Techno Electric & Engineering Company Ltd.

Capitalizing on Transmission capex and Data Center theme

Investment thesis in short:

➡️Twin Engines 🚀🚀: Transmission and Data Centers (both high growth areas)

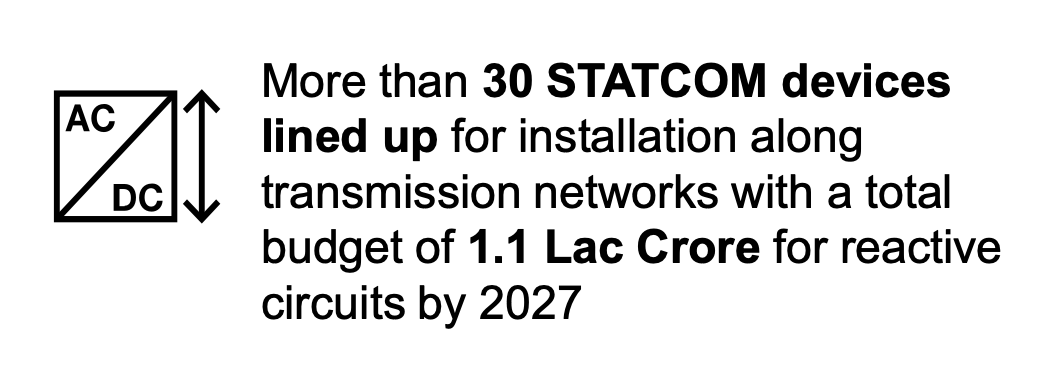

1. Uniquely positioned EPC for higher kV substations and STATCOMS.

2. Data Center optionality. Technoe has been investing in data center space for quite some time. Data centers have a huge demand and few players on the supply side.

