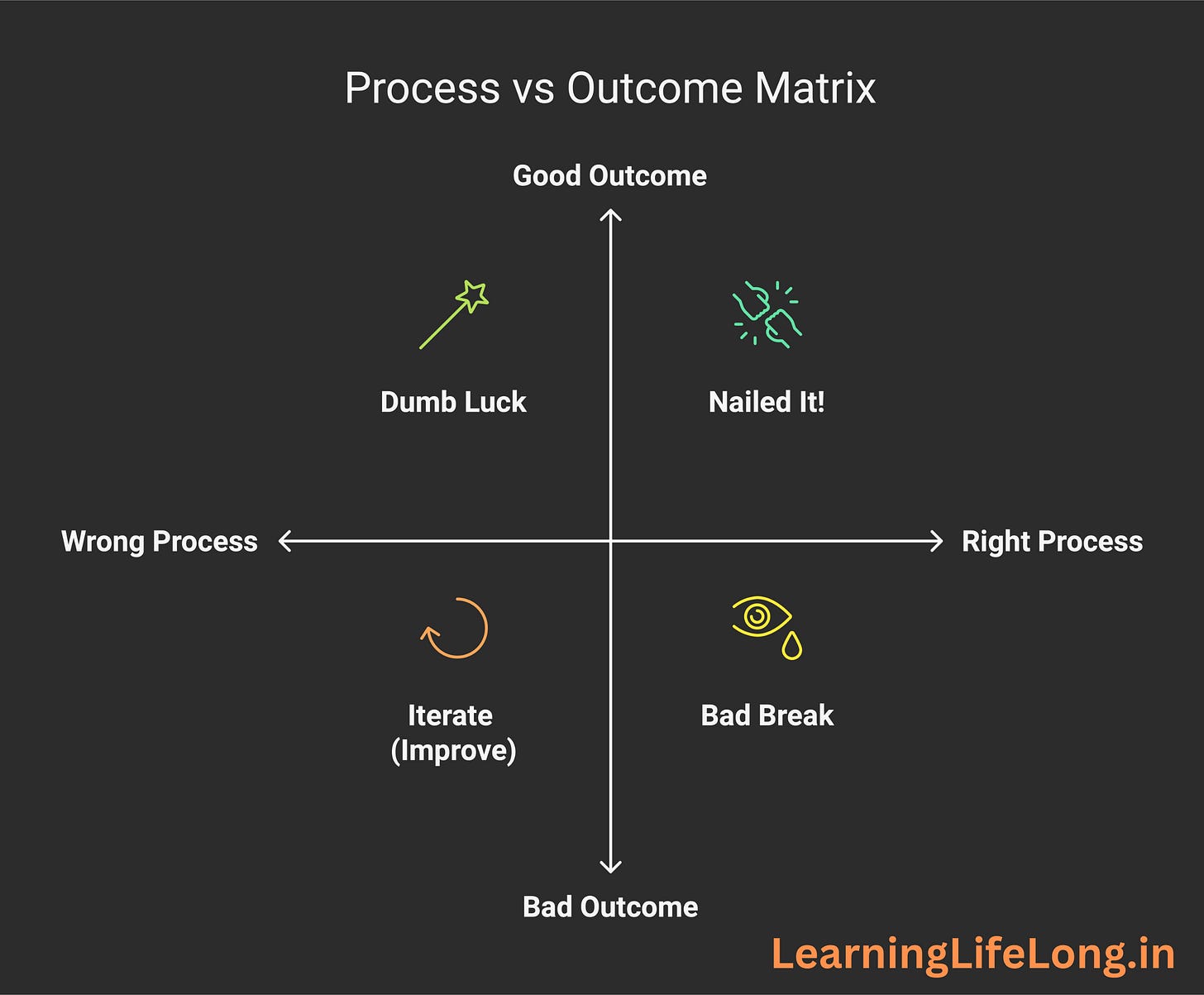

but there is an impediment in this process - it is difficult to know whether you followed the right process or it was a lucky outcome.

