Mental Model: Eggs vs Tennis Balls

Tennis balls and eggs are often used as a metaphor to describe how someone reacts to adversity - you bounce back or shatter!!.

The same model applies in markets as well.

Buying stocks is easy. But when should you sell? Truth be told selling is one of the most difficult parts of the equation. Sell too late…you give back profits. Sell too soon…you leave money on the table.

Mark Minervini Sir has given a simple formula for separating the wheat from chaff. Every time the market suffers a setback, you must ask yourself a simple question.

Do I own a tennis ball or an egg?

It’s during pullbacks you get to see what a stock is really made of. Does it come bouncing back like a tennis ball or splat like an egg? The best stocks rebound the fastest. Once I buy a stock, if it displays tennis ball action, I will probably hold it longer.

Eggs are those that fall down and don’t rise back after they hit the floor. However, Tennis balls do hit the floor and bounce back.

If it is a healthy stock, the dips are short and are soon supported by buying that should propel the stock to new highs within a few days or weeks – it bounces back like a tennis ball.

Its not just the tennis balls in the Price Action - look for fundamentals as well

What applies to price action i.e. in the Charts applies to fundamentals as well.

As an investor,I try to add another layer of fundamentals. Make sure you have tennis balls (stocks of high quality companies) in your portfolio and not eggs (low quality stocks) that will splat after hitting the ground. In a broad stock market correction, both will fall. High quality eventually recovers, low quality does not.

Be ruthless in eliminating your losers from the portfolio. Instead of focusing on your winners, you need to remove, the eggs, from your portfolio. Best Loser Wins. The same is echoed by fundamental investors as well.

Selling the winners and holding the losers is like cutting the flowers and watering the weeds.

Incidentally, this is Warren Buffett’s favorite quote, which he even highlighted in his 1988 annual letter. Precisely: cut your losses quickly and let your winners run.Let’s look at this concept through some charts…

Zomato

Egg 🥚

Gap down opening...didn't recovered during the dayThis was a positional holding….but after giving it lee way it breached EMA 100 with a gap down.

Laurus Lab

Tennis Ball 🎾

Recovery in a day and hit new highAnant Raj

Tennis Ball 🎾

I had exited this stock earlier. I had entered right but the exit was triggered as I tend to err on the side of caution. I also have the tendency to "Shoot First and Ask Questions Later" When the facts change - change your mind. Market is supreme - trade the market not your own opinions.

Here I was clearly wrong, the way it has behaved till date. Today’s action was also like a tennis ball, as it closed over yesterday’s high.

Fundamentally also lot of buzz in the data center space.

Note to self: The mental model of erring on the caution itself is not bad...it can protect from sudden drawdowns and save from the regret of inaction.

But as you lighten yourself from the position, it is time to reflect and align with the market. You have to ultimately trade the market not your opinion.Genesys International

Tennis Ball 🎾

Strong reversal and new high. Volumes also supported. Clearly in the watchlist to follow it. It is a different matter that this is hard money environment...do not intend to chase breakouts...a strong stock nevertheless Skipper

Egg 🥚

This one showed the egg character way too early...as it didn't followed through the breakoutZen Technologies

Tennis Ball 🎾

APAR Industries

Tennis Ball 🎾

Weekly chart...This one showed great relative strength. Didn't succumbed to selling pressure on Monday and today also followed through. KEC International

Egg 🥚

Goldiam International

Tennis Ball 🎾

Superb price volume action.

Again this one is backed by the growth in lab grown diamonds.Update 10th January 2025

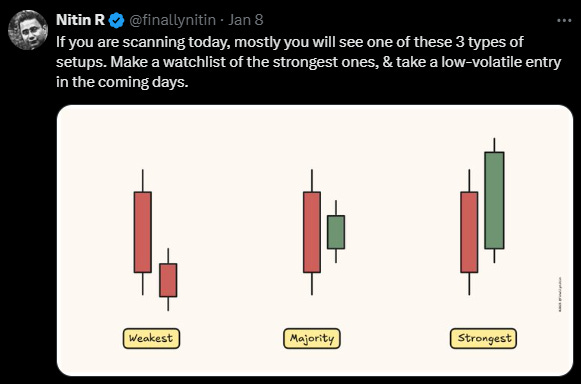

Interesting infographic by

Bhai on how to look at strength!!- The weakest following through downside (Eggs) and Stronger (Tennis Balls)

⚠️ This is to prepare list of strong names over a period of time....No adventures at this jumcture To Sum Up

It does not matter whether you focus on the fundamentals or the technicals of a stock - the game is quite simple (not easy)- You have to play with tennis balls.

To be honest, it is just a little easier to follow with the charts.

Ultimately, simplicity is the highest level of sophistication.

And we only need to know two things:

Tennis balls bounce.

Eggs do not. *****

Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Why not check them out? - Join the community of learners.

Free Course by Vivek Mashrani (TechnoFunda Investing)

TradingView Affiliate Link

Resources:

What I am Reading this Month:

Focus: The ASML way - Inside the power struggle over the most complex machine on earth

Capital Returns: Investing Through the Capital Cycle by Edward Chancellor

Finished reading

Supporting my work

If you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Thanks for reading Pankaj’s Substack! Subscribe for free to receive new posts and support my work.

Great concept but too short a period used as an example . Interesting read nonetheless.

👌👌👌👌