➡️Prudent Management Company

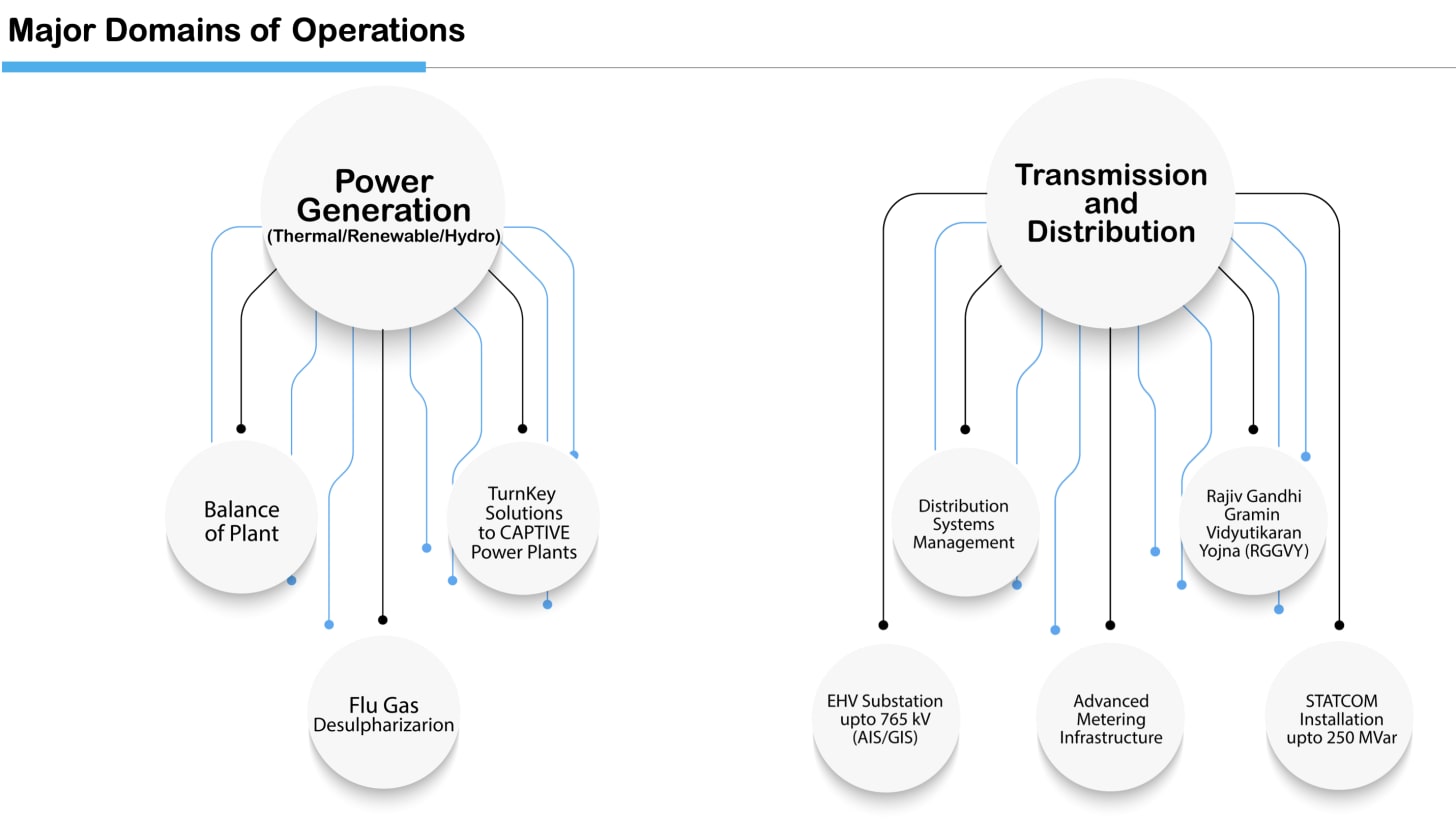

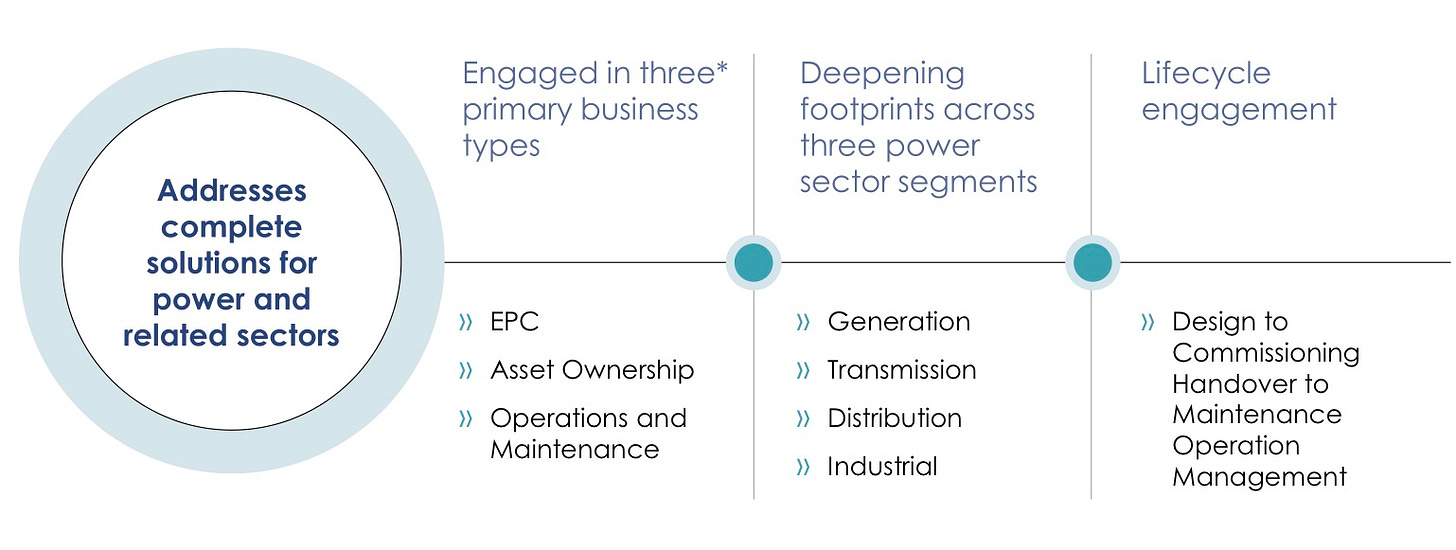

EPC player with market leadership in 765Kv transmission. Over the years it has diversified across the Power Sector with Flue Gas Desulphurisation projects at the Generation side and smart meters at the Distribution side of the Power Sector Value Chain.

