“We overestimate what we can do in a year and underestimate what we can accomplish in a decade”

This is a slightly edited quote from Bill Gates. Human nature tends to focus on the immediate future while being oblivious to the potential of the long term. Why? because we fail to account for the power of compounding, where even small, consistent actions can accumulate and lead to significant progress. Hence, it is worthwhile to step back, look at the bigger picture, and try to perfect processes that can lead to long-term wonderful outcomes.

So here the idea is not to look from a short-term perspective but rather to build processes that you can follow for the long-term and achieve great results over bigger timeframes. Know Yourself

Finance, trading, investing, or markets is essentially a game of psychology. Even the chart patterns are reflective of human psychology. Isn’t it how the support and resistance levels are formed!

It is imperative to understand our temperament, flaws, goals, and skills. Even the best money printing strategy will not help you if it does not align with your psychology or you are not able to follow it consistently.

You have to know yourself. Only when there is no resistance in following the path that super performance will be unlocked.

My motto here is Learn Unlearn Learn. Keep learning. Learn LifeLong. Always adapt.

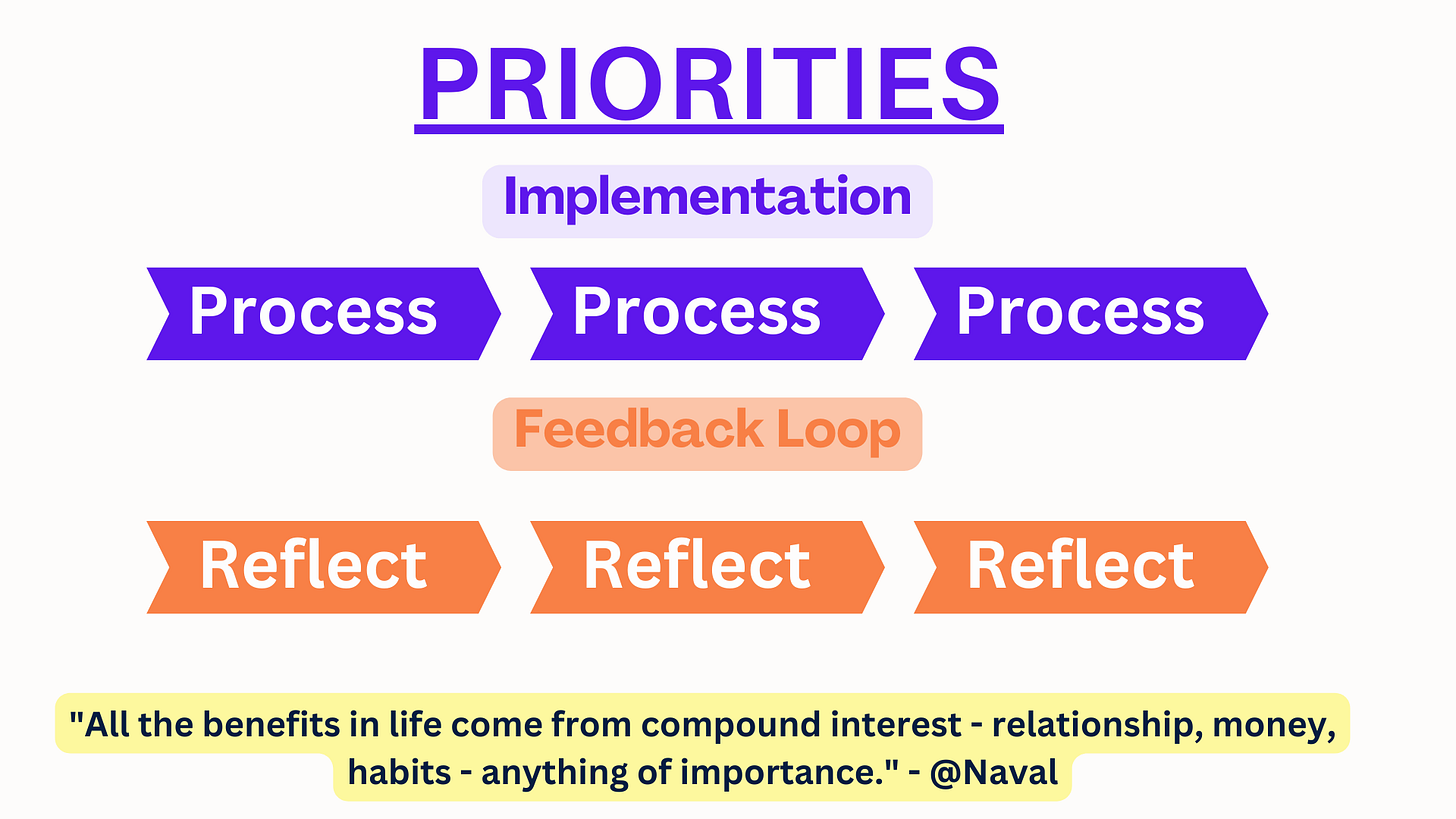

Focusing on the process will keep you sane and make money in the long run

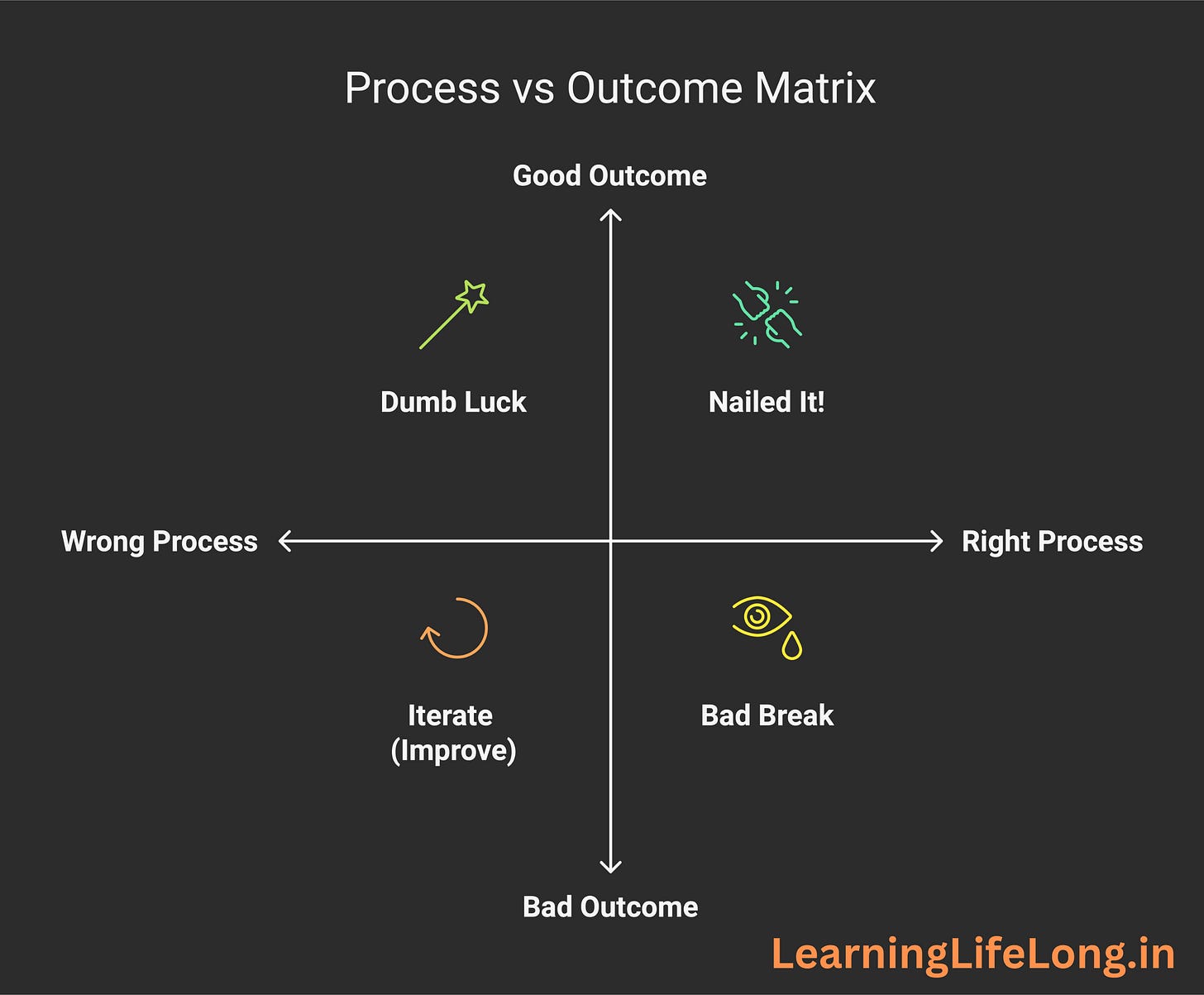

Results are random; perfect trades can lose while low-quality setups can be winners. This is what a probabilistic world is. The inputs and outputs are nit completely correlated - they are probabilistic. I always go back to this matrix:

Don’t be swayed by the outcome. Pat on the back if you followed the process. More data and reflections are aimed at improving the process rather than cringing about one outcome.

Remember, small consistent efforts in improving the process will yield long-ranging benefits. This is the power of compounding

Also, mental health matters more than your trading account health. Fixating on immediate outcomes erodes mental health.

Building blocks of your trading system

Let’s dive into the components of the Trading System

Pre-market Scanning and Watchlist

Scan the stock universe as per your strategy.