You can be right for the wrong reasons... You can be wrong for the right reasons

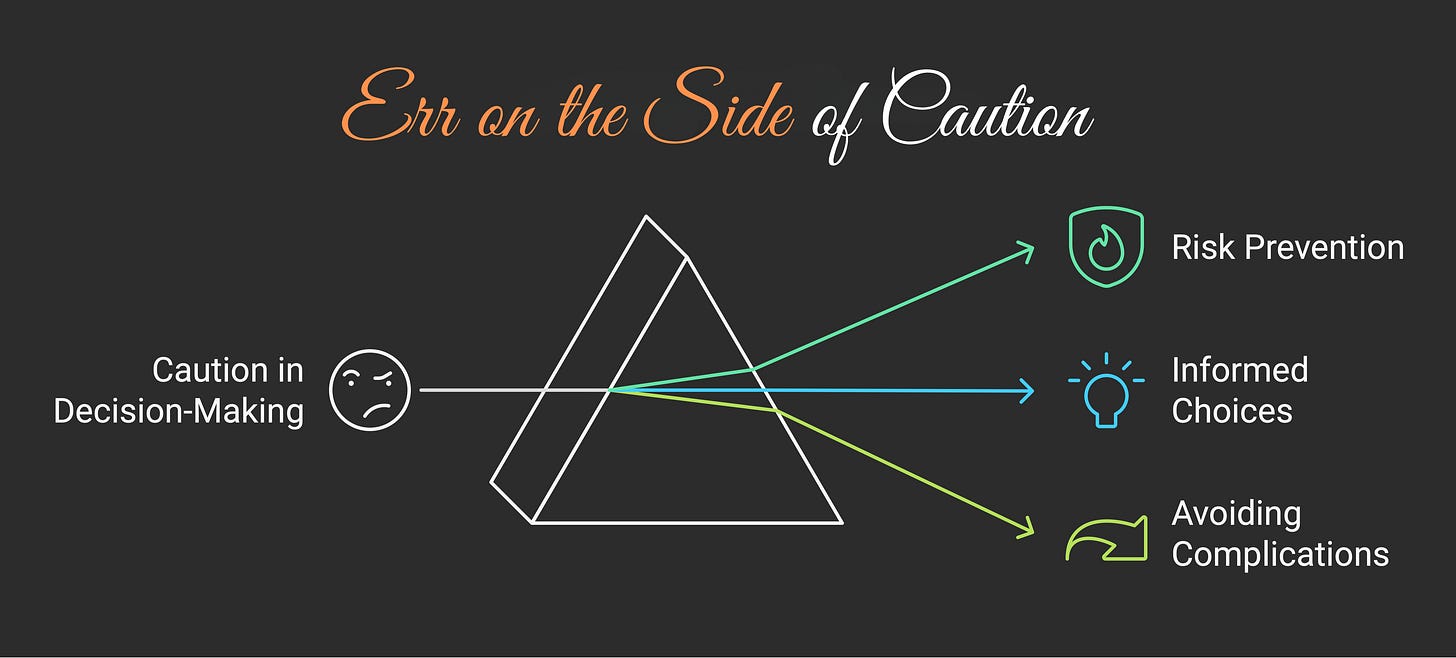

There is a conscious, continuous effort, to decouple from outcomes and focus on process. Mental Model: Err on the side of caution

This mental model reflects the preference for minimizing risks, even if it means sacrificing potential rewards.

Why I follow this approach:

✅ Maintaining emotional stability

✅ Risk Prevention and Preserving Capital

✅ Informed Choices - taking the risks you are comfortable with.

✅ Prioritise Long Term Thinking and Long Term Success

✅ Avoid complications and inconsistencies in decision-making

ANANT RAJ

Anant Raj is a real estate company that is showing good growth potential in the Data Center Space.

ENTRY on 16th December 2024 at 776

✅Prior Uptrend

✅ Good Base

✅Volume at the right hand of the base

Position Size- 12% (0.36% Risk to Portfolio)

Exit on 17th December 2024

Here we come to the main part of analyzing this decision:

Why exit?