Right to Win

I’ve been discussing the vast opportunity in the Transmission and Distribution sector.

(1) Power is now a growth sector backed by increasing demand and government push towards green energy.

(2) In transmission of power per se, a trend in the industry is towards higher kV transmission lines and higher kV substations.

(3) The increasing share of renewables in the energy mix requires more FACT (Flexible Alternating Current Transmission) devices to increase grid resilience. One such FACT device is STATCOM i.e. a fast-acting device capable of providing or absorbing reactive current and thereby regulating voltage in the grid.

As you move up in higher kV substations it becomes a niche segment as the sophistication of the job increases.

Probably 10 years back none could have visualized a substation with a capacity of 10 gigawatt to 25 gigawatt each, which is becoming an order of the day now.

Prudent Management

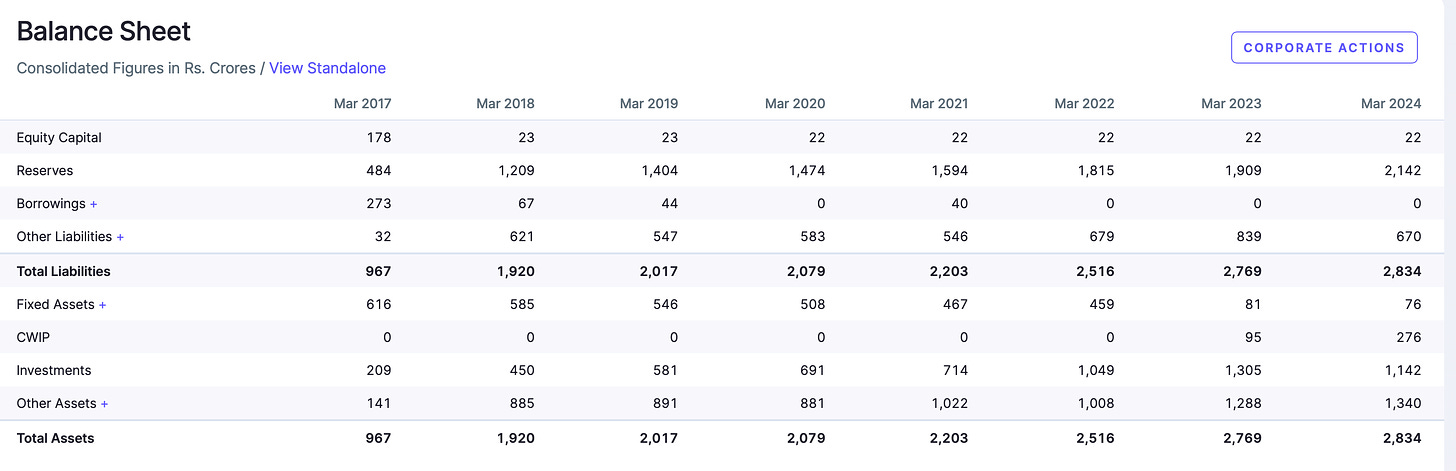

The management is super conservative. The cash balance in the books does not optimize for return on capital but makes the business resilient. After a down cycle in the power sector, this cash balance showcases management’s prowess and grip on the industry.

Having a debt free balance sheet opens up lots of doors especially when the sector is finally waking from the slumberPressing the pedal….getting aggressive

We are very focused on IT layered power solutions and we believe that is a future of power. And it is more rewarding than pure commodity solutions in power sector.

Company has to evolve and transform itself which we are doing it. We have set up an office in Delhi and we are now doubling or rather I will say tripling the size of the office in Delhi sir. It is a part of our own complex where Tata, Bata are also our tenants in Gurgaon. We have taken a full flow of 6 floors of the building. It is under furnishing. A lot of people are under recruitment on the IT side, data center side as well as on the transmission, smart metering.

For 8 years, this sector has only suffered and suffered but what could we have done better? Anybody going aggressively in those times would have burnt himself, I can assure you. Today is the time to benefit now. We have cash. We have a strong balance sheet. We have good credentials and we have good knowledge to -- and cash going forward opportunities. I can assure you tomorrow is day for us.