Create watchlists - may be immediately actionable, probable candidates, charts that seem constructive

Have the levels earmarked in advance and create alerts

Normally, I create alerts on trading view along with the relevant SL levels. Further, capture additional information like where the SL would be, accordingly how much risk is involved, and calculate the position size well in advance. So at the time of taking trade most of the things are already chalked out Executing Trades

This is the easiest part, when you have done your homework right. You have to create rules for yourself. For eg my basic rules are:

I will not chase extended stocks. Max SL of 8% (although I prefer it to be 6%) - so as to have a meaningful initiating position

The basic premise is to enter at a low-risk entry. Only then can I build meaningful position. Otherwise, I would clutter my portfolio and will be disoriented.

I will not indulge in futures and options

Never sell the full position in strength. When it moves up and you are without an iota of position pending then it is painful. Sell 30-50% to free roll your risk.

No Bottom Fishing.

Be selective, write for clarity.

Risk Management & Position Sizing

Risk management and position sizing can’t be independent of each other.

I am indebited to Tom Basso sir for his incredible yet simple book “Successful Traders Size Their Positions - Why and How?”

Basically, to manage risk you have to first measure it. I know sometimes there will be slippages or gap downs but if you are following Stoplosses religiously then that data can serve as a good approximation of the portfolio risk.

What I measure:

Open Risk in a stock

Portfolio wide open risk

Potential drawdown if all the stocks hit SL

Scaling: Buy a position with less risk and the stock is behaving as expected - the position can be scaled. Like from a .25% risk to an ideal 0.5% risk (for me). Don’t buy too much above the ideal buy point so that Risk / Reward does not topple.

Averaging up: This can only be done from a least-risk area i.e. pullbacks (preferable) or a new base breakout. The idea is if you can add to the existing name why add complexity - with a caveat that it must pass through criteria from a fresh trade perspective.

Partial selling in strength:

One of the ways to achieve a peaceful risk-reward bump is by selling some part of the position in strength. For example, if you get a 3X your risk, then if you sell 30% of the position you reduce your risk by 90%. At 2X risk, you reduce the risk by 60%.

Aftermarket

Update trading journal

Revise SLs

Make notes on the chart

Reflections on what you felt or are thinking

Monitoring Risk in the Portfolio

Capital Preservation should be on top of the mind always.

Benefits of continuous reflection:

The above process is iterative with room for improvement and hence reflections are very important. There are many things that I have found about myself or my trading through reflections like:

To be curious about unknown names. Don’t be biased towards any names. Try to know more about each company. All companies can’t be investment-worthy, but if liquidity is there, they can be traded.

The goal as a trader is to get to a point where you are trading from a calm and confident state of being so that you can observe what the market is doing from an objective point of view and execute your plan accordingly. I’ve struggled earlier in my career to put myself in the trader box or investor box.

The most difficult thing is to have two contrasting ideas in your mind at the same time and both are right from different vantage points or objectives. So, I now clearly define whether this is trading or investment. Anyhow the trading is mostly positional and I invest very less directly in equities (invest through mutual funds plus have a separate account for experimenting with holding on only based on thesis)understanding what you own and why and what your time horizon makes a difference.To sum up

“To achieve greatness, you must trust the process and have unwavering belief in your abilities.” - Michael Jordan

Having your own plan help navigate the markets with discipline, confidence, and consistency. It is essential for long-term success, to ensure that the strategy aligns with your risk tolerance, personality, and financial goals, and helps avoid emotional decision-making as well as impulsive trades.

A structured plan and process promotes consistency, risk management, and disciplined execution, reducing costly mistakes. It also provides clarity and confidence, allowing to follow a set process rather than reacting to market noise. Moreover, tracking and refining your plan over time leads to continuous improvement. Since no single strategy fits all, a tailored approach enhances sustainability and profitability in trading.

Reflect and you may find your own questions and answers.

All the best. Remember this is a continous process.*****

Invest in yourself…. be a learning machine.

These communities have helped me learn the nuances of investing. Check them out and join the community of learners.

Free Course by Vivek Mashrani (TechnoFunda Investing)

TradingView Affiliate Link

Resources:

What I am Reading this Month:

Best Loser Wins: Why Normal Thinking Never Wins the Trading Game

Stan Weinstein's Secrets For Profiting in Bull and Bear Markets

The Almanack Of Naval Ravikant: A Guide to Wealth and Happiness

Never Enough: From Barista to Billionaire

Finished reading

Felt like an honest glimpse into the life of a billionaire. Makes you question the purpose of money in our life.Supporting my work

If you got this far, chances are you find my writing valuable. So please spread the word! Sharing, liking, and commenting all help spread the word!

Connect on X @pankajgarg_ciet

Disclaimer: I am not SEBI registered. The information provided here is for informational purposes only. This is not a buy or sell advice. I will not be responsible for any of your profit/loss based on the above information. Consult your financial advisor before making any decisions.