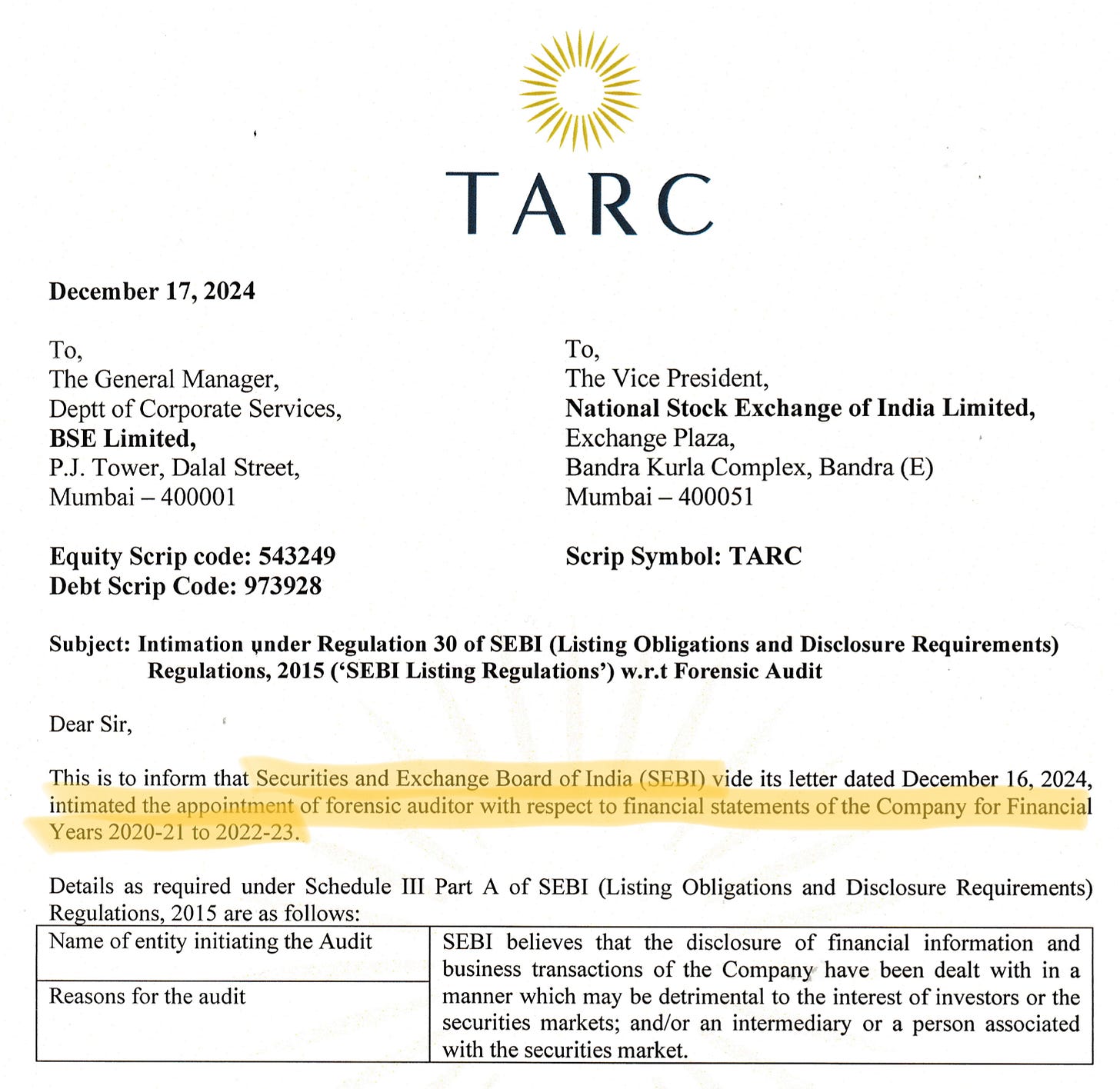

My reason for exiting was a corporate governance issue in TARC.

in TARC the action was sudden

but I overestimated the contingent impact on Anant Raj….

How it fared post exit

Actually it has shown a great relative strength post my exit and in the hindsight it looks like a bad decision to exit - since the SL was not hit and I chose to act on news.

But let’s reverse this - had it performed badly and had hit the SL I would have felt regret of inaction - given the facts had changed.

So yes I erred on the side of caution and it is fine missing on profits. It sure feels bad missing out on profits but when you have made a consious decision it does not made you regret but rather nudges to introspect. Actually actions like this resolve more to not have FOMO.

Own your decisions. No doubt I've missed on a good trade but was a conscious decision.

Trade Log

*****

Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani (TechnoFunda Investing)

TradingView Affiliate Link

What I am Reading this Month:

Finished reading Co-Intelligence: Living and Working with AI

It is a book on how Humans and AI will collaborate in the future.Supporting my work

If you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Thanks for reading Pankaj’s Substack! Subscribe for free to receive new posts and support my work.

Not explained relationship with TARK