(Q4FY 2024 Concall)

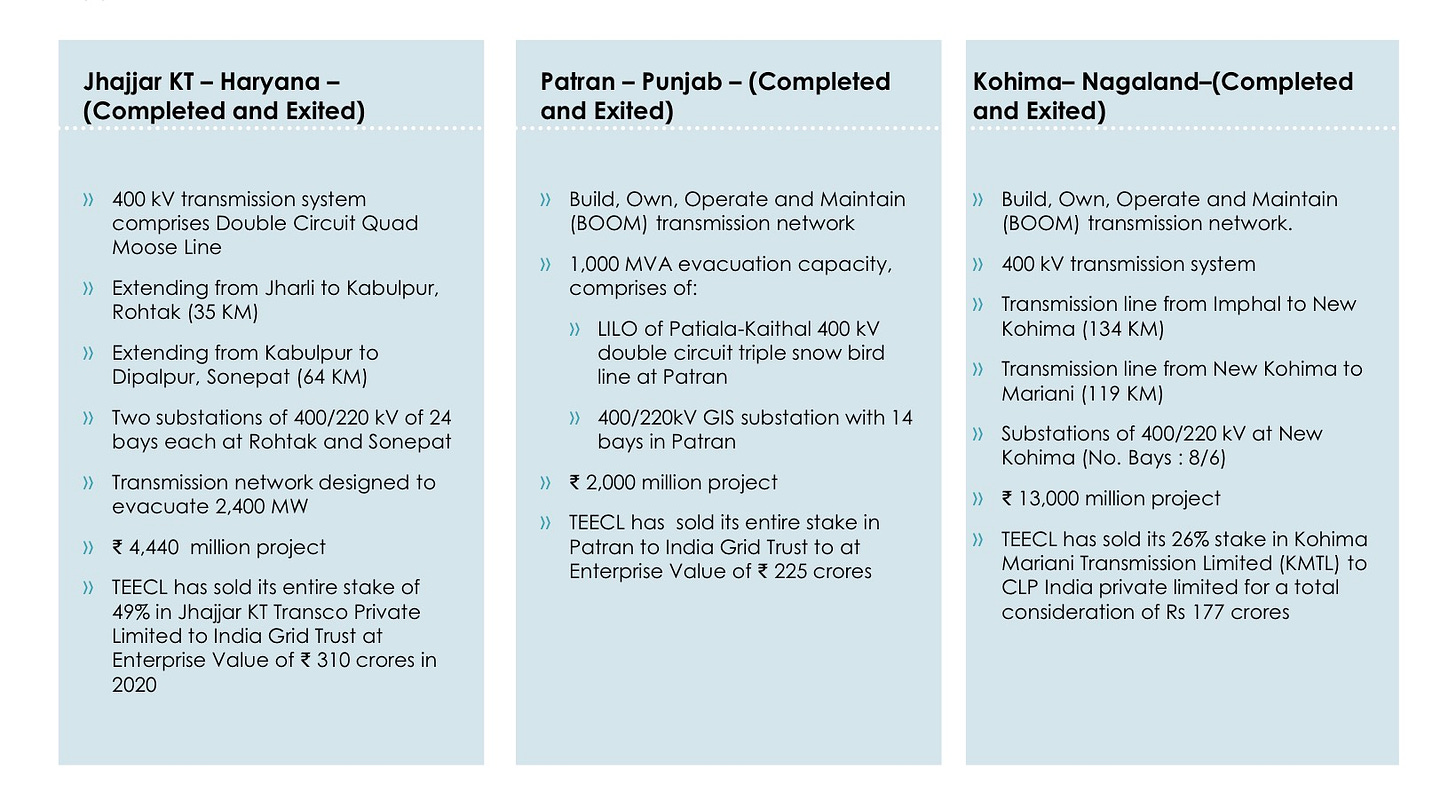

In the past has been able to sell assets at value accretive prices….same strategy for the current cycle

Another good thing which has happened that whatever assets we had created over the last 15 years now stands monetized successfully in last four to five years and we possess no asset on hand today other than the data center under construction.

Asymmetric Data Center Bet

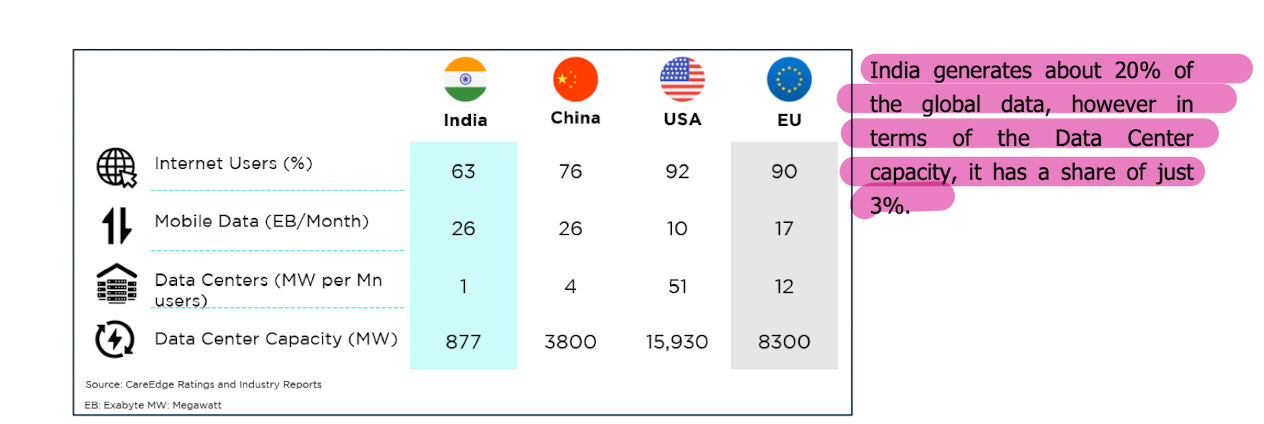

India’s data center capacity is hugely underpenetrated…

Data Centers are capital-intensive. Land and building account for 40% of the cost (Real Estate) + 40% towards electrical systems (Can be compared to substation EPC) and the remaining 20% is Heating, Ventilation, and Cooling.

Construction of a data center is underway in Chennai. This data center is expected to be a proof of concept.

The setup ASPV for a 40-megawatt data center at Chennai. The asset is still in implementation stage and is not revenue accretive, but is definitely value accretive.

We have been allotted land in Kolkata to set up a data center next to the various data centers being set up by STT and Reliance as well as Adani Connect

Recently won a concession from RailTel where we will be setting up 100-plus edge data centers on the very prominent all railway stations of the Indian Railways under digitization plan of the railway in partnership with RailTel. We anticipate this to be a very huge opportunity. To begin with, as a value accretive and later on as a business

Gearing up Human Resources

Filling up gaps in human resources for future growth:

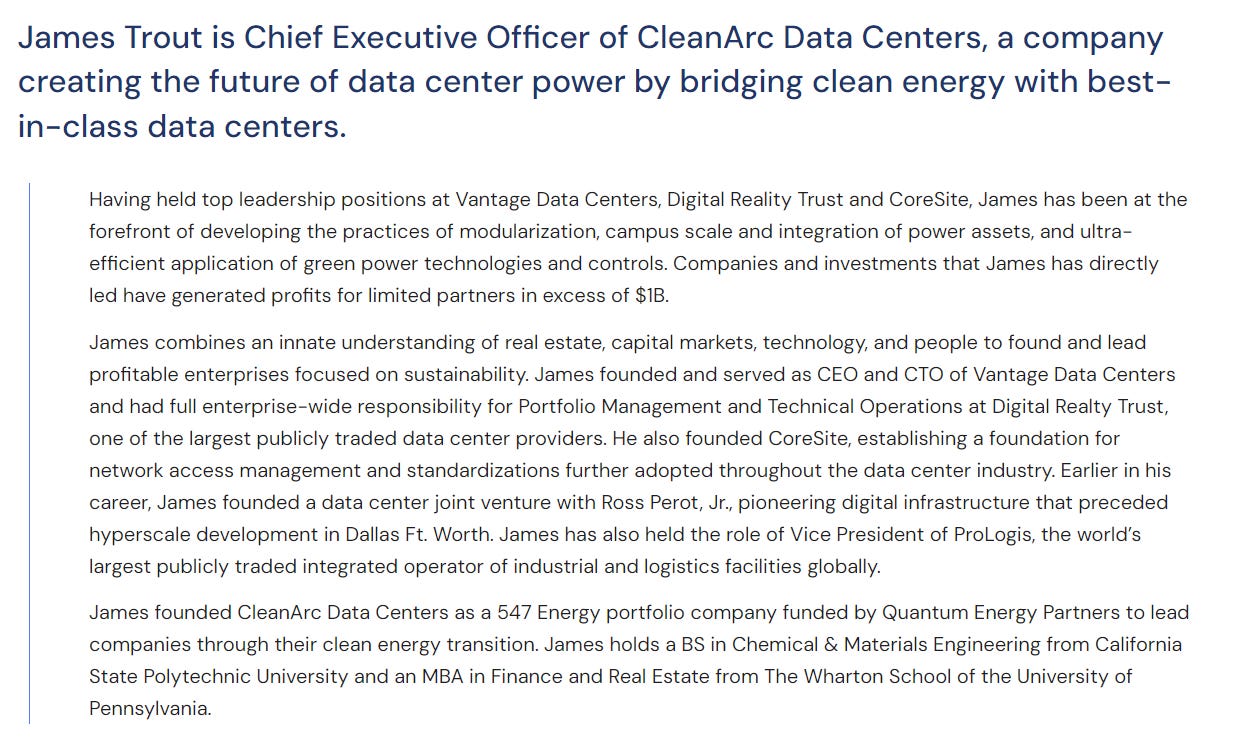

Have taken on board Mr. James Trout for growth in Data Center Business.

Mr. Shailesh Mishra, former director at Solar Energy Corporation of India (SECI), onboarded as an independent director.

To Sum up

The growth is visible. The business stayed resilient in tough times and now the cycle is turning

I can assure you that we will rise to achieve 10,000 (cr revenue) by if not '28 at least by 2030.

FY24 ended with an unexecuted order book of 9200 cr (i.e. 5.5X FY24 revenue) + L1 in over 10,000 cr.

They are moving up the value chain and hence apart from topline growth, margins can expand (1) operating leverage (2) high-margin projects

This is a paradigm shift for Techno now that we are no more rubbing shoulders with our conventional players limited to conventional solutions in all low end or mid-end all this sector is now having opportunities as, I call it mediocrity to technocracy or high-end complex solutions. And definitely, they have rewards in it. And we are definitely built for it. We definitely look forward to enhancing our rewards to more than 15% going forward over next 2, 3 years. And even what Madhu ji had asked, I will say the IRR looked upon by us will not be less than 18% to 20% on all these investments put together

Key Monitorables

Equity Dilution from QIP - Looking to raise around 1250 crore i.e. 9-10% of market cap today. - Update 16 July 2024: QIP floor price at 1506

Order wins in Transmission, Distribution (smart meters) and FGD

Progress on Chennai Data Center

Progress on RailTel Edge Data Centers concession

So far so good....lets keep tracking the business. Hopefully better times to come for this company and sector.

Always remember (1) This is regulated industry (2) Execution risks as an EPC player - here the risk is greater as company takes BOT projects as well.

Data Center story lets see how it pans out. RailTel project gives confidence but execution is paramount. I’m invested and biased:

P.S.

Thanks, Vineet Jain (@vineetjain1101) for sharing his thesis on Twitter, which served as a starting point for developing conviction in this idea.

UPDATE:

*****

Invest in yourself…. be a learning machine

These communities have helped me a lot in learning the nuances of investing. Why not check them out? - Join the community of learners.

Supporting my work

This Substack will never be paywalled. I don’t want to accept voluntary payments for future unknown work.

But if you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Disclaimer: I am not SEBI registered. The information provided here is for educational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.

Thanks for reading Pankaj’s Substack! Subscribe for free to receive new posts and support my work.

Very detailed and well explained Pankaj. After reading this article and reading through the company myself, I understood that this is a construction service type of company. It's biggest advantage is that it is asset light business. However they are just making an ROE of 13%. I want to know your thoughts as to if we should play power and data center theme of India via this construction service type company because I am not sure if they will be getting the explosive side of growth with this business model.

Please share your thoughts on the same. Thank you